Key takeaways

What are B2B payments?

Business-to-business (B2B) payments are transactions where one business accepts payments from another in exchange for goods or services. These are generally characterized as large-volume or large-ticket sales over a set of payment terms (accounts receivable) instead of upfront purchases. Traditional payment methods for B2B transactions are cash, checks, ACH wire transfers, and commercial credit cards.

How do B2B payments work?

The B2B payment process significantly differs from the traditional customer “checkout” experience. Unlike in a consumer relationship, where many customers engage with businesses in small purchases, B2Bs deal with large orders that don’t always happen at a storefront.

B2B payments components

B2B payments consist of key components:

- B2B seller: The business entity that delivers goods or services to another business.

- B2B client: The business entity that receives the goods or services.

- Invoice: Document detailing the transaction and terms of payment.

- Seller’s accounts receivable team: Prepares and sends the invoice; reconciles and updates the outstanding payment from the client.

- Client’s accounts payable team: Verifies the transaction and prepares the necessary documents for payment approval.

- Client’s decision maker/s: Individuals within the client’s company that approve payment requests.

- Merchant account and payment services: Service providers that have the technology to securely send and receive transaction information to the financial institutions on behalf of the seller and client.

- Financial institutions: Entities such as banks and card networks that authenticate and approve the exchange of funds between seller and client.

Stages of B2B payment processing

Below are the stages of B2B payment processing, which starts after the delivery of the product or service:

- Invoicing by seller: At this stage, the seller prepares and sends an invoice to the client. The invoice details the goods or services involved, related taxes, and payment terms. Payment processing services often include digital invoicing features to create templates and send invoices.

In cases where the client defaults or misses a payment due date (for transactions with payment terms), a reminder is sent with an updated invoice attached. This is standard procedure done manually or automated via an invoicing management feature.

- Approval by client: Unlike consumer transactions, B2B invoices often go through approval levels that begin with the accounts payable department preparing relevant documents. The payment request, including the payment method to be used, goes up the ranks for approval.

- Payment by client: After approval, payment is sent to the seller based on the terms set in the invoice. The customer’s payment goes through the relevant channels for authentication, verification, and approval from the customer’s bank, confirming that funds are available.

Regardless of the payment method of choice, the seller is responsible for meeting various compliance requirements, such as:

- Data protection: Businesses are expected to meet PCI-DSS compliance to ensure that the exchange and storage of customer and transaction information are protected.

- Anti-money laundering: Know Your Customer (KYC) standards require sellers to conduct due diligence to ensure that their customers pay using legitimate sources of funds.

- Acceptance by seller: The seller is notified that the transaction is approved and waits to receive the payment. Depending on the mode of payment, clearing can take anywhere from 24 hours to several business days. Funds are credited to the seller’s merchant account and eventually moved to a business bank account.

- Reconciliation by seller: The seller’s accounts receivable team records the payment, crediting the client’s records and adjusting the outstanding balance. A receipt is then sent to the client to acknowledge the payment.

B2B payment methods

Traditional B2B payment methods such as paper checks and wire transfers are still used today. Thankfully, payment technology is finally catching up (albeit slowly) with systems that can automate much of the B2B seller’s payment processing and accounts receivable management requirements.

Popular B2B payment technologies

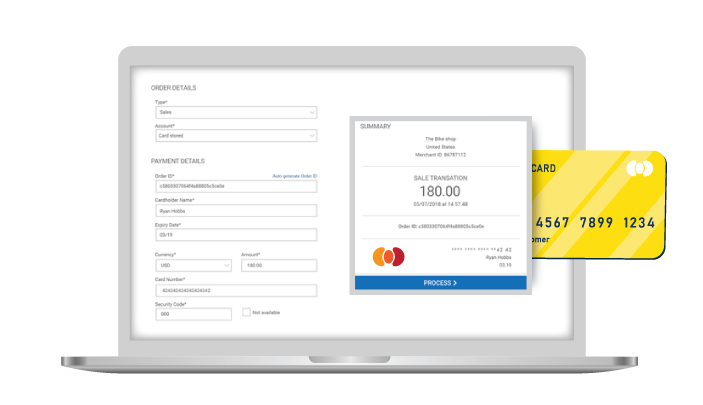

Payment processing solutions are equipped with the technology to create platforms for collecting transaction information online, in person, and over the phone.

- Online B2B payment platform: This includes e-commerce website checkouts, customer self-service portals, payment links embedded in digital invoices and emails, via QR code, and more.

- In-person B2B payment platform: Payment software built into a standalone payment terminal or web-based payment platform accessible via smartphones and tablets.

- Virtual terminal platform for mail order/telephone orders (MOTO): Seller-facing platform accessed via a merchant account where users can manually enter a client’s payment information received via email, over the phone, or live messaging services.

Common B2B payment methods

All of the payment platforms listed above can be configured to accept the most common payment methods used for B2B transactions:

- Paper checks: Some B2B companies continue to accept paper checks today. Some payment processors can track check payments the same way they manage cash payments on their platforms.

- Credit cards: Credit cards that companies use to make purchases differ from consumer credit cards. These corporate, commercial, or purchase cards have very high limits (at times none) and charge lower interchange rates.

- ACH payments: ACH payments are bank-to-bank transactions in the US that go through the ACH network. B2Bs often use ACH payments in the form of eChecks (digital checks) and direct debits or credits. ACH is less expensive than credit cards, and many payment processors are equipped with tools to process ACH payments. But because the funding time takes longer, businesses often prefer credit cards.

Fortunately, payment technology is beginning to catch up with the demands for open banking to provide real-time ACH transfers and, in the near future, securely connect banking systems across the globe.

- Wire transfers: Wire transfers are also bank-to-bank transactions, but unlike ACH, these payments are processed directly and do not have an intermediary. It can be used to accept payments from both local and international clients and takes an hour to a few days to receive. The fees for using this payment method, however, are significantly higher than other types, so it is rarely used for regular B2B sales.

Top B2B payment processing solutions

Based on my evaluation, the five best B2B payment processing solutions for 2024 are:

B2B Payment Companies Compared

Company

Our score (out of 5)

Monthly account fee

Pricing

Level 2 & 3 data processing

Helcim

4.48

$0

Interchange plus

✓

Stax

4.36

$99–$199

Wholesale subscription

✓

Adyen

4.33

$0

Wholesale subscription

✓

Stripe

4.31

$0

Custom Interchange plus

Via third-party integration

PaymentCloud

4.30

$10–$45

Client preference

✓

Helcim: Best overall B2B payments processor

Overall Score

4.48/5

Pricing

4.69/5

B2B processing features

4.75/5

General features

4.25/5

Support and user experience

4.25/5

Average user review scores

4.20/5

Pros

- Automated volume discounts

- Level 2 and 3 interchange optimization

- HIPAA-compliant for B2B healthcare services

- $500 credit if switching from other payment processors

Cons

- Additional fees for Amex transactions

- Interchange optimization fee

- Third-party POS integration requires custom APIs

Why I chose Helcim

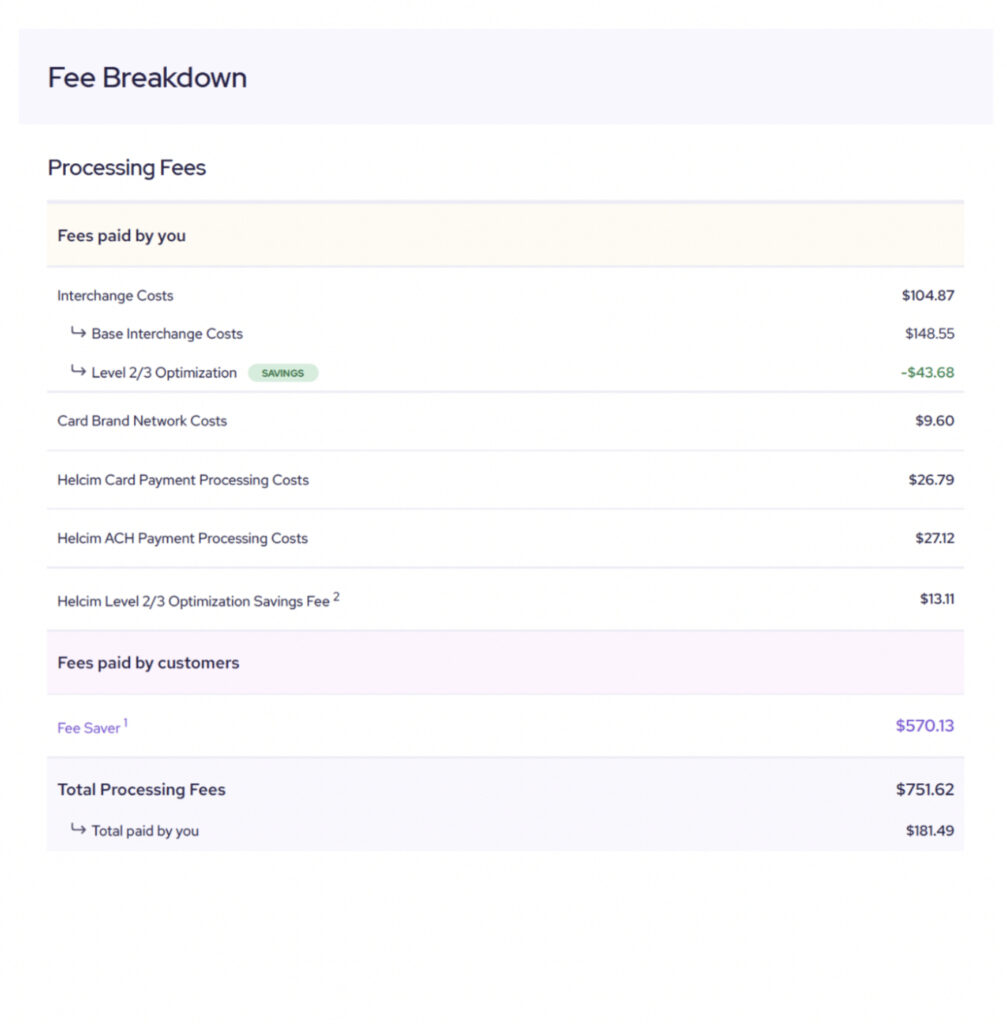

Helcim is a traditional merchant services provider that offers interchange-plus rates and complete payment services without any monthly fees. It provides automated volume discounts and built-in free credit card processing programs for businesses that accept ACH payments (for online transactions) and use Helcim’s smart POS terminal (for in-person transactions). Combined with its level 2 and 3 data processing tools, Helcim is an all-around B2B payment processor for businesses of all sizes.

Unlike other merchant services, Helcim’s level 2 and 3 data processing is built-in and available to all of its approved merchants. Helcim also uses AI to provide its users with interchange optimization that automatically retrieves the customer and transaction information needed to qualify for level 2 and 3 discounts. It supports a variety of industries, including healthcare B2B transactions (i.e., filing and receiving reimbursement from health insurance companies), since Helcim is also HIPAA-compliant.

Stax: Best B2B billing solution

Overall Score

4.36/5

Pricing

4.38/5

B2B processing features

4.25/5

General features

4.75/5

Support and user experience

4.5/5

Average user review scores

3.9/5

Pros

- Advanced billing solution

- Wholesale subscription rates

- Interchange optimization for Level 2 data

- No additional cost for B2B payment processing

Cons

- Lacks same-day funding option

- May require manual input for Level 3 data

- ACH payment processing is an add-on

Why I chose Stax

Stax is another leading traditional merchant service provider. Like Helcim, it offers interchange optimization for B2B transactions but combined with wholesale rates instead of interchange plus cost. This arrangement creates even larger discounts for businesses that regularly process large-volume sales. Compatibility sets Stax apart from Helcim, as it can work with most POS systems, including Clover, with simple integration.

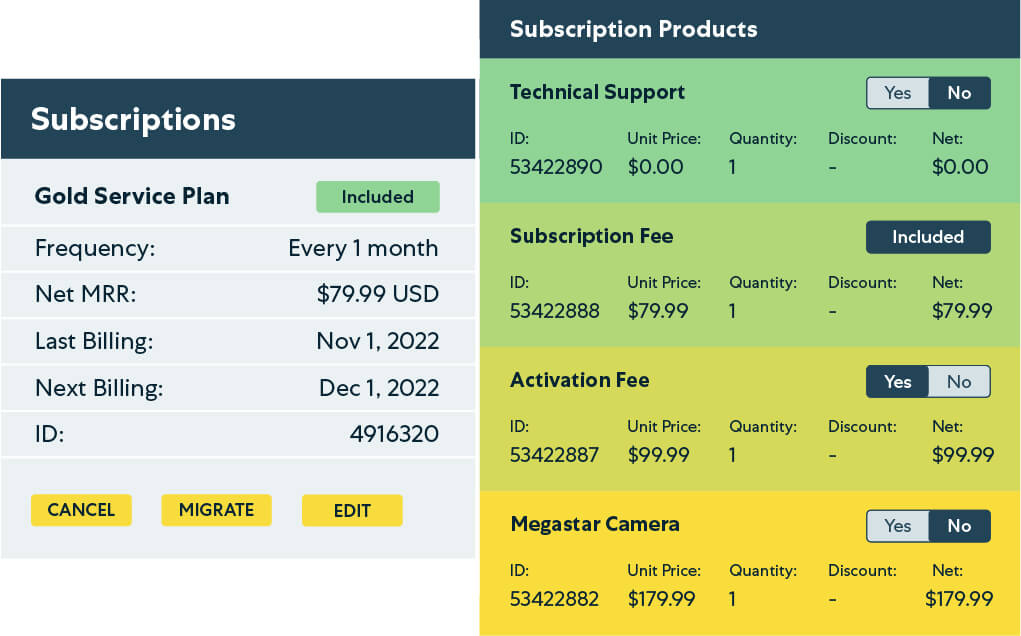

That said, I recommend Stax primarily for managing subscriptions for large B2B SaaS businesses. Stax Bill is equipped with everything from pricing and billing models to dunning management and a payment gateway processor to handle one-time and recurring subscription billing. It also provides revenue recovery, revenue recognition, analytics, sales tax automation, accounting tools, and APIs that allow integration with almost any business software.

Adyen: Best for global B2B payments

Overall Score

4.33/5

Pricing

4.38/5

B2B processing features

4.25/5

General features

4.5/5

Support and user experience

4.5/5

Average user review scores

4.05/5

Pros

- Dynamic currency conversion

- Single integration for multiple local payment methods

- Long list of B2B integration partners

- Strong omnichannel payment solutions

Cons

- Does not work with high-risk businesses

- Invoicing available via integration

- May require monthly minimum

Why I chose Adyen

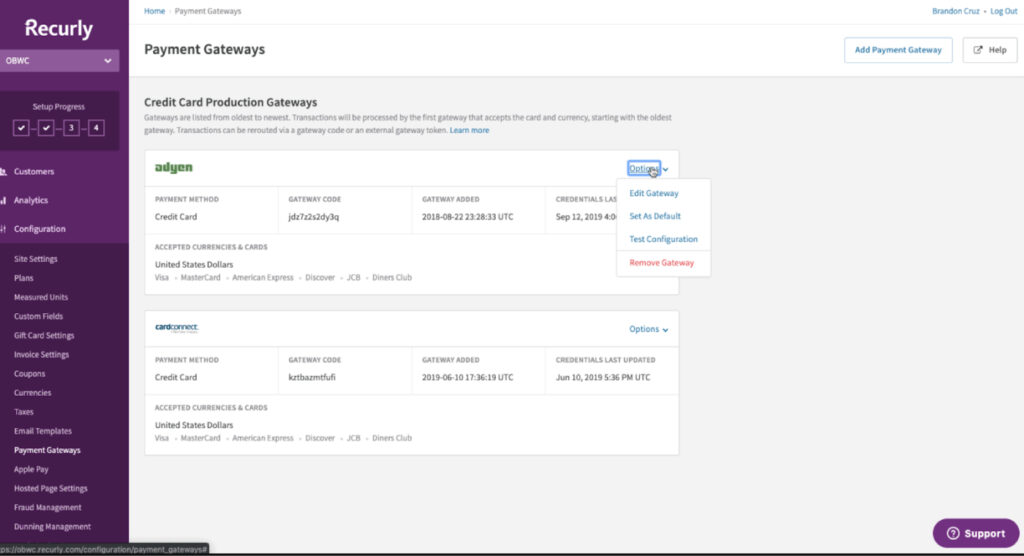

Adyen is a global merchant services provider designed for mid- and large-sized businesses. While Adyen is primarily European-based, it is a popular choice for embedded payments by top online platforms such as Recurly, Salesforce, and eBay. This makes Adyen seem similar to Stripe — another global payment processor on our list — but Adyen offers much stronger support for in-person transactions, making it a more well-rounded option.

Adyen’s expertise in both in-person and online payment services across the globe gives it a special place on our list. It allows businesses to accept 30 currencies from nearly 100 countries, including a long list of local European payment methods. At the same time, it supports unified/omnichannel payment features for brick-and-mortar businesses with a large online presence. Customizable embedded payment flows make Adyen a perfect provider for large B2Bs.

Stripe: Best for custom online payment processing

Overall Score

4.31/5

Pricing

4.38/5

B2B processing features

4.25/5

General features

4.25/5

Support and user experience

4.25/5

Average user review scores

4.47/5

Pros

- Custom interchange plus pricing

- Instant bank account verifications

- Highly customizable features with well-documented APIs

- Excellent security and anti-fraud tools

Cons

- Lacks built-in level 2 and 3 interchange optimization

- Limited virtual terminal functionality

- Requires heavy coding for advanced customization

Why I chose Stripe

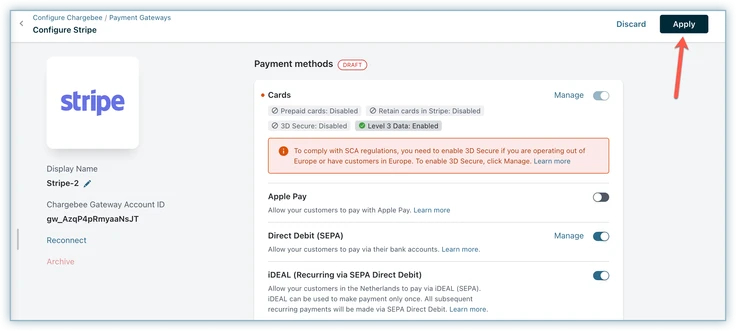

Stripe is one of the leading online payment processors in the industry, with a long list of simple and advanced customization tools. It offers flat-rate transaction fees for small businesses and custom interchange-plus rates for large-volume and enterprise-level companies. Stripe’s customization capabilities make it possible for businesses to accept a variety of online payments, including multi-currency transactions, with real-time authorization.

These features make Stripe a standout B2B payment processor for online businesses. Stripe has direct integration with global card networks and issuers. For large businesses with custom systems such as SaaS and online platforms, Stripe can be customized to process level 2 and 3 data. Customization options vary from simple third-party integrations to developer tools. Stripe can even connect businesses with partner web developers and integration consultants to get the process started.

Read more: Stripe alternatives and Square vs Stripe

PaymentCloud: Best for mid- to high-risk B2Bs

Overall Score

4.30/5

Pricing

4.06/5

B2B processing features

4.5/5

General features

4.5/5

Support and user experience

4.25/5

Average user review scores

4.65/5

Pros

- Supports high-risk B2Bs

- Customizable fee structure

- Integrates with most payment gateways

- Instant ACH transfers

Cons

- Lacks same-day funding

- Add-on monthly fees for payment gateways and virtual terminals

Why I chose PaymentCloud

Large-volume and card-not-present transactions are common between high-risk businesses and B2Bs, so our list would not be complete without PaymentCloud. As a leading high-risk merchant services provider, PaymentCloud offers a wide range of payment services that most B2Bs require to run their business. Its expertise in high-risk merchant processing ensures secure and easy-to-use payment solutions for businesses of any size.

What PaymentCloud does best is its ability to work and integrate its system with the most unique business models. PaymentCloud supports B2Bs with a virtual terminal to accept MOTO payments. It is also gateway-agnostic, which means PaymentCloud can work with any payment gateway for seamless migration. PaymentCloud can also provide a payment gateway that can better support a company’s payment processing requirements, such as level 2 and 3 data.

Pros & cons of B2B payments

Pros

- Lower transaction fees

- Well-documented transactions

- Often cheaper to process than business-to-consumer (B2C) payments

Cons

- Typically involves manual processes

- Security measures cause slow funding

- High risk of late payments

Businesses that sell to other businesses enjoy higher revenue compared to traditional businesses because transactions often involve discounted rates for high-volume or high-ticket sales. Interest rates on accounts receivable also add to businesses’ income. Volume-based discounts in processing fees are also often given for these transactions.

That said, the lack of automation in many B2B payment processes results in overall funding delays. B2B companies still rely, in part, on manual processes to manage their accounts receivable, which can cause human errors and delays in collections. Even traditional B2B payment methods, like wire transfers and paper checks, which are still used today, undergo manual security measures that unnecessarily extend the approval wait time.

What is level 2 and 3 data processing for B2B credit card transactions?

B2B transactions are less frequent than B2C transactions but usually involve large volumes or large-ticket products or services. By this nature, card networks have a separate interchange category for corporate/business/commercial purchase cards, which implements much lower interchange rates.

However, accepting these card types alone does not automatically qualify a transaction for discounted rates. Card networks expect businesses to meet certain requirements; otherwise, transactions are “downgraded” and charged a higher interchange fee.

Expert Tip

Note that interchange fees make up only the portion of a credit card transaction imposed by card networks. Fees can go as high as 4% per transaction after other service fees and markups are added.

This is where level 2 and 3 data processing comes into play. Each data processing level has different requirements. The higher the level, the more requirements there are. However, the higher the level, the lower the processing fees.

The idea is that as more transaction data is collected, the more secure the payment processing becomes. The act of setting up a process to qualify for these rates is referred to as “interchange optimization.” Businesses should look for B2B payment processors that can automate this task.

Here’s a quick breakdown of the different processing levels:

Level 1

Level 2

Level 3

Transaction type

Business-to-consumer

Business-to-business

Business-to-government or business-to-business

Transaction levels

No minimum requirement

- Visa and Mastercard: 1-6 million transactions

- American Express: Apply for approval

- 20,000-1 million in e-commerce transactions

Required data

Basic purchasing information

Level 1 data, plus taxes, orders, and invoice information

Level 2 data, plus products, discounts, and shipping information

Average discount on interchange rates

None

0.45%-0.90%

1%

Card network

All major card brands

Visa, Mastercard, American Express

Visa, Mastercard

Required data for level 2 card processing

- Merchant name

- Merchant category code

- Billing zip code

- Purchase amount

- Purchase date

- Purchase order number

- Customer code

- Destination zip

- Destination address

- Destination city

- Destination state

- Invoice number

- Merchant tax identification number (TIN)

- Sales tax amount

- Sales tax indicator

Required data for level 3 card processing

- All Level 2 data

- Commodity code

- Country code destination

- Debit/credit indicator

- Duty and/or import taxes assessed

- Extended price

- Freight and/or shipping cost

- Item ID or SKU

- Item description

- Line discount

- Unit of measure (each)

- Unit price

- Unit quantity

- VAT information/reference number

How to choose the best B2B payment processors

Consider the following criteria when choosing a B2B payment processor:

Determine what payment methods you want to accept

Choose a provider that can accept B2B payment methods that your business needs — credit cards, ACH payments, and wire transfers; maybe even paper checks. Also, consider payment methods that your company may need in the future. The payment processor should provide you with a custom plan that considers all these factors.

Decide what other tools you need

The best B2B payment processor should provide businesses with the right payment services. This includes virtual terminals, subscription management, and the ability to process cross-border transactions. The most important factor is a payment processor’s ability to automate interchange optimization for level 2 and 3 data processing. Chargeback management and customizable fraud protection are also both crucial B2B payment tools.

Compare pricing

Because B2Bs regularly deal with large-volume and high-ticket sales, the best payment processor should offer cost-saving features. These include being able to offer interchange plus instead of flat fees to qualify for level 2 and 3 interchange rates, free credit card processing programs, wholesale subscription pricing, and custom plans, so you only pay for features that your business needs.

Make sure your specific industry is supported

The best B2B payment processor should support a variety of business types. This can include nonprofits, wholesalers, professional services, and SaaS platforms. These business models may require a level of expertise to get approved for a merchant account, which a payment processor should be ready to provide.

Finding the best B2B payment processor for you

The cost of accepting payments takes away a huge portion of revenue from any business, especially B2Bs. So, when finding the right payment processor, B2Bs should look for a provider that offers cost-saving and customizable payment processing features that will help maximize your savings.

Helcim is our most recommended B2B payment solution if you need a payment processor that combines the most efficient automation with a range of cost-saving features. Stax is your best choice if you want to efficiently scale a subscription-based B2B business. Stripe and Adyen offer the highest level of customization for businesses that are comfortable with web development. But if you run a business that’s been qualified as mid- or high-risk, choose PaymentCloud.

Read more: If you need more budget-friendly recommendations, check out our list of the cheapest credit card payment processors.