Stripe is a popular online payment processor because of its ability to accept a wide range of payment methods, its top-notch security features, and its customizability. However, online businesses looking for an ecommerce payment processor may look for Stripe alternatives that are easy to use, are competitively priced, and offer seamless in-person payment processing.

Our team compiled a list of some of the top Stripe alternatives for ecommerce businesses and looked at their pricing, features, ease of integration, security, and customer support quality. Here are our top 6 picks:

- Square: Best overall Stripe alternative

- Shopify Payments: Best for Shopify websites

- Helcim: Best for interchange pricing

- PayPal: Best for easy integration

- PaymentCloud: Best for high-risk merchants

- CardX: Best for zero credit card processing

Software Spotlight: Helcim

Want to reduce – or eliminate – processing fees?In addition to free cloud POS software, Helcim offers some of the lowest payment processing fees on the market. With Helcim, you’ll get:

- Free POS software and low, interchange-plus pricing

- Options to pass processing fees on to your customers

- Dedicated merchant account with greater security and stability

Visit Helcim

Top alternatives to Stripe in 2024

Although Stripe is an excellent payment processor for online businesses, it may not be the best option for those needing a “plug-and-play” option or an easy-to-use point-of-sale (POS) system. Here are some of our top Stripe alternatives:

Provider

Starting Price per Month

Online Transaction Fee

Ecommerce Tools

Customer Support

Square

$0

2.9% + 30 cents

Website builder, payment links, ecommerce platform integrations, virtual terminal

Extended business hours

Shopify

$5

2.9% + 30 cents

Shopify store

24/7 chat, email, phone

Helcim

$0

Interchange plus 0.15% + 15 cents to 0.50% + 25 cents

Website builder, payment links, ecommerce platform integrations, virtual terminal

Extended business hours

PayPal

$0

2.99% + 49 cents

PayPal Checkout integration, one-click integrations, virtual terminal

Extended business hours

PaymentCloud

$10

2% to 4.3%

Ecommerce platform integration, payment links, virtual terminal

Monday to Friday, 7 a.m. to 6 p.m. Pacific time

CardX

$29

Credit card: 0%

Debit card: Starts at 2.91%

Website integration

Business hours

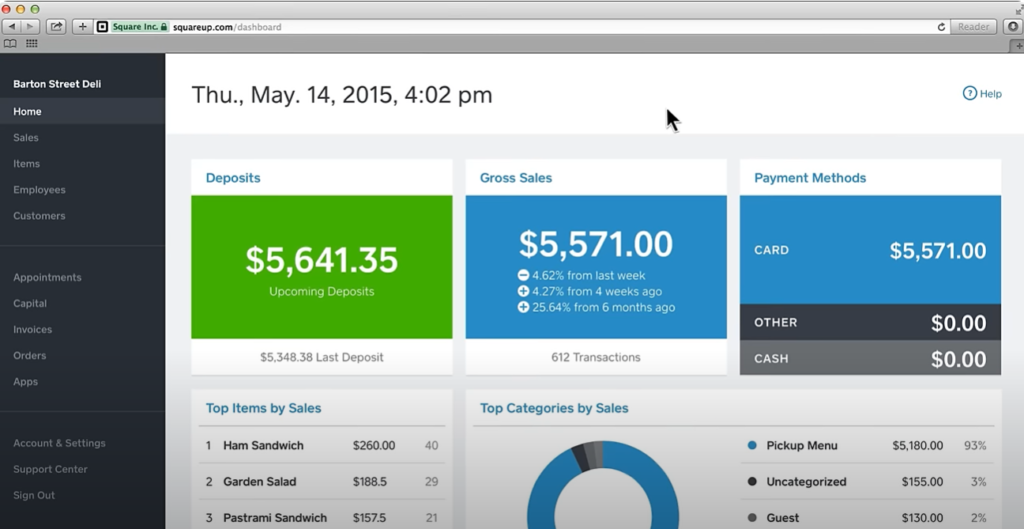

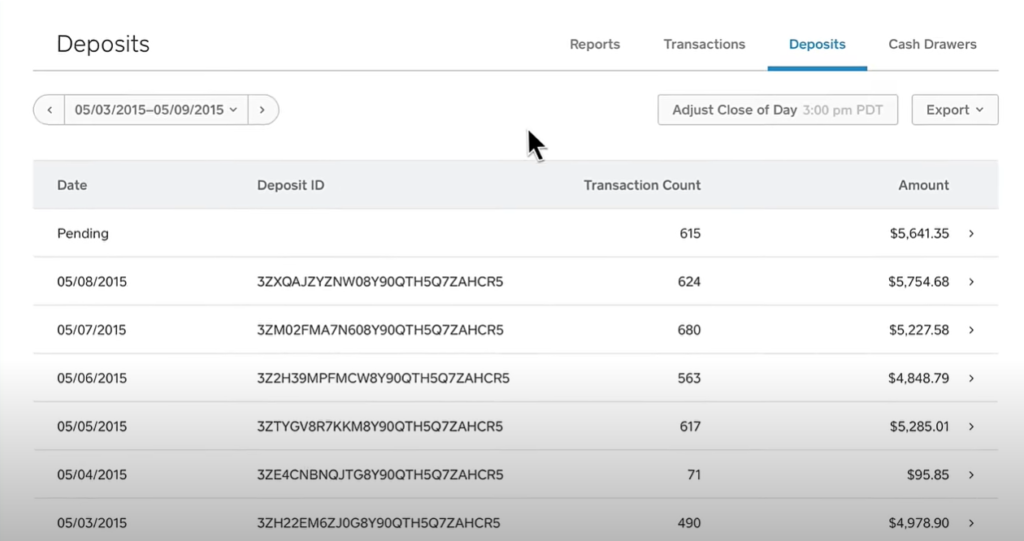

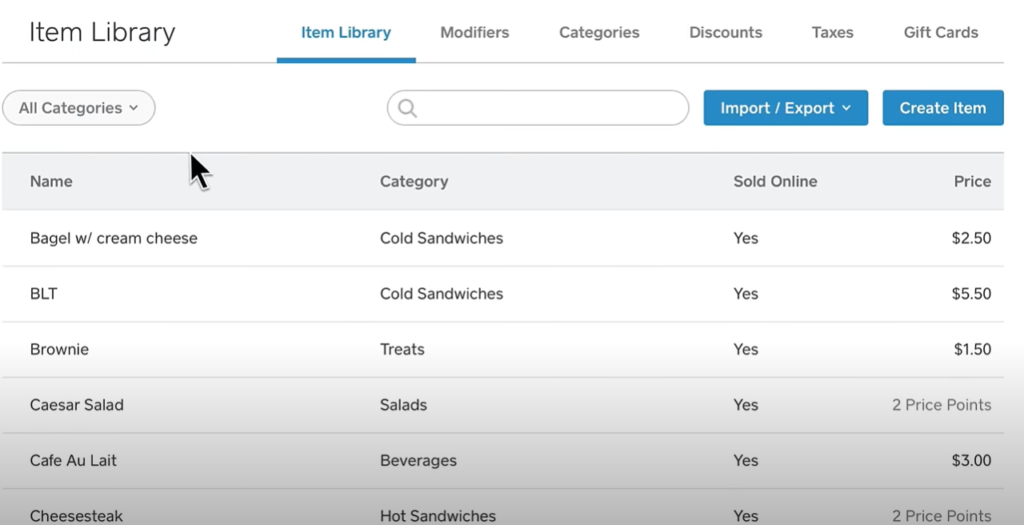

Square: Best overall Stripe alternative

Pros

Cons

Our Rating: 4.28/5

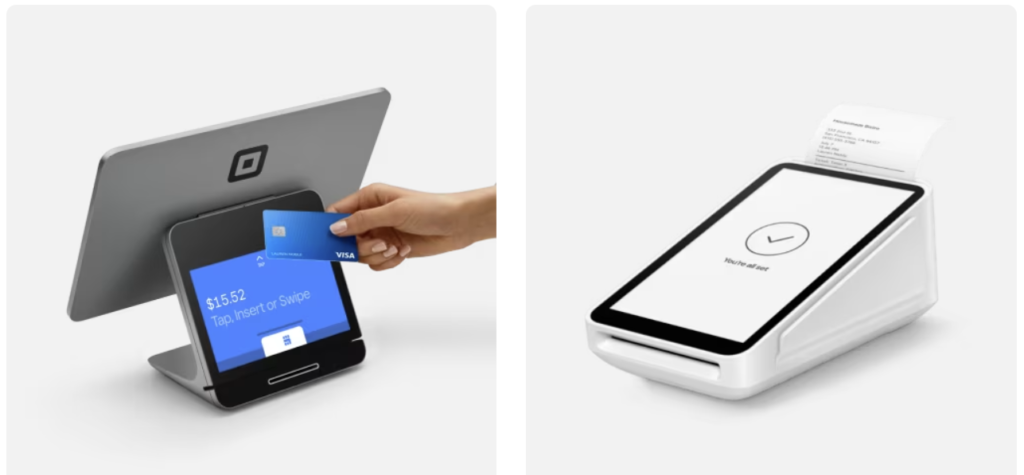

Square Payments is a complete payment processing platform that enables businesses to accept various forms of payments through several channels—inperson, online, and mobile. Square provides hardware like card readers and terminals, as well as software solutions for POS systems and online payment processing. Square’s zero initial cost makes it a viable and attractive option even for startups, and it also offers easy integration with many popular ecommerce platforms for larger online businesses.

As a Stripe alternative, Square Payments offers several comparable features and functionalities. Both platforms let businesses accept payments easily and securely, with transparent pricing structures and straightforward setup processes. Square Payments may appeal to businesses seeking a simple all-in-one solution, as it integrates hardware and software seamlessly. Online businesses that also need in-person payment processing capabilities will find Square’s user-friendly POS systems highly suitable. Moreover, Square Payments is designed to adapt and grow alongside businesses, providing scalability and flexibility to accommodate changing demands.

Shopify Payments: Best for Shopify websites

Pros

Cons

Our Rating: 4.16/5

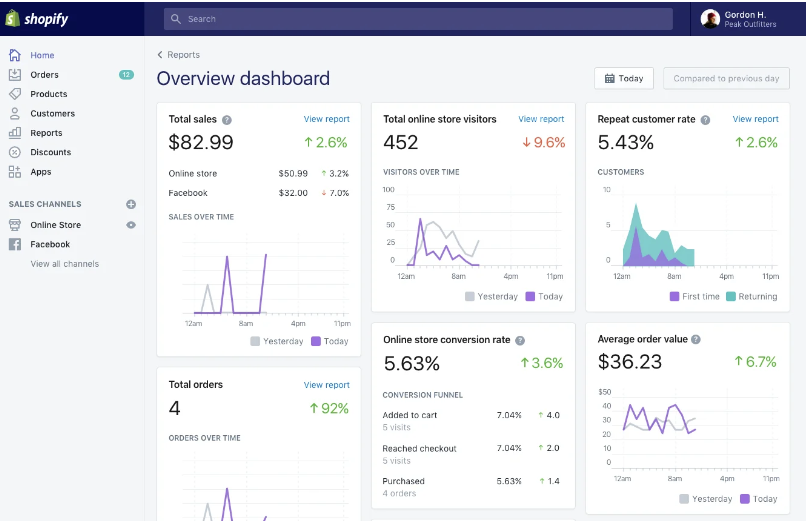

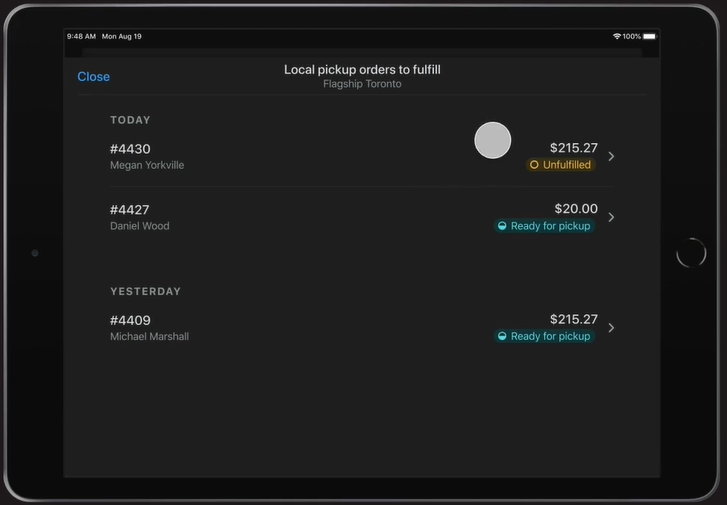

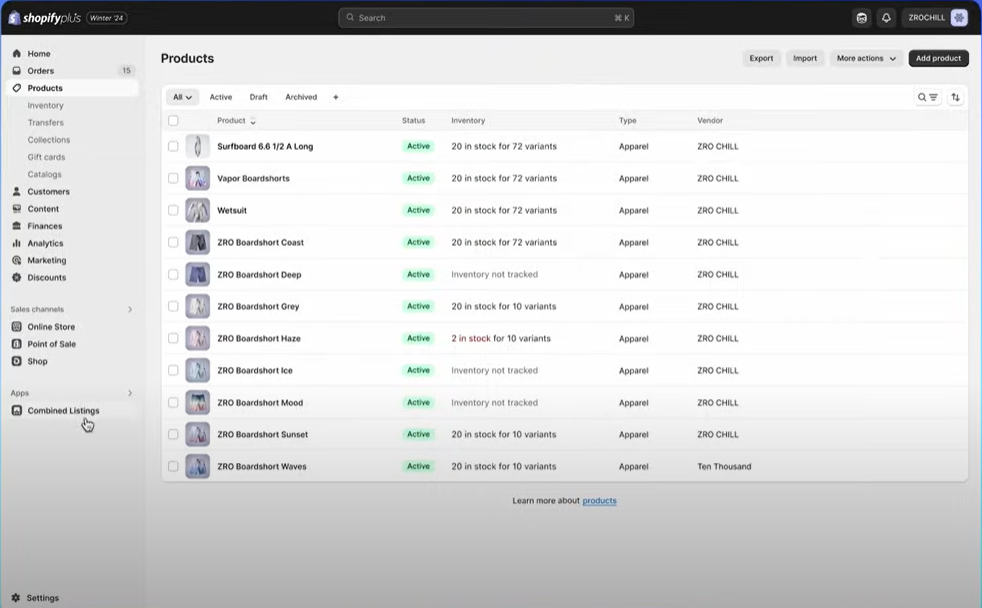

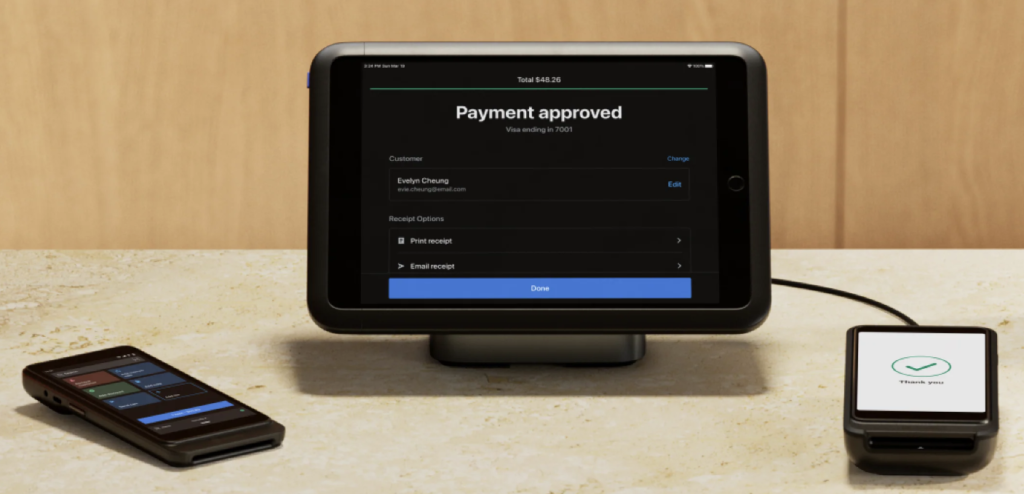

Shopify Payments is an integrated payment processing solution offered by the ecommerce platform Shopify. Businesses can accept credit card payments directly through their Shopify stores without needing to set up a separate payment gateway. With Shopify Payments, sellers can manage their entire online business, from product listings to order management and payment processing, all within the Shopify dashboard.

As a Stripe alternative, Shopify Payments offers several advantages. Firstly, it provides a seamless integration with Shopify’s platform, eliminating the need for third-party plugins or additional setup. This reduces complexity and potential technical issues throughout the process.

Additionally, Shopify Payments offers competitive pricing, often matching or even undercutting Stripe’s fees, especially for users who are already leveraging Shopify’s services. Moreover, Shopify Payments provides unified support and assistance, letting sellers resolve payment-related issues without having to coordinate between multiple service providers.

Overall, Shopify Payments presents a robust and user-friendly alternative to Stripe for merchants operating within the Shopify ecosystem. Its simplicity, and competitive pricing make it an attractive option for businesses looking for a hassle-free payment processing solution tightly integrated with their Shopify ecommerce operations.

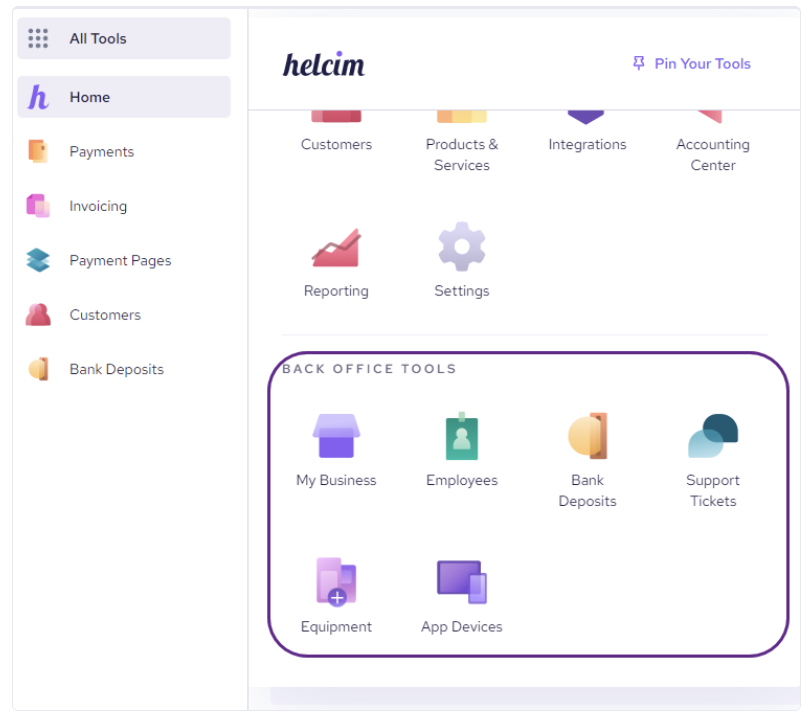

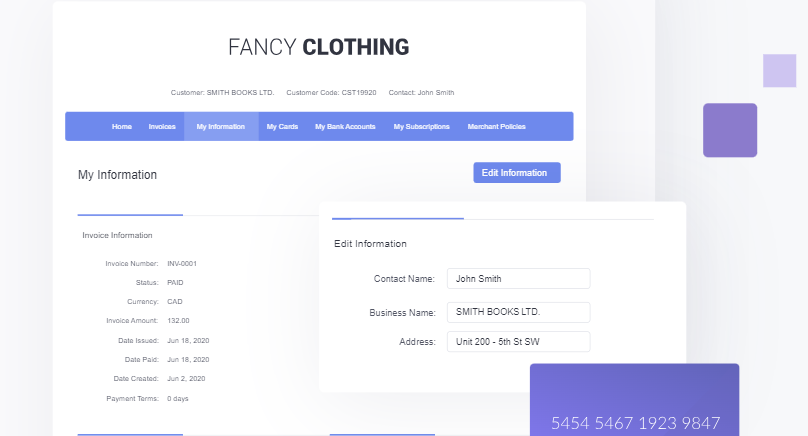

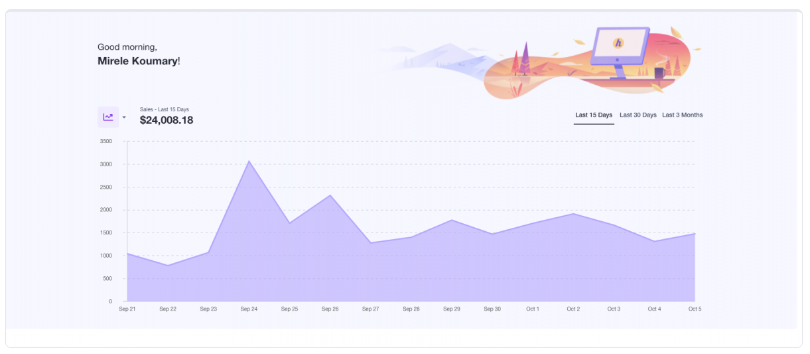

Helcim: Best for interchange pricing

Pros

Cons

Our Rating: 4.13/5

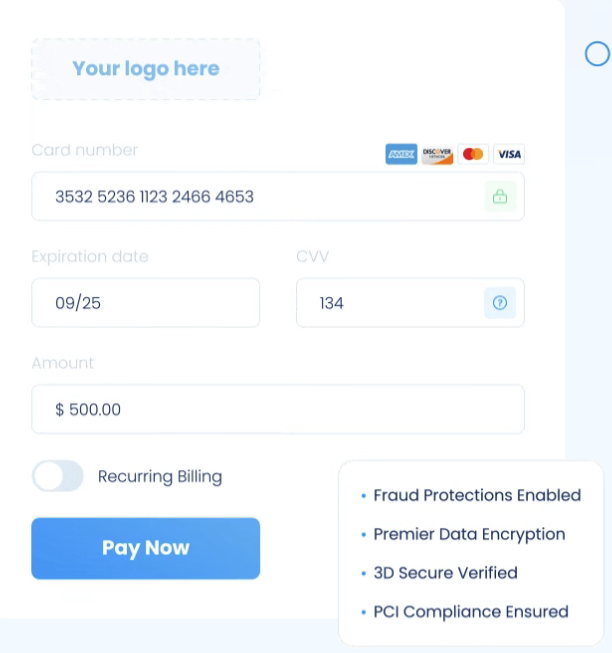

Helcim offers a robust payment processing solution for all kinds of businesses. It provides a range of features including payment gateways, virtual terminals, and POS solutions. Helcim distinguishes itself by offering transparent pricing with interchange-plus pricing models and automatic volume discounts, meaning businesses pay the actual interchange fees set by card networks plus a small markup rather than flat rates. This can potentially result in lower costs for businesses processing a high volume of transactions.

Compared to Stripe, Helcim offers similar functionalities but with focus on a more competitive pricing structure. While Stripe is widely popular for its developer-friendly APIs and extensive integrations, Helcim appeals to businesses looking for straightforward payment solutions with lower processing fees.

Like Stripe, Helcim is known for its strong commitment to security and compliance, offering features like tokenization and Payment Card Industry (PCI) compliance to ensure the safety of transactions. Overall, businesses considering Helcim as a Stripe alternative may find its cost-efficiency and simplicity in their payment processing solutions appealing.

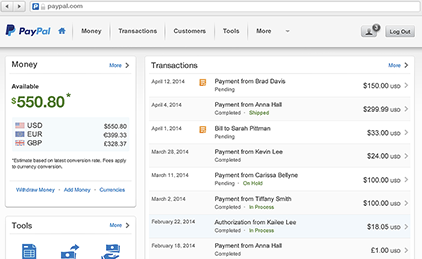

PayPal: Best for easy integration

Pros

Cons

Our Rating: 4.12/5

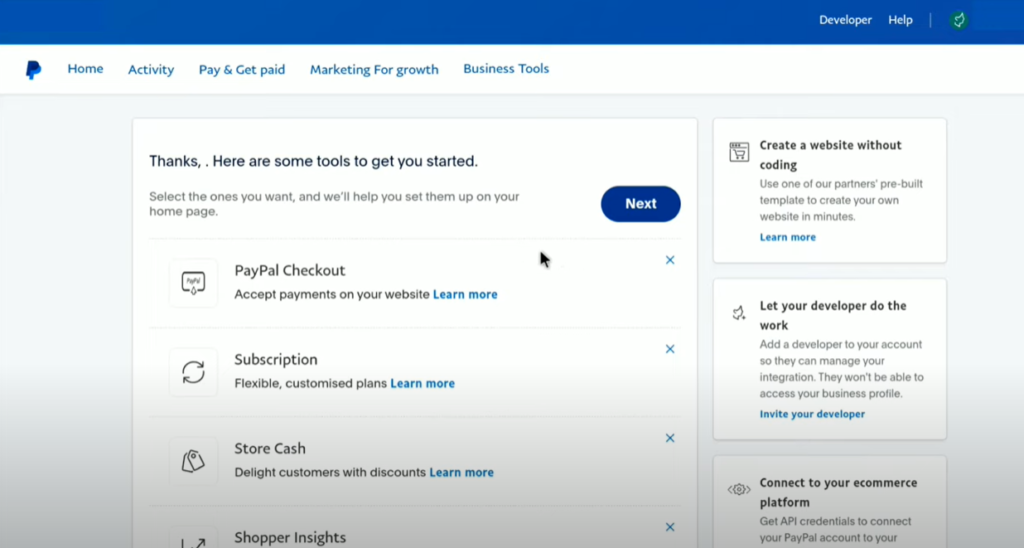

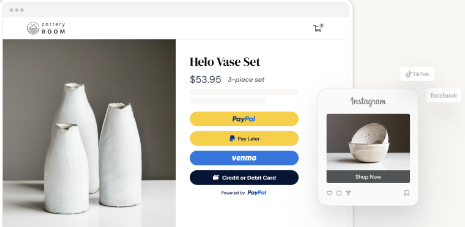

PayPal is a digital payment platform that allows users to send and receive money securely online. It helps businesses manage their finances, accept payments, and facilitate transactions.

It offers various features such as invoicing, payment processing, customizable checkout options, and business analytics. With PayPal Business, merchants can accept payments from customers globally through multiple channels, including credit/debit cards, PayPal accounts, and more.

As a Stripe alternative, PayPal Business provides similar functionalities in terms of payment processing and online transactions. Both platforms offer easy integration into websites and applications, allowing businesses to accept payments seamlessly. However, PayPal is more widely recognized, which may provide a sense of trust and familiarity to customers.

PaymentCloud: Best for high-risk merchants

Pros

Cons

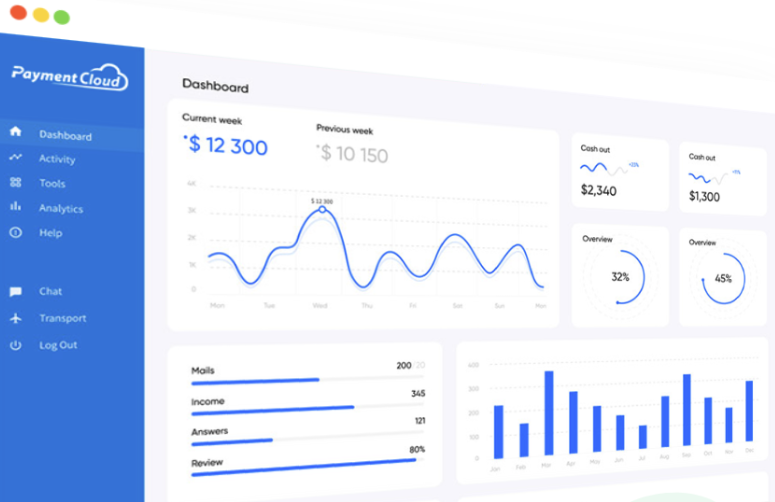

Our Rating: 3.31/5

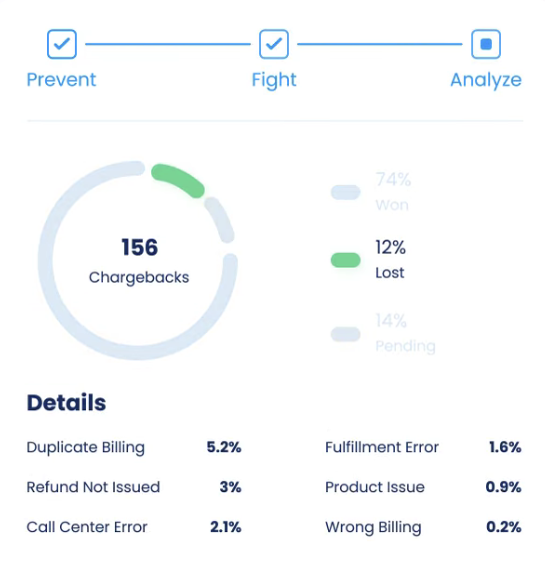

PaymentCloud is a payment processing solution designed for high-risk businesses, offering services like credit card processing, ACH processing, and e-check processing. It caters to industries such as CBD, vape, adult entertainment, and other businesses typically considered high-risk by traditional payment processors. PaymentCloud provides specialized solutions tailored to the needs of these industries, including fraud prevention tools and chargeback management.

As a Stripe alternative, PaymentCloud distinguishes itself primarily by its willingness to work with high-risk businesses that may struggle to get approved by Stripe or to secure payment processing services elsewhere.

While Stripe is a popular choice for many businesses due to its user-friendly interface, extensive features, and wide range of integrations, it may not be suitable for industries considered high-risk. PaymentCloud fills this gap by offering reliable payment processing solutions with an emphasis on industries facing challenges in obtaining payment services.

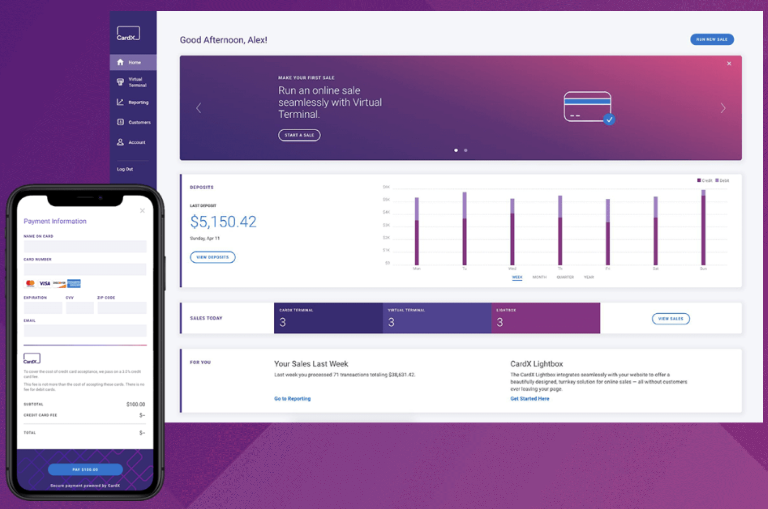

CardX: Best for zero credit card processing

Pros

Cons

Our Rating: 3.27/5

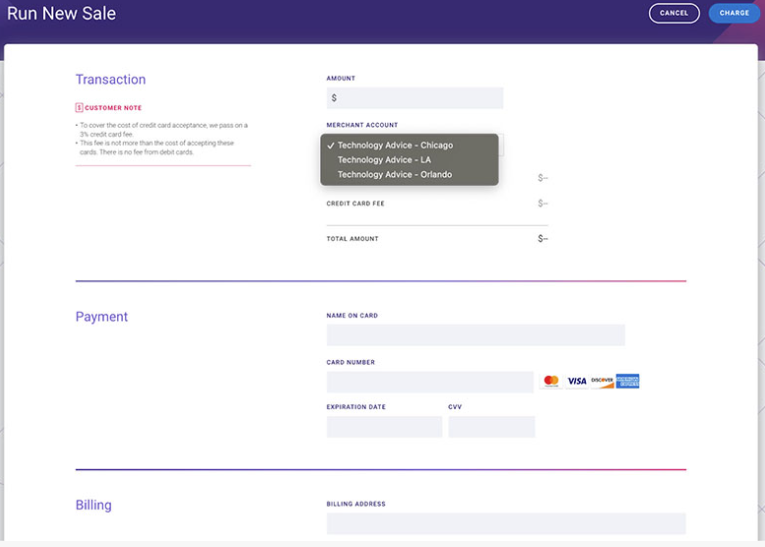

CardX is a payment processing solution designed to help businesses accept credit card payments and pass on credit card processing fees to customers. This approach aims to help businesses save on processing costs by shifting the burden of fees to the cardholder. Additionally, CardX emphasizes compliance with regulations surrounding credit card surcharging, ensuring that businesses can implement surcharges legally and transparently.

Compared to Stripe, CardX offers a distinct approach to pricing and fee management. While Stripe typically charges businesses a percentage of each transaction along with a flat fee, CardX’s model allows businesses to potentially save on processing costs by passing fees directly to customers.

Its range of payment processing solutions includes in-person payment processing for accepting card payments at physical locations, use of a virtual terminal for processing payments over the phone or mail, and online for integrating a payment solution into ecommerce platforms or websites.

Still not seeing the right solution for your business? Check out our full Retail POS Software Buyer’s Guide for more solutions.