Key takeaways

Payment technology has evolved in recent years, allowing small and medium-sized businesses access to a wider range of payment methods and automations that eliminate repetitive business management tasks. Stripe and Square are two popular names in the payment industry, as each offers a wide range of payment processing services and integrations for building a customized POS and payments ecosystem.

When comparing Stripe vs Square, businesses should keep an eye on the key differences between the two software systems to decide what will work best for their business.

Stripe and Square are just two of the many POS and payment systems in the industry. Check out our guide to POS software for more options.

Stripe: Best for customization and growing ecommerce

Pros

Cons

Our Rating: 4.53/5

Square: Best all-in-one system for startups and small businesses

Pros

Cons

Our Rating: 4.28/5

Read more: Top Stripe Alternatives

Read more: Top Square Alternatives

How are Square and Stripe different?

| Stripe | Square | |

| Software type | Payments | All-in-one POS |

| Payment services | Primarily for online | In-person and online |

| Compatibility | Open-source; can be paired with most other software and websites | With other Square applications and APIs |

The key difference between Stripe and Square is the nature of each software. Stripe is primarily a payment processing service originally designed to support online sales, while Square is a POS system originally designed to support in-person sales.

Stripe relies on integrations to build a complete business software, while Square provides native POS tools, including payment processing.

Stripe is compatible with most online platforms, such as ecommerce websites, CRMs, project management software, and more. Meanwhile, the downside of Square is that its business tools, such as Square Payments, are not compatible with other platforms.

Square is more versatile when it comes to payment services. The system is designed for easy payment processing setup for ecommerce websites, and its POS and payment terminals are ready to use out of the box.

Stripe, on the other hand, is well known for creating highly customized online payment checkouts. And while it can also support in-person sales, Stripe will require some configuration and coding before it accepts payments.

Stripe vs Square: Pricing

| Stripe | Square | |

| Monthly account fee | $0–$10 | $0–$60 |

| Transaction fee | From 2.7% + 5 cents | From 2.6% + 10 cents |

| Cross border fee | +1% | N/A |

| Hardware cost | $59–$349 | $0–$799 |

| Forever free plan | ✓ | ✓ |

| Available upgrades | ✓ | ✓ |

| Chargeback cost | $15 (refundable) | Waived up to $250/month |

When comparing Square vs Stripe in terms of pricing, the key is to remember that Square’s monthly fees include the use of its POS software, while Stripe’s quotes are purely for payment processing features. Both Stripe and Square do not charge businesses a monthly fee to access their payment processing services and quote a flat-rate fee for transactions.

Square only adds a monthly fee and decreases its transaction cost if the business upgrades to a more advanced POS software. Square also offers a slightly better transaction rate for simple card-present and card-not-present transactions. It even waives chargeback costs up to $250 per month. As an all-in-one POS system, Square leads for hardware variety and price range.

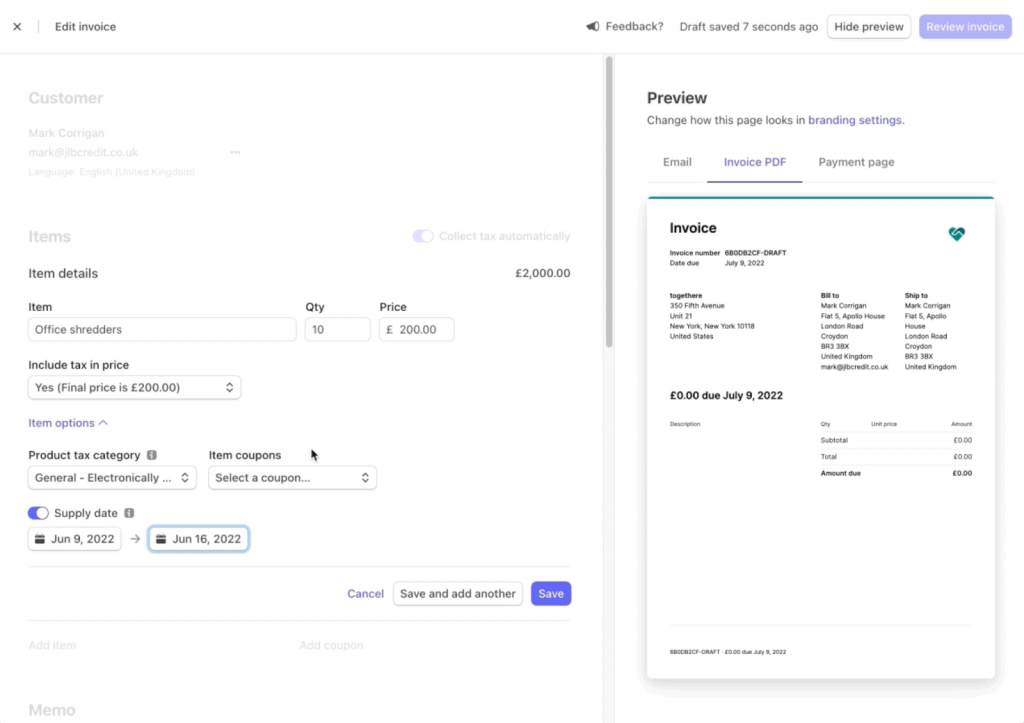

On the other hand, Stripe only charges a monthly fee if the business upgrades to access custom checkout pages. Stripe is also cheaper than Square for businesses that accept payments from a digital invoice, keyed-in, and ACH payments. Only Stripe can process international payments and charges a small 1% for cross-border fees.

There are no long-term contracts and cancellation fees for Square and Stripe, so businesses using either provider can cancel any time. Both providers also offer discounted rates for nonprofits and businesses processing over $250,000 annually.

Stripe vs Square: Hardware

Square is clearly the better choice in terms of hardware, offering a range of mobile and in-store options. Square’s mobile credit card readers start at $10 for a magnetic stripe reader (the first one is free), while the contactless card reader costs $59 each. In-store card readers are built into the Square POS hardware and range from $149 to $799 (available in installments in some states).

|

|

|

|

|

|---|---|---|---|---|

| Square Magstripe Reader | Square Contactless Reader | Square Stand | Square Terminal | Square Register |

Stripe offers a limited range of payment processing hardware. The mobile contactless card reader costs $59, similar to Square. Stripe also provides a couple of in-store card readers priced at $249 and $349. These are handheld mobile types similar to Square’s (which cost $299).

|

|

|

|

|---|---|---|---|

| Stripe Reader M2 | BBPOS WisePad 3 | BBPOS WisePOS E | Stripe Reader S700 |

The main difference between Square and Stripe hardware is the setup requirement. A mobile credit card reader needs to be paired with a POS app downloaded to a smart mobile device. Square’s mobile POS app can be downloaded for free but with Stripe, businesses will need to design their own or pay for a third-party app.

Similarly, Stripe’s in-store credit card readers can be programmed with Lightspeed POS or custom POS software. So, if you are looking for hardware that’s ready to use out of the box, then Square is your best option.

Stripe vs Square: POS system

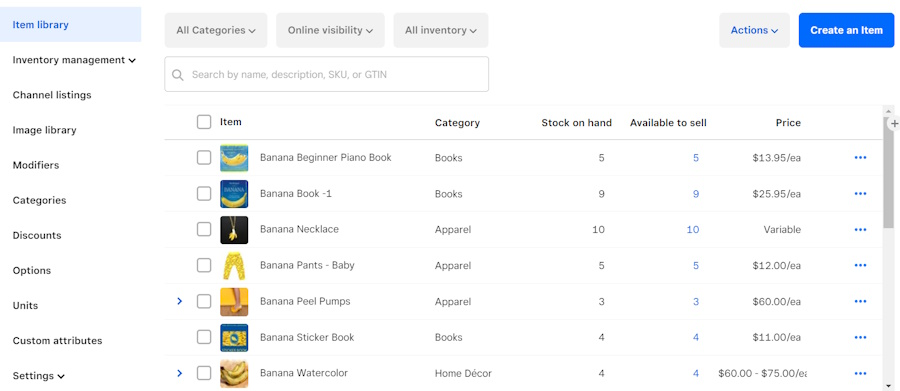

One of the key differences between Stripe and Square is its POS system. Being primarily a POS provider, Square has a clear advantage. Square offers free POS software and different types of POS software for users upgrading to industry-specific solutions.

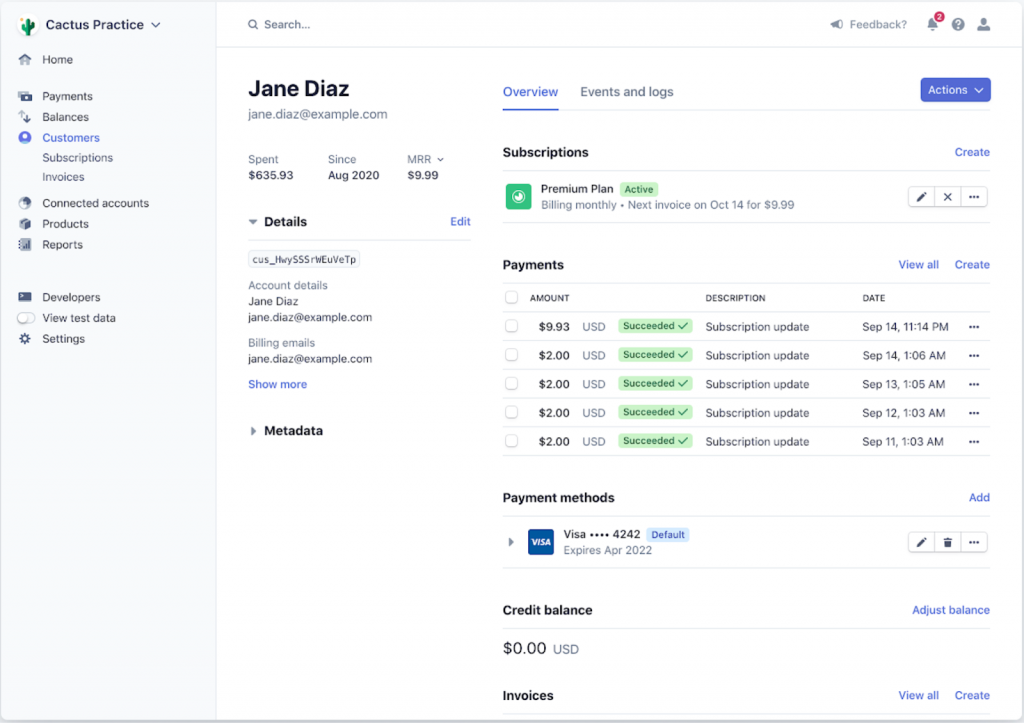

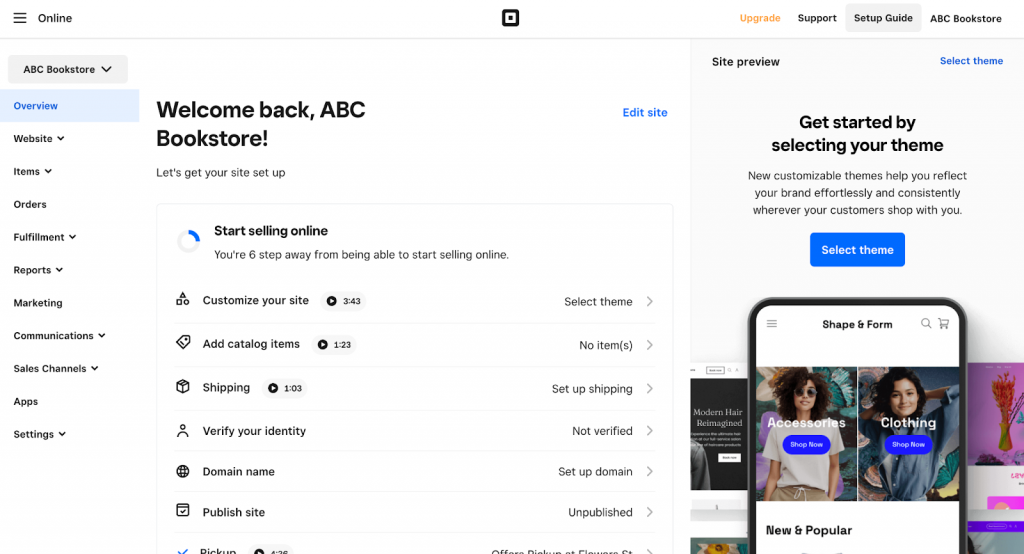

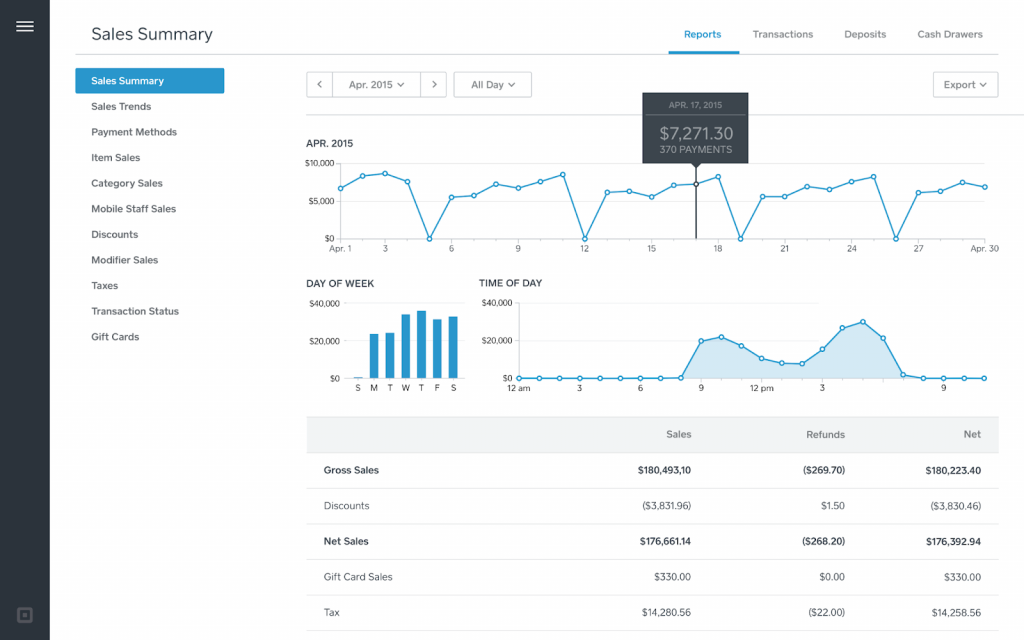

Startups and small businesses find Square’s all-in-one POS system the most convenient because it can be set up and ready to manage your omnichannel sales, ecommerce, inventory, fulfillment, CRM, and reporting within a day.

However, midsize businesses can easily outgrow Square’s features, even with its software upgrades. For example, Square’s inventory management features offer limited flexibility. They won’t be able to handle a complex matrix of raw ingredients, processed items, and special orders that other retail and restaurant POS software could.

Stripe, on the other hand, can be integrated with most POS systems, including custom POS software for midsize and larger businesses. This makes Stripe a better choice if you are looking for scalability.

Stripe vs Square: Payment services

| Payment Types & Methods | Stripe | Square |

| Credit card | ✓ | ✓ |

| Digital wallets | ✓ | ✓ |

| ACH/e-check | ACH | ACH |

| Buy now, pay later (BNPL) | Integration | ✓ |

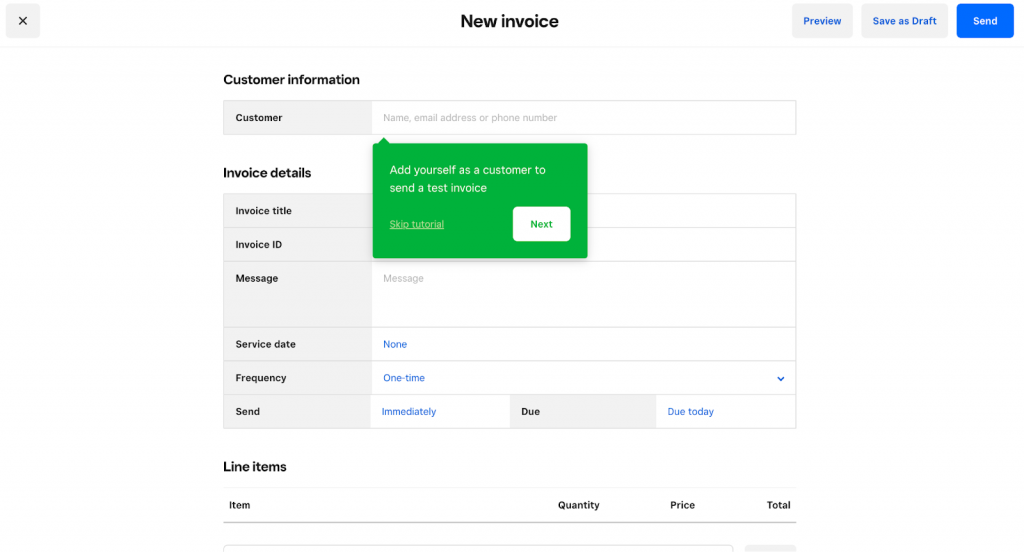

| Invoicing/Recurring billing | ✓ | ✓ |

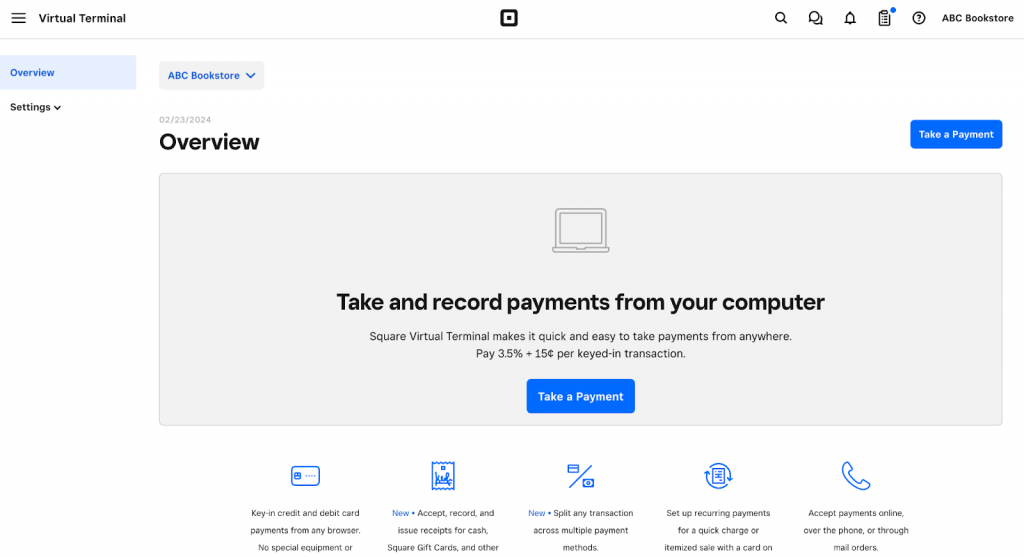

| Virtual terminal | Limited | ✓ |

| International | ✓ | ✗ |

| CBD | ✗ | ✓ |

| Healthcare services | ✗ | ✓ |

| Social media selling | ✓ | ✓ |

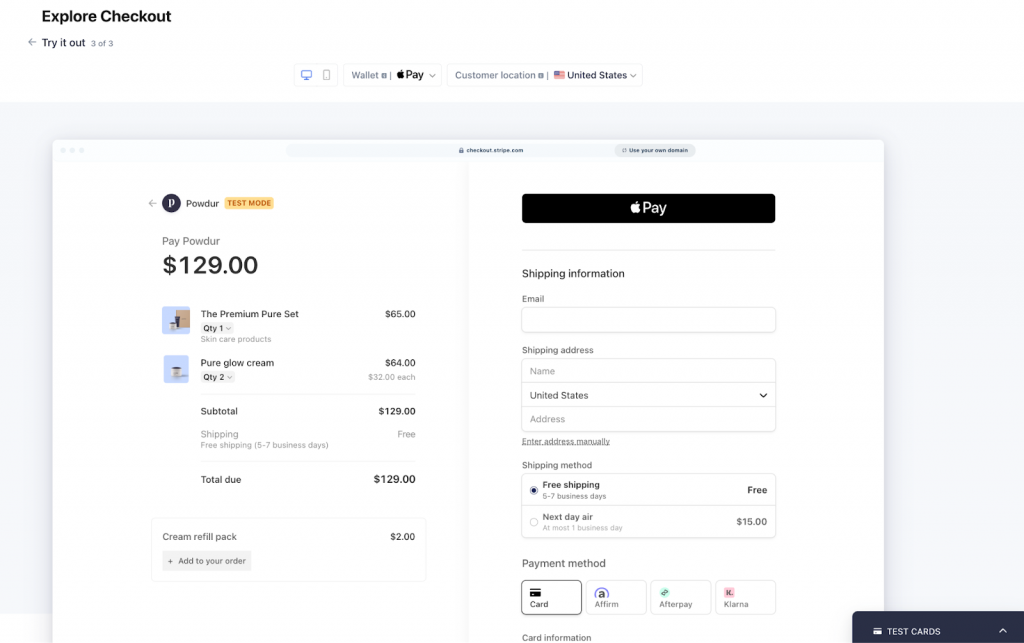

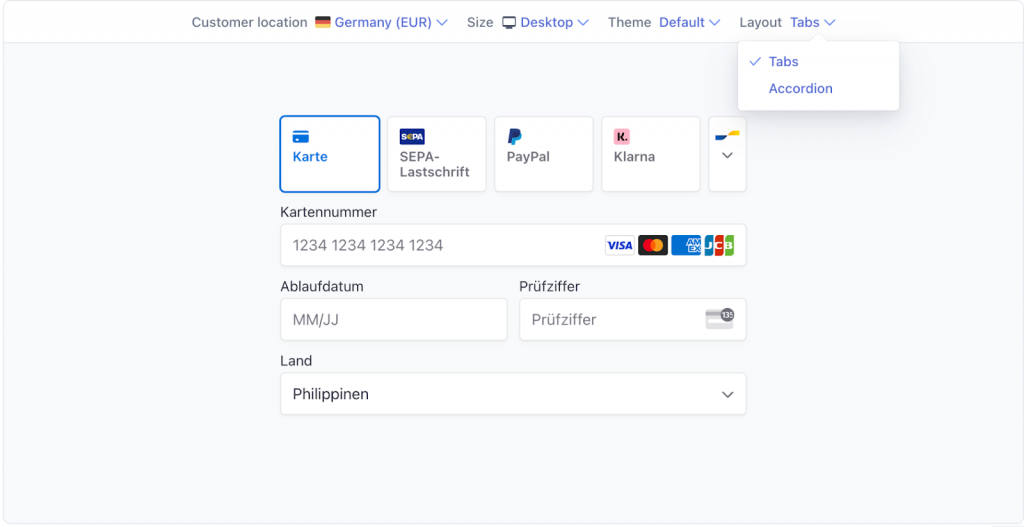

Choosing between Stripe and Square for payment services boils down to the type of payment methods and checkout solutions you are looking for. Stripe is regarded as one of the most outstanding online payment providers, particularly for its ability to process international payments and customize language and currency at checkout based on the customer’s location.

Meanwhile, Square offers specific features such as being a fully HIPAA-compliant POS and payment service ideal for healthcare POS solutions. It also provides its own CBD program for businesses that want to use Square to sell some form of CBD products. Square is also the better choice for users looking for a virtual terminal and BNPL payment service.

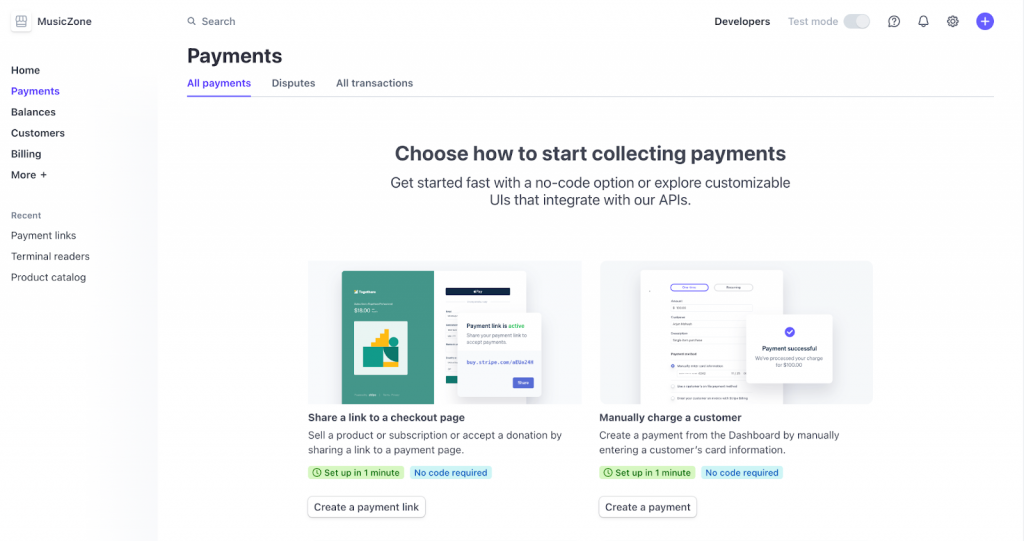

Stripe vs Square: Customization

Stripe is the clear winner over Square in terms of customization. Everything from how a checkout page looks and feels to the actual design of POS software can be created with the help of Stripe’s trove of SDK and application programming interface (API) documentation. Stripe is also compatible with over 600 third-party applications and offers a long list of accredited developers to help get your custom POS system started.

As for Square, you can customize your payments and POS software with other Square products. For instance, Square’s invoicing solution can be upgraded to include tools such as multiple package estimates. Square Payroll, Square Marketing, and Square Loyalty are optional add-ons that can help tailor your POS software to your business needs. There’s also a Square App Marketplace for third-party business management integrations.

Stripe vs Square: Fraud prevention

Fraud prevention is a significant factor to consider when choosing a payment and POS system. Both Square and Stripe use machine-learning technology and are certified PCI Level 1 service providers using 3D secure and 256-bit encryption. Both also have a merchant management platform to manage fraud detection settings and chargeback claims.

Stripe edges Square out with more customization and fine-tuning fraud detection options to adjust according to a merchant’s acceptable risk level. On top of that, Stripe also supports additional tools for identity verification through SSN, address, IP, and biometrics (facial and fingerprint). Stripe can also recognize and verify local IDs in more than 30 countries.

With Square, businesses can also set custom rules and alerts for fraud prevention. Although it does not provide the same level of customization as Stripe, Square’s Risk Manager service ensures that every payment sent for processing is screened and assessed for potential risk. Square’s chargeback management tool also makes it easy to dispute and respond to claims by having the functionality to submit proof of transactions from the platform instead of sending via email.

Which is best?

Square stands out as an ideal solution for small businesses—with its all-in-one solution, easy setup, affordable and ready-to-use hardware, and forever-free plan. As a one-stop-shop for all things startup, Square is a popular choice for businesses needing a quick and convenient way to get their business off the ground with minimal investment.

Stripe is also popular among small businesses. Though not as convenient as Square, Stripe is also preferred by new online businesses using ecommerce platforms such as WooCommerce and even Shopify. Stripe users have an advantage because it can work with most business platforms, which means your POS system can grow, and Stripe’s features can scale along with it.

Making your choice

The choice between Stripe and Square comes down to your goals and available resources—not just in terms of budget, but also your access to software development skills. Square is definitely the most cost-effective solution, especially if you are building from the ground up. Setting up quickly at a low cost means minimum business downtime and more sales.

On the other hand, if your goal is to quickly grow your business with product volume, partnerships, integrations, and international sales, then Stripe may be your best fit.