Key takeaways

Check out our Accounting Software Guide for a full range of solutions to your needs.

QuickBooks vs. FreshBooks: Which is better?

Intuit’s QuickBooks Online and FreshBooks are two comparable accounting software solutions to help automate and consolidate your financials in one place. Both platforms focus heavily on features for small businesses with limited accounting knowledge.

However, where QuickBooks offers more robust reporting and add-on features for growing businesses, FreshBooks is better for freelancers looking to build lasting relationships with their clients.

| QuickBooks | FreshBooks | |

|---|---|---|

| Pricing | Starting at $25 per month for three months with promo and 30-day free trial. | Starting at $8.50 per month for three months with promo and 30-day free trial. |

| Accounts receivable | Inventory and integrated online sales channel management. | Client account access for invoices and estimates. |

| Business expenses | Contractor and accounts payable plus available employee payroll add-on feature. | Must integrate with Gusto for contractor and employee payroll. |

| Timekeeping | Must purchase Essentials tier for timekeeping features. | Native project timekeeping. |

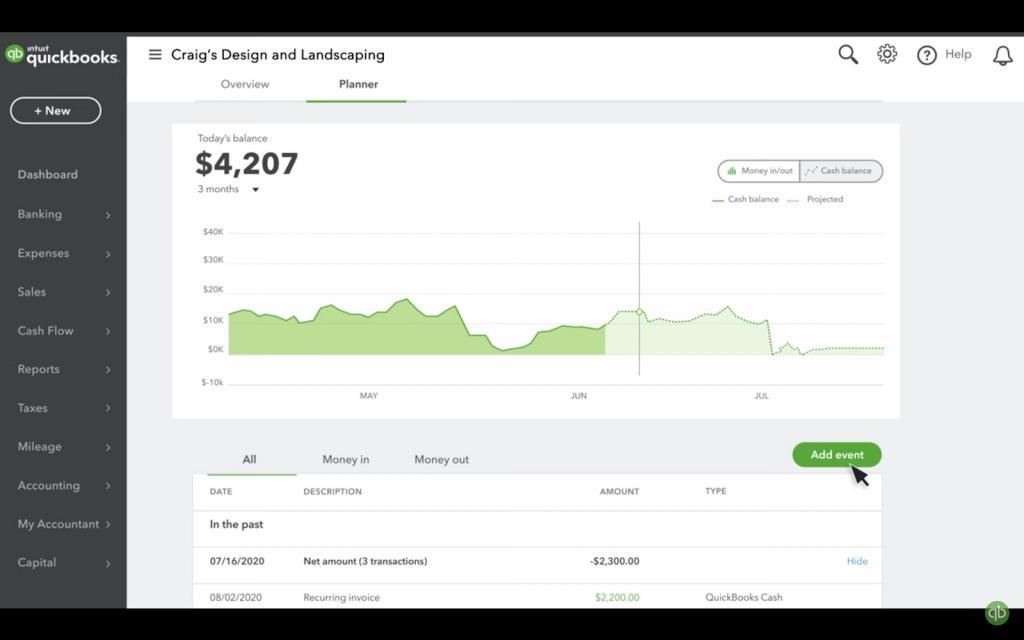

| Banking and accounting | Focus on budgeting and cash flow predictions. | Focus on basic expense tracking for simple account transactions. |

| Try QuickBooks | Try FreshBooks |

Watch our video below for a quick overview of QuickBooks vs. FreshBooks.

QuickBooks: Best for small businesses selling products

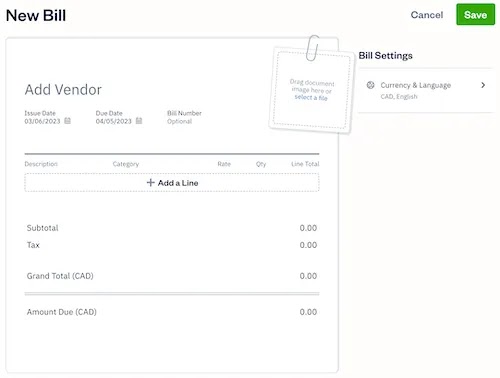

QuickBooks Online is a popular small business accounting platform with essential client invoicing, bill management, and bank reconciliation features. As one of the leading self-accounting platforms out there, it includes additional add-ons for more customization, including:

- QuickBooks Payroll: One of our top payroll software solutions, it helps you automate payroll in all 50 states.

- QuickBooks Time: Includes more advanced timekeeping for a deskless workforce, such as geofencing.

- QuickBooks Payments: Required product if you want to accept online customer payments.

- QuickBooks Checking: Offers a QuickBooks checking account and combines with QuickBooks Payments for Instant Deposit.

- QuickBooks Live: Virtual bookkeeping services with QuickBooks ProAdvisors to help diagnose and maintain your financial accounts.

Despite QuickBooks’ focus on small businesses in general, many of its native features are geared toward retail companies. For example, with QuickBooks Plus, you can track your product inventory and connect all of your online sales channels, such as eBay, Amazon, or Shopify.

With automatic inventory adjustments, as you sell your products online or invoice your products, you can ensure your stock remains up-to-date. It also removes the hassle of double data entry in an external inventory management system or spreadsheet. This gives you more time to focus on selling quality products instead of tracking them.

Pros

Cons

Check out 4 QuickBooks Alternatives for SMB Accounting for other comparable small business accounting solutions.

FreshBooks: Best for freelancers or solopreneurs selling services

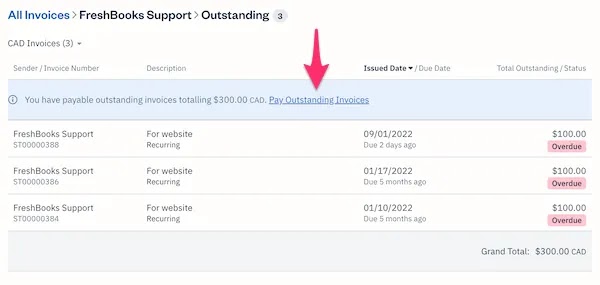

FreshBooks is a more bare-bones accounting platform for teams with little to no accounting experience than QuickBooks. As a result, you will find that FreshBooks lacks some of the more advanced accounting features of QuickBooks, including predictive analytics like profitability and cash flow forecasting.

Nevertheless, because FreshBooks does not have some of these more in-depth features, it is a much more accessible tool for new business owners, freelancers, or solopreneurs. In addition, if your business depends on accurate timekeeping to bill for services, FreshBooks includes a native time-tracking tool. This allows you to avoid using third-party alternatives or tracking billable hours manually.

Pros

Cons

Check out FreshBooks in our video overview below:

QuickBooks vs. FreshBooks: A detailed comparison

| QuickBooks | FreshBooks | |

|---|---|---|

| Starting price | $35/mo. | $17/mo. |

| Free trial | 30 days | 30 days |

| Invoicing | Yes | Yes |

| Estimates | Yes | Yes |

| Bill management | Essentials trier and up | Premium trier and up |

| Expense tracking | Yes | Yes |

| Bank reconciliation | Yes | Plus tier and up |

| Timekeeping | Essentials tier and up | Yes |

| Client tools | No | Yes |

| Mobile app | Yes | Yes |

| Payroll | Add-on | Add-on with Gusto |

| Bookkeeping services | Add-on | Add-on with Bench |

Pricing

QuickBooks and FreshBooks follow similar pricing structures, with a monthly subscription rate plus four pricing tiers. Each pricing tier offers more features than the previous one, such as more advanced reporting or automated workflows. Both offer a 30-day free trial and a promotional discount for new businesses for the first three months.

QuickBooks Simple Start, the lowest price tier, offers more starting features than FreshBooks’s comparable Lite tier. However, this means that QuickBooks is a much more expensive solution than FreshBooks, so it may not be the best choice if you’re new to accounting or lack the funds for something more robust.

Accounts receivable

As cloud-based solutions, both QuickBooks and FreshBooks focus on payment collection through electronic methods, such as ACH transfers or online credit card payments. However, QuickBooks’ accounts receivable (A/R) features are geared more toward small businesses selling products. In contrast, FreshBooks’ A/R features are more suited for self-employed individuals billing for services.

Business expenses

Both QuickBooks and FreshBooks include expense tracking in all of their plans so that you can bill clients accordingly and monitor cash flow. However, QuickBooks accounts payable (A/P) software features come standard in its Simple Start plan. In contrast, FreshBooks users must buy a higher-tiered plan or integrate with third-party solutions for similar capabilities.

Timekeeping

Although both QuickBooks and FreshBooks include time-tracking features, their approaches are quite different. While QuickBooks offers basic time logging on its Essentials plan and up, FreshBooks incorporates time-tracking elements on all of its plans.

Banking and accounting

QuickBooks Simple Start plan includes the three main accounting reports:

- Income statement (profit and loss report).

- Double-entry accounting (balance sheet).

- Cash flow statement.

These features help measure the strength of your business and plan for future growth.

With FreshBooks, on the other hand, you must purchase its higher plans for banking and accounting functionality on par with QuickBooks.

QuickBooks vs. FreshBooks: Ready to choose?

QuickBooks Online and FreshBooks offer accounting tools for different types of businesses. The best one for you comes down to whether your company sells products or services and whether you expect to grow.

Choose QuickBooks if you are a small business selling products and need scalable solutions to help track your finances as you grow. However, if you’re new to accounting, a solopreneur, or an independent contractor, choose FreshBooks for its simple-to-navigate interface and native timekeeping features for accurate client billing.

However, if you’re still unsure whether QuickBooks or FreshBooks is right for you, explore our Accounting Software Guide for other solutions.