Finding the cheapest credit card processor is crucial for any business looking to maximize savings and efficiency. Aside from fixed monthly costs, processing fees can quickly add up, and choosing the least expensive credit card processing solution is essential to maintaining healthy profit margins.

In this guide, we evaluated low-cost credit card processing companies in the market and scored them based on pricing, features, support and reliability, user experience, and user reviews.

Based on our evaluation, here are the cheapest credit card processing providers for 2024:

Software Spotlight: PaymentCloud

Flexible payment processing for any business- 98% of applications are approved for a merchant account

- Wide range of payment options – including no-cost (surcharging)

- Month-to-month contract

- No setup, application, or annual fees

Visit PaymentCloud

Cheap credit card processing compared

Our Score (out of 5)

Monthly Fee Starts At

Processing Fee

Chargeback Fee

Deposit Speed

Helcim

4.23

$0

Interchange + (0.15% + $0.06 to 0.50% + $0.25)

$15 (refundable)

1-2 business days

Stax

4.21

$99

Interchange + (8% to 18%)

$25 (non-refundable)

1-2 business days; Instant: with fee

Square

4.21

$0

2.5% + $0.10 to 3.5% + $0.15

$0 (waived up to $250)

1-2 business days; Instant: 1.75% fee

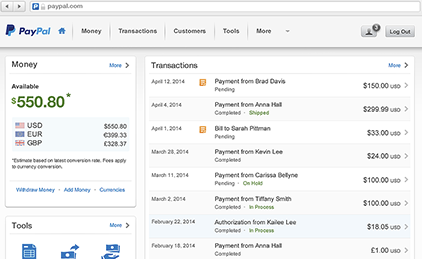

PayPal

4.11

$0

2.29% + $0.09 cents to 3.49% +$0. 49

$20 (non-refundable)

1-2 business days; Instant: 1.5% fee

Stripe

4.02

$0

2.7% + $0.05 to 3.4% + $0.30

$15 (non-refundable)

1-2 business days; Instant: 1.5% fee

PaymentCloud

3.96

$10

2% to 4.3%

$25 (non-refundable)

1-2 business days

CardX

3.99

$29

0%

$0

Next business day

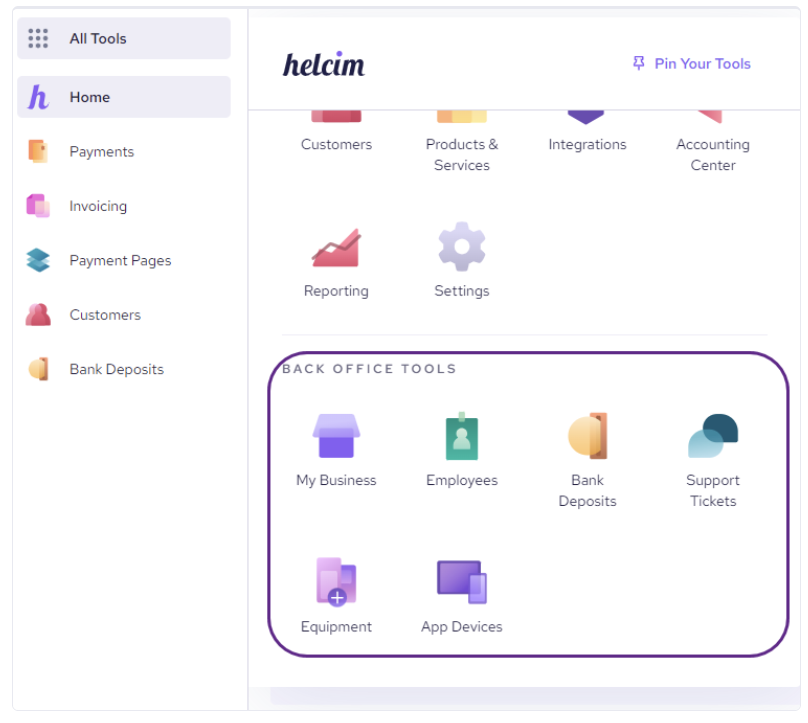

Helcim: Cheapest credit card processor

Overall Reviewer Score

4.23/5

Pricing

4.75/5

Features

4.25/5

Support and reliability

3.25/5

User experience

4.69/5

User scores

4.2/5

Pros

- Interchange-plus pricing model

- Automatic volume discount

- Surcharging option

Cons

- Limited integrations

- Charges extra for Amex transactions

- Only for businesses in US and Canada

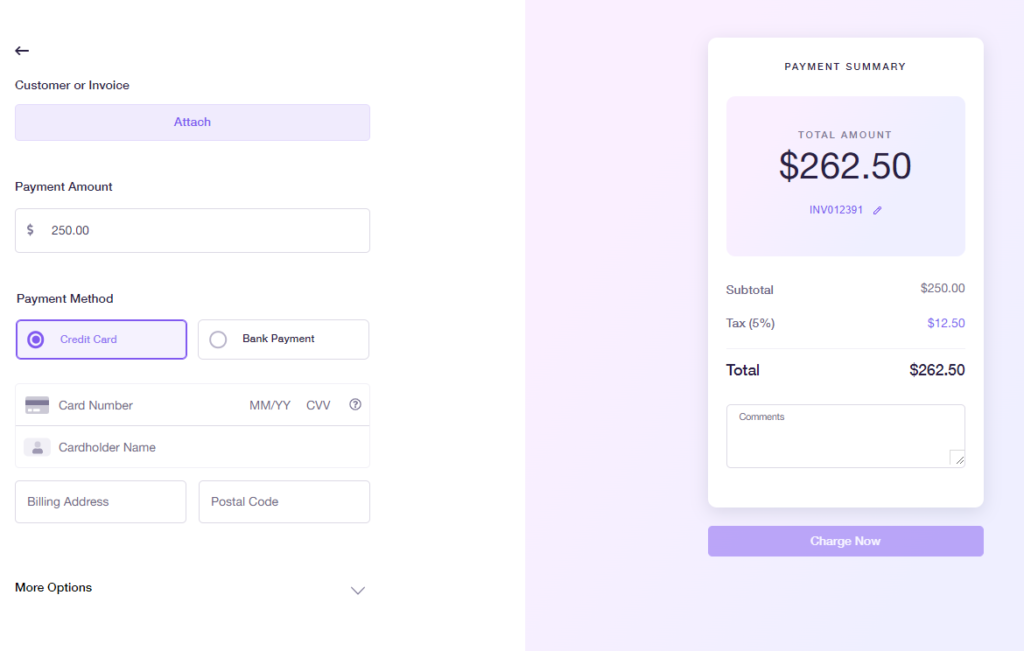

Why I picked Helcim

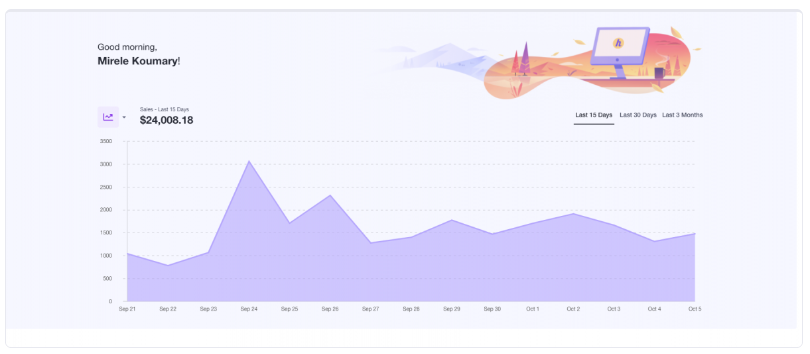

Helcim’s fees are no fuss — no monthly, set-up, or cancellation fees. This means monthly credit card processing costs are limited to the payment processing fees. Aside from this, Helcim uses an interchange plus pricing structure, which often incurs lower costs compared to flat-rate or tiered pricing structures.

There is also an automatic volume discount, meaning the fees Helcim charges automatically decrease per transaction as you scale. This isn’t something we’ve seen elsewhere. Usually, volume discounts are by request only.

Helcim also has a surcharging option for passing on processing fees to customers, potentially further reducing expenses for businesses where surcharging is allowed.

When we simulated processing fees for certain total monthly volumes and average transaction values, Helcim has one of the cheapest total processing fees for a total monthly transaction volume of up to around $40,000. If your business processes higher total monthly amounts than this, Stax will be a cheaper option.

Stax: Cheapest credit card processor for large-volume businesses

Overall Reviewer Score

4.21/5

Pricing

4.5/5

Features

3.75/5

Support and reliability

4.5/5

User experience

4.06/5

User scores

3.9/5

Pros

- Interchange-plus pricing model

- 24/7 customer support

- Automatic updates for stored credit cards

Cons

- Monthly fee starts at $99

- Only for businesses in the US

- Customization tools and ACH payments are add-ons

Why I picked Stax

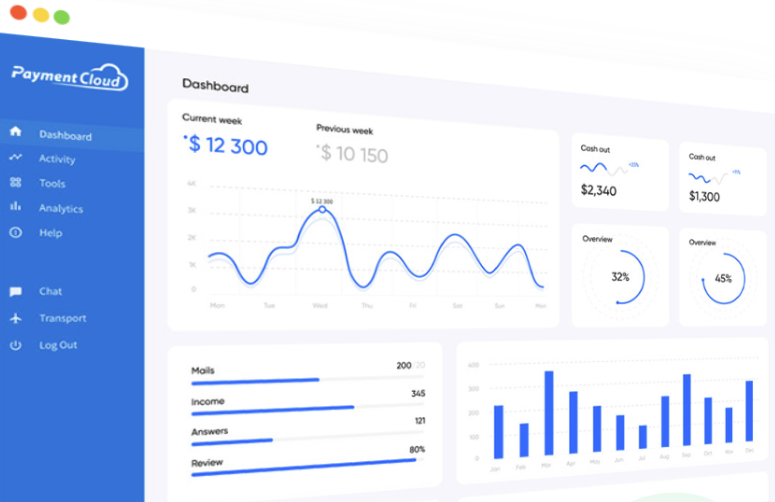

Although Stax charges a distinctly higher monthly fee than other providers in this guide, it offers low interchange-plus transaction fees with no percentage markup. Even when factoring in the monthly fee, Stax offers the lowest credit card transaction fees for any business processing around $50,000 and above. This makes Stax particularly advantageous for businesses with higher transaction volumes, where the savings on transaction fees can quickly offset the monthly costs.

Additionally, Stax provides a range of value-added features, including robust analytics and reporting tools, seamless integration with various POS systems, and excellent customer support. With its transparent pricing model and complete credit card payment processing solution, Stax is a powerful option for high-volume businesses.

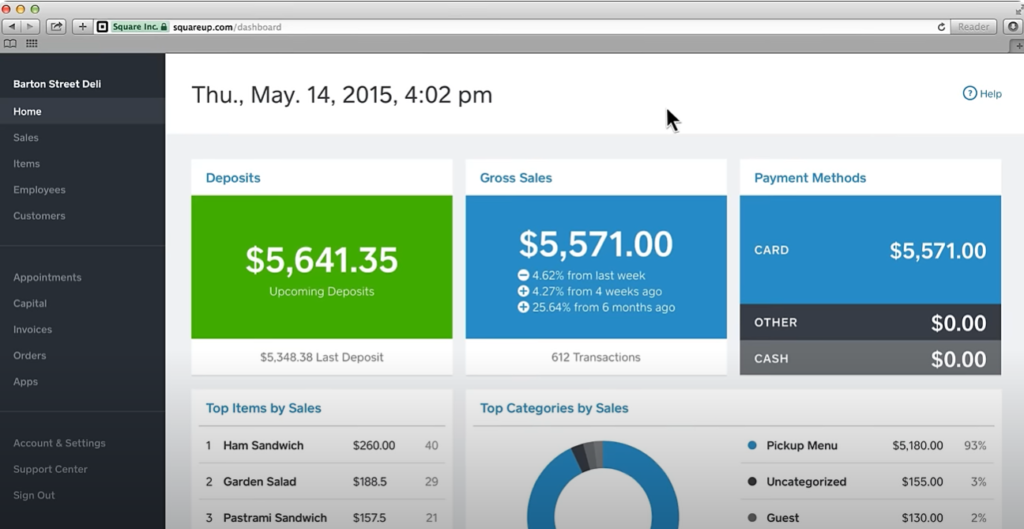

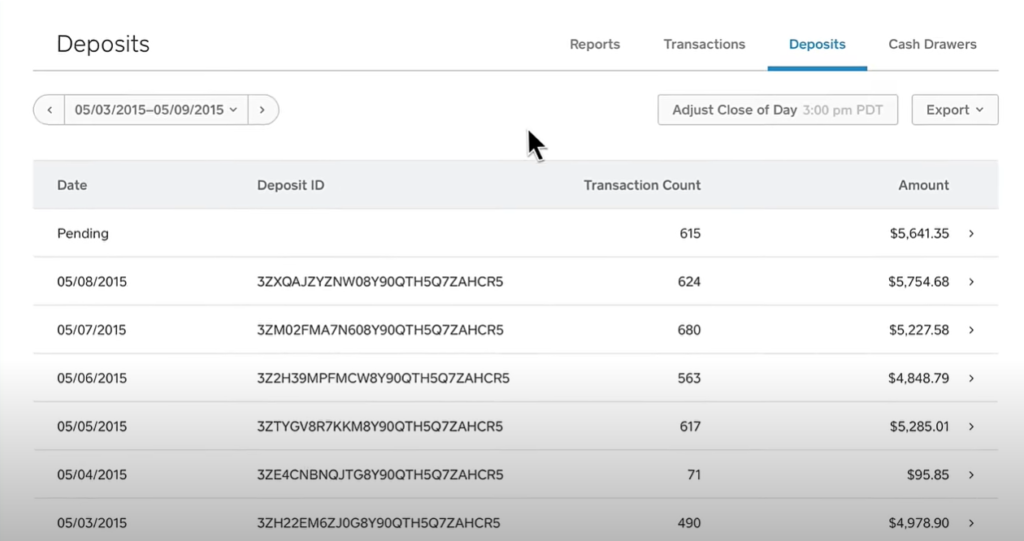

Square: Best for small and new businesses

Overall Reviewer Score

4.21/5

Pricing

4.25/5

Features

4.25/5

Support and reliability

3.5/5

User experience

4.38/5

User scores

4.67/5

Pros

- No starting and ongoing fees

- Instant approval

- Free magstripe reader

Cons

- Account stability issues

- Expensive for monthly processing volume higher than $10,000

- Limited customer support hours

Why I picked Square

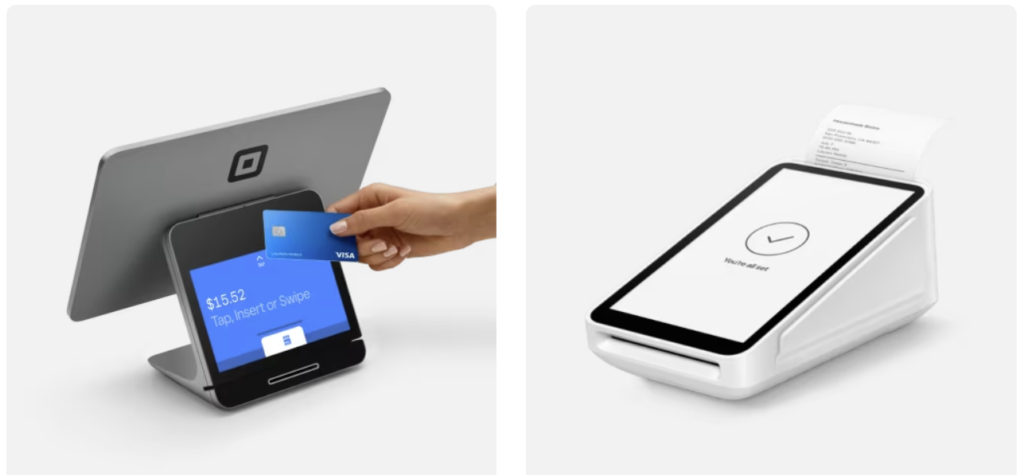

For new and small businesses processing only up to around $10,000 or businesses with average transaction amounts of up to $50, Square is the best option for an all-in-one solution.

Its flat-rate pricing simplifies payment processing, making it easy for businesses to predict and manage their monthly costs without dealing with complex interchange fees. Square’s transparent fee structure eliminates the guesswork, allowing for straightforward financial planning.

Square offers a comprehensive suite of tools, including point-of-sale (POS) systems, invoicing, and e-commerce capabilities, all seamlessly integrated into one platform. This integration streamlines operations, allowing businesses to efficiently manage sales, inventory, and customer data in one place. Additionally, Square provides robust analytics and reporting features, offering valuable insights to help businesses make informed decisions.

With no monthly fees, Square is an attractive option for businesses that seek flexibility without long-term commitments. Its user-friendly interface and excellent customer support ensure that even those new to payment processing can easily adopt and utilize its features. For small businesses looking for an affordable, all-in-one solution, Square is a suitable choice.

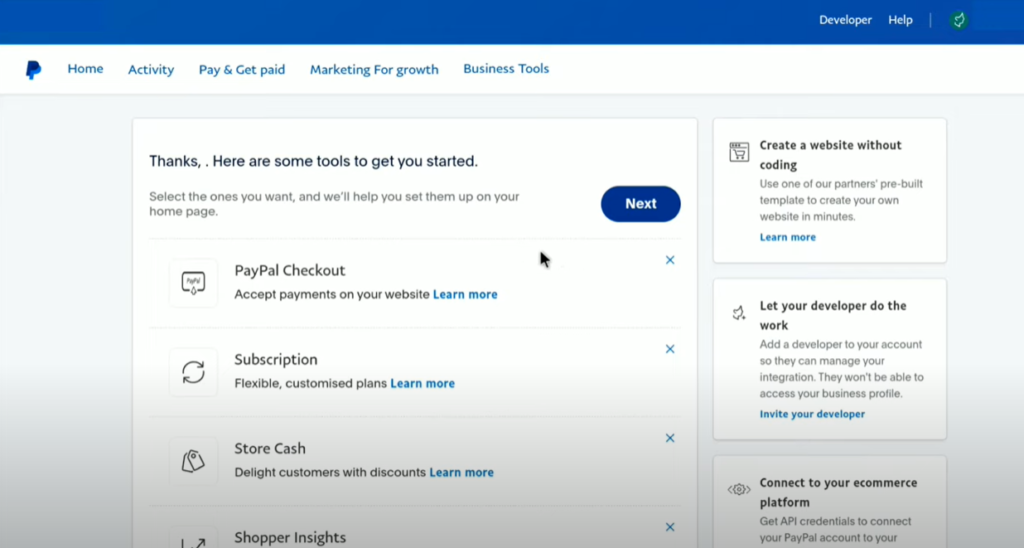

PayPal: Cheap additional payment method

Overall Reviewer Score

4.5/5

Pricing

3.75/5

Features

3.25/5

Support and reliability

4.25/5

User experience

4.69/5

User scores

4.6/5

Pros

- Quick and easy sign-up and widely popular

- Flat-rate pricing with no monthly fees

- Easy integrations

Cons

- Complicated pricing structure

- Account stability issues

- Add-on fees for virtual terminal

Why I picked PayPal

PayPal is an excellent choice for businesses looking to add a cost-effective, additional payment method. With its global recognition and trusted reputation, PayPal can help businesses increase customer trust and conversion rates. It does not charge any monthly fees and has no monthly minimum transaction volume.

PayPal is particularly beneficial for online transactions and international sales, offering a secure and familiar option for customers worldwide. Most ecommerce platforms and POS systems offer one-click PayPal integrations that make it easy for businesses to add PayPal as a payment option for their customers. The ease of integration with various e-commerce platforms and POS systems makes it a convenient addition to any existing payment processing setup.

Additionally, PayPal’s robust security features and buyer protection policies benefit both businesses and customers. It also allows businesses to accept Venmo and PayPal Credit payments, which are not available through the other payment providers in this guide.

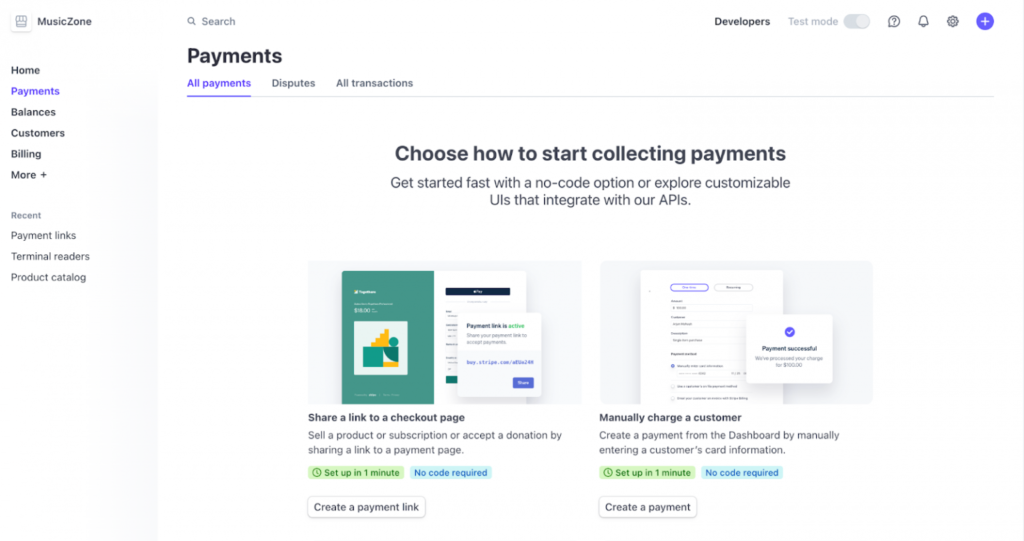

Stripe: Best for online businesses

Overall Reviewer Score

4.02/5

Pricing

3.75/5

Features

3.25/5

Support and reliability

4.25/5

User experience

4.38/5

User scores

4.47/5

Pros

- Quick instant sign-up

- Robust developer tools and powerful APIs

- Transparent pricing with no monthly fees

Cons

- Requires integration for in-person payment processing

- Account freezes

Why I picked Stripe

Stripe is the best choice for small online businesses. It offers a powerful and flexible payment processing solution. Its competitive, transparent pricing model makes it easy for businesses to predict and manage their costs.

Stripe excels in online payment processing, with extensive developer tools and APIs that allow businesses to customize their payment solutions to fit their specific needs. This flexibility is ideal for small online businesses looking to scale and adapt quickly. Additionally, Stripe supports a wide range of payment methods and currencies, making it easier for businesses to cater to a global customer base.

In our estimates of monthly costs, Stripe landed with Square for businesses that process up to around $10,000 in total monthly transaction volume and around $50 in transaction amount. If your business processes higher monthly volumes or average transaction amounts, then Helcim could be a cheaper option. However, Stripe does offer custom pricing options, including interchange-plus and volume discount pricing, upon request.

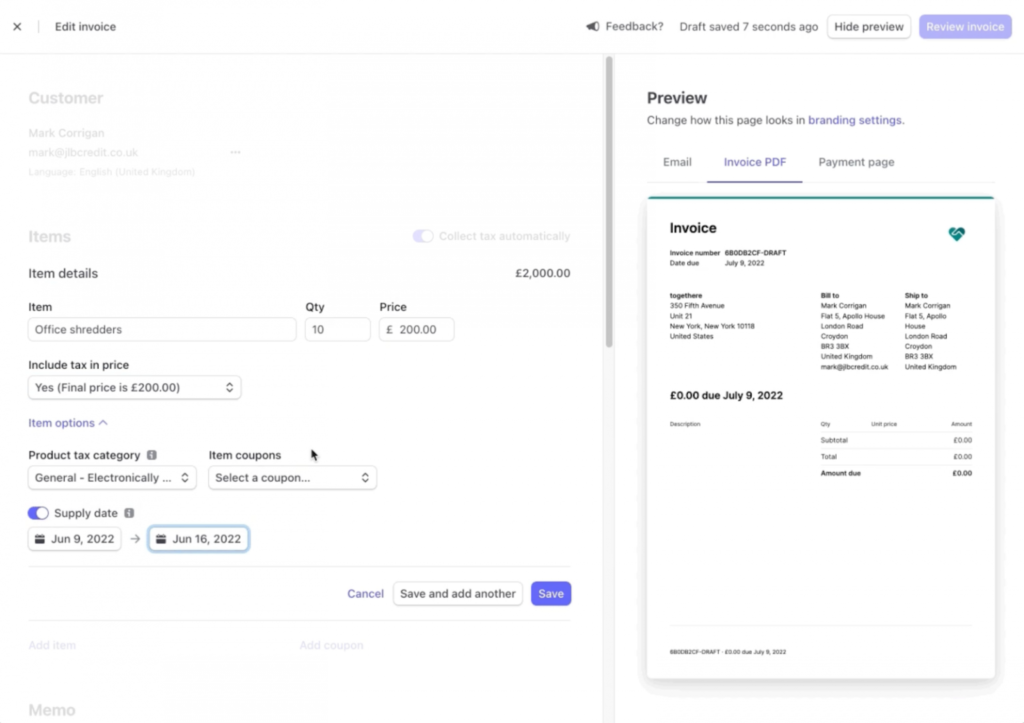

PaymentCloud: Best for high-risk business

Overall Reviewer Score

3.96/5

Pricing

3.5/5

Features

3.75/5

Support and reliability

4.75/5

User experience

4.69/5

User scores

4.47/5

Pros

- Supports high-risk business

- Free card reader

- High approval rate

Cons

- Pricing is not publicly disclosed

- Longer application and approval process

- Higher fees for high-risk businesses

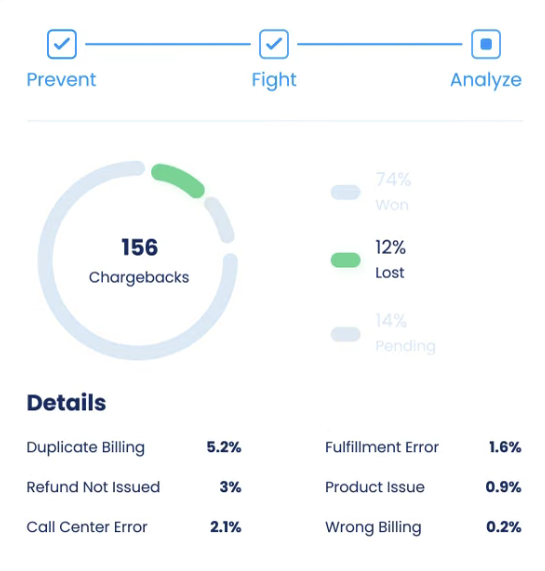

Why I picked PaymentCloud

PaymentCloud is the best choice for high-risk businesses, offering specialized services and solutions tailored to these industries. None of the other providers included in this guide offer support for high-risk businesses, while PaymentCloud excels at navigating the complexities and challenges associated with high-risk payment processing.

The pricing is not readily available on the website, especially since actual processing rates depend on the business’s risk status. Despite the seeming lack of readily available fees, PaymentCloud’s range of rates is cost-effective, and it has a high approval rate for all kinds of businesses. Additionally, PaymentCloud’s expertise in fraud prevention and chargeback management helps high-risk businesses mitigate potential risks and protect their revenue.

Like most high-risk merchant account providers, the application and setup process can take longer than that for low-risk businesses. But PaymentCloud’s dedicated support team ensures that high-risk businesses receive personalized assistance throughout the application and set-up process.

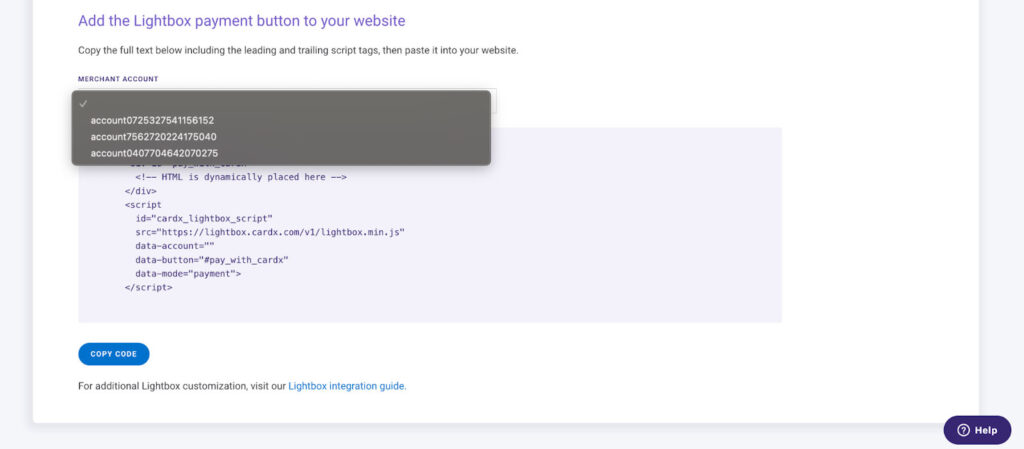

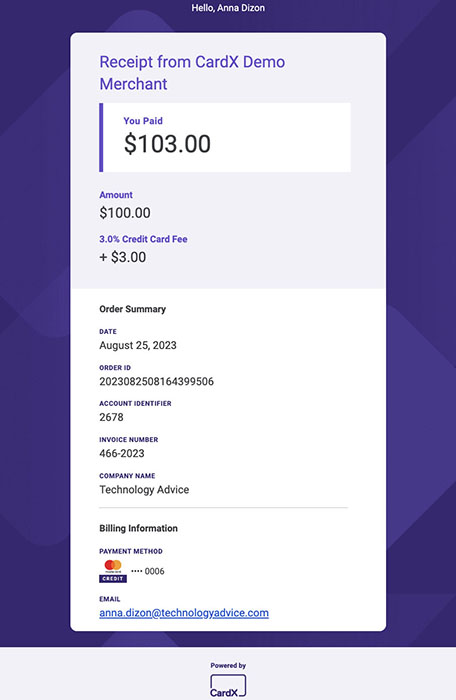

CardX: Best for zero-cost credit card processing

Overall Reviewer Score

3.99/5

Pricing

4.38/5

Features

3.33/5

Support and reliability

4.25/5

User experience

4.69/5

User scores

3/5

Pros

- Fully compliant automatic surcharging

- No-cost credit card processing

- Quick integration with ecommerce websites

Cons

- Limited hardware options

- Only available for businesses in specific locations

- Higher monthly fees at higher monthly transaction volume

Why I picked CardX

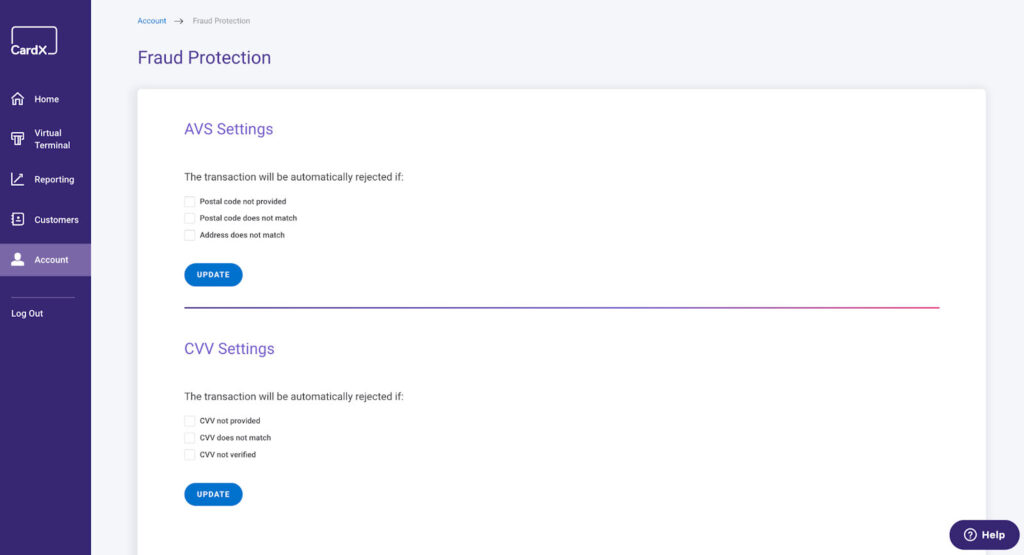

If your business is located in one of the 48 states that CardX serves and you want free credit card payment processing, CardX is the best choice for zero-cost credit card processing. It offers businesses a unique solution to eliminate processing fees entirely by passing the processing costs to the customer through surcharges. This can significantly enhance profit margins, especially for businesses with high transaction volumes.

CardX provides a surcharging solution that’s fully compliant with all state and federal regulations to ensure that businesses can confidently implement this zero-cost solution. Businesses can also expect training and signage that will make it easier for them to implement surcharging for their business.

How to lower credit card processing fees

Lowering credit card processing fees is essential for maximizing your business’ profitability. Aside from looking for the cheapest credit card processors, there are effective strategies that will help you save on credit card processing fees.

Negotiate with providers

Discuss your rates with your payment processor to see if you can secure a better deal based on your transaction volume. While some processors, such as our cheapest option in this guide, Helcim, provide automatic volume discounts, other options, such as Stripe and Square, also offer volume discounts upon request.

Additionally, if you receive a quote for a lower rate, ask your current processor if they’ll match it.

Consider interchange-plus pricing

It’s no surprise that when considering just the monthly and credit card processing fees, the cheapest credit card processing options in this guide, Helcim and Stax, both offer interchange-plus pricing. This pricing model can often be more cost-effective than flat-rate or tiered pricing, especially for higher transaction volumes.

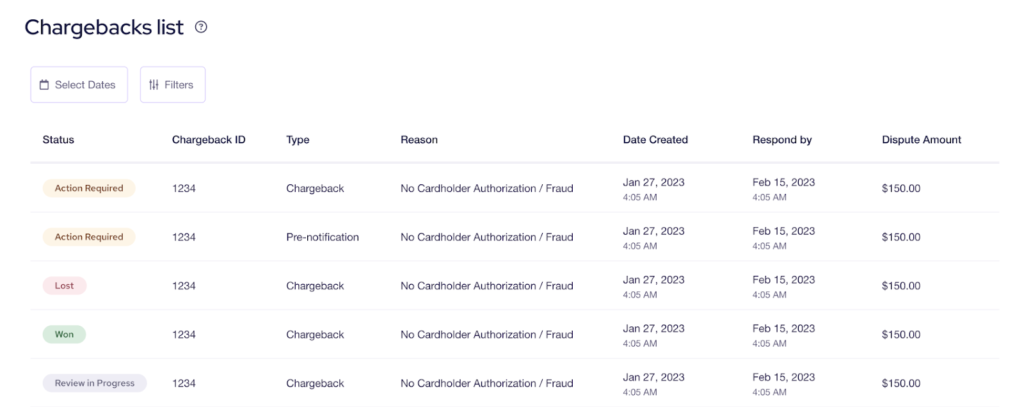

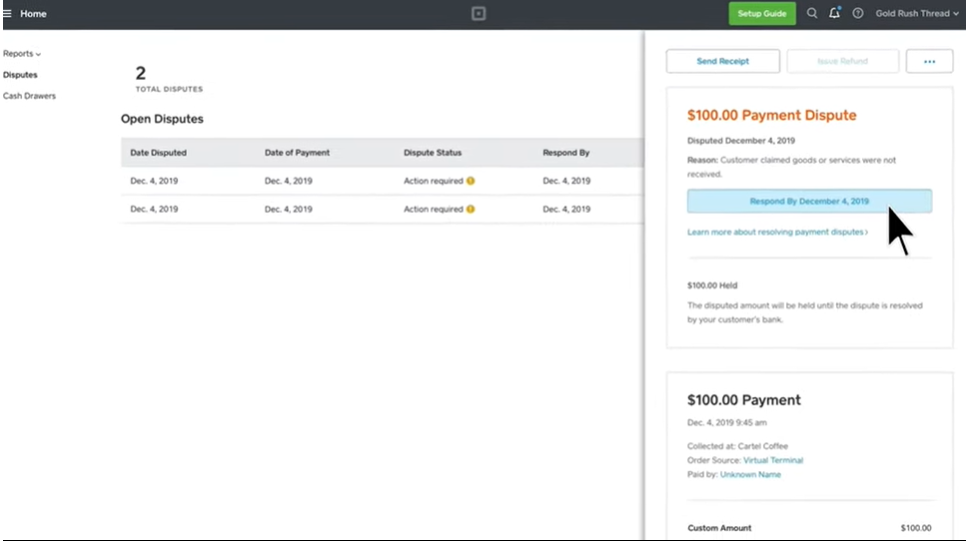

Reduce chargebacks

Aside from the chargeback fees that most processors charge, you will also lose revenue from sales and transaction fees, which are typically not returned to the business in the event of a chargeback. Implementing fraud prevention measures and choosing a provider with strong fraud protection tools will help minimize chargebacks.

Use surcharging

If it is legal in your state to pass on credit card fees to your customers and you are willing to have your customers shoulder the processing fees, choose a credit card processor that allows surcharging. While CardX offers a fully compliant surcharging program, other providers in this guide, such as Helcim, Stax, and Stripe, also allow surcharging.

Review your card processing fees regularly

As your business grows, regularly review your credit card processing fees. The cheapest credit card processor will often depend on your business volume.

Based on the estimates we made for the providers in this guide, Stripe and Square offer the most cost-effective rates for small businesses with low monthly transaction volumes and whose typical transaction amount is just around $50 and below. If your business processes higher volumes and amounts than these, Helcim and Stax will be better options.

Regularly reviewing your fees will allow you to determine whether it is time to switch to a different provider or re-negotiate with your current one.

Encourage other payment methods

The cheapest credit card processing is no processing at all. This means encouraging your customers to use other payment methods that will incur lower to no fees for you, such as cash payments or ACH payments.

Which is the cheapest?

Choosing the cheapest credit card processing provider depends on your business’s specific needs and transaction volumes. For businesses processing up to $10,000 monthly, Square and Stripe offer a cost-effective solution with no monthly fees and a flat-rate fee structure, while Helcim is ideal for those processing up to $40,000 monthly due to its transparent interchange-plus pricing with no monthly fees.

Stax is the most economical for high-volume businesses, providing low transaction fees without a percentage markup despite a higher monthly fee. If you need a zero-cost credit card processing option, CardX can help by passing processing fees to customers, significantly reducing expenses for businesses in states where surcharging is allowed.