Point-of-sale (POS) systems are key to the success of any business, big or small. They keep your business running daily, letting you process sales, oversee inventory, track performance, run marketing campaigns, and manage your employees. The POS market, however, is saturated with tons of options, leaving many small business owners wondering what the best solution is for them.

In this guide, we will explore the best POS systems for small businesses of all kinds so that you can pinpoint exactly which option will serve your unique business needs and support your goals. We reviewed the top providers on the market, evaluating each on more than two dozen criteria, including pricing, features, and user experience. Based on our findings, the best POS systems for small businesses are:

- Square: Best overall small business POS system

- Toast: Best for restaurants

- Shopify: Best for ecommerce

- Helcim: Best for professional services

- PayPal Zettle: Best for microbusinesses and solopreneurs

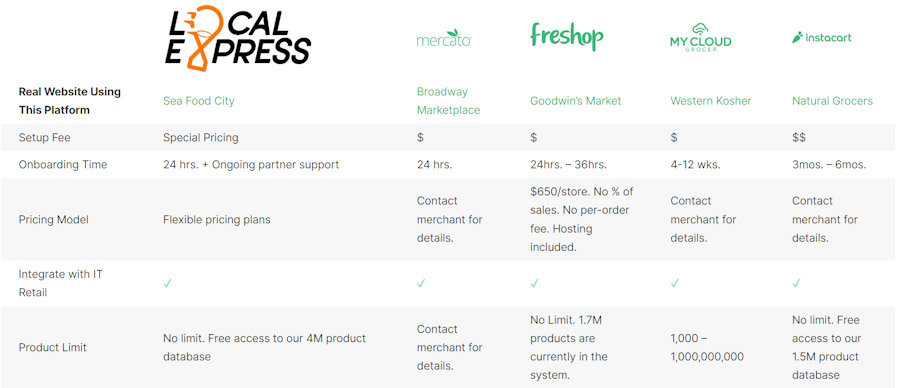

- IT Retail: Best for grocers and markets

- Lightspeed for Retail (R Series): Best for large, complex inventories

Monthly POS Software Fees

Compatible Industries

Mobile Capabilities

Payment Processing Fees

Square

$0–$153

- Retailers, primarily brick and mortar

- High-risk retailers (CBD, liquor)

- Cafes, quick service restaurants, full service restaurants, bars, food trucks

- Appointment-based businesses

- Service businesses

Square POS app for Android and iOS

Mobile hardware options

Square Payments

In-person: 2.5%–2.6% + 10 cents

Online: 2.9% + 30 cents

Toast

$0–$69

- Full-service restaurants

- Quick service restaurants, cafes, and food trucks

- Bars and nightclubs

- Hotel restaurants

- Retail/restaurant hybrids

POS only operates on proprietary hardware; no mobile apps

Mobile hardware options

Toast Payments

In-person: 2.49%–3.29% + 15 cents

Online: 3.5%–3.89% + 15 cents

Shopify

$39–$399

- Retailers, primarily ecommerce

- B2B retailers

Shopify POS app for Android and iOS

Mobile hardware options

Shopify Payments

In-person: 2.4%–2.6% + 10 cents

Online: 3.1%–3.5% + 30 cents

Helcim

$0

- Retailers, primarily brick and mortar

- Healthcare

- Professional services and contractors

- Wholesalers

- Automotive industry

Helcim POS app for Android and iOS

Mobile hardware options

Helcim Payments

In-person: 0.25%–0.4% + 6–8 cents

Online: 0.15%–0.5% + 15–25 cents

Rates vary based on sales volume

Paypal Zettle

$0

- Small retailers, primarily brick and mortar

PayPal Zettle POS app for Android and iOS

Mobile hardware options

PayPal Payments

In-person: 2.29% + 9 cents

Online: 3.49% + 9 cents

IT Retail

$199

- Groceries and markets

- Convenience, thrift, and dollar stores

- Butchers and fish markets

No mobile hardware or app options

IT Retail Payments Custom rates

Lightspeed

$89–$269

- Retailers, best suited for those with large complex inventories that operate primarily in-person

Lightspeed Retail POS app for iOS ( iPad only)

Mobile hardware options

Lightspeed Payments

In-person: 2.6% + 10 cents

Online: 2.9% + 30 cents

Not finding what you are looking for? Check out our guide to the Best Point-of-Sale (POS) Software for 2023 for more options.

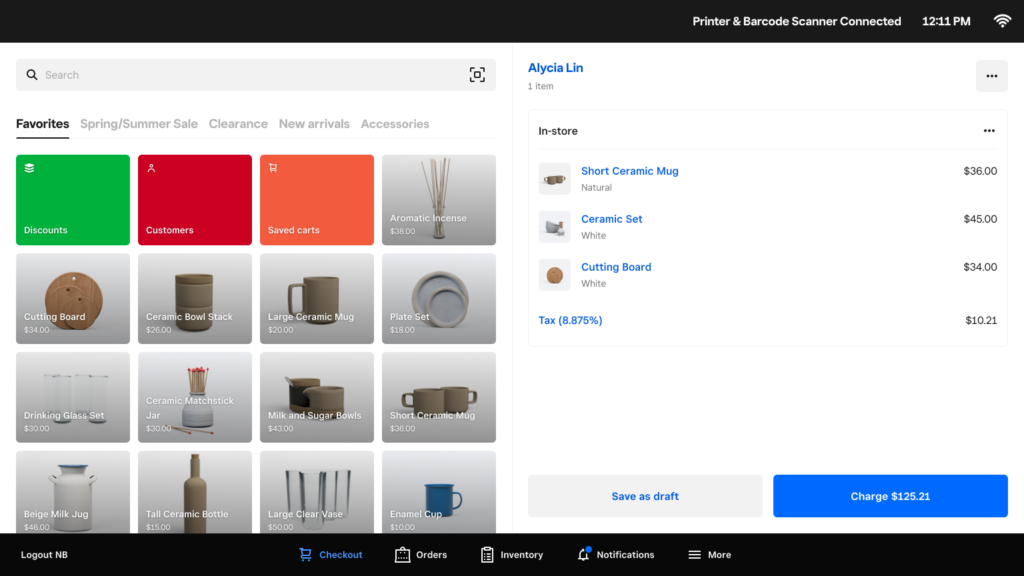

Square: Best overall small business POS system

Pros

Cons

Our Rating: 4.33/5

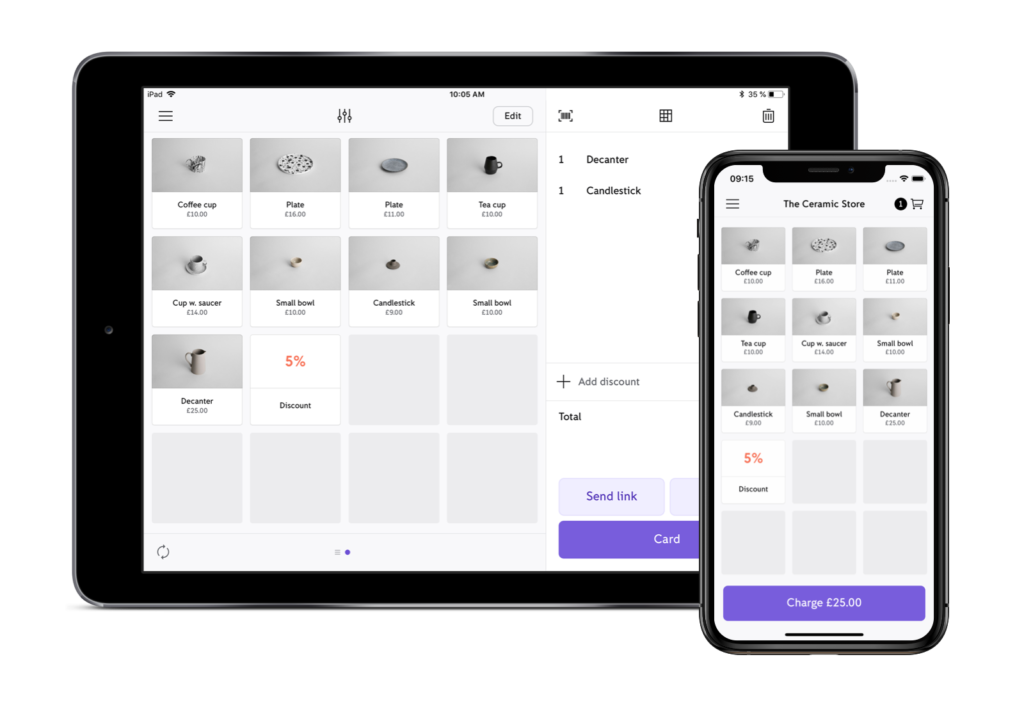

Square is a top POS system for all types of small businesses. Along with its general POS offering, Square also has industry-specific POS systems for restaurants, retailers, beauty, and wellness operations, and service-based industries, ensuring that there is something for everyone. Not only that, every POS system comes with a free version to help get your idea off the ground, along with more advanced plans to support you as you grow.

Square is easy to use, has great customer and expert reviews, offers some of the best POS hardware that money can buy, and can support small businesses from the moment they start and as they continue to expand.

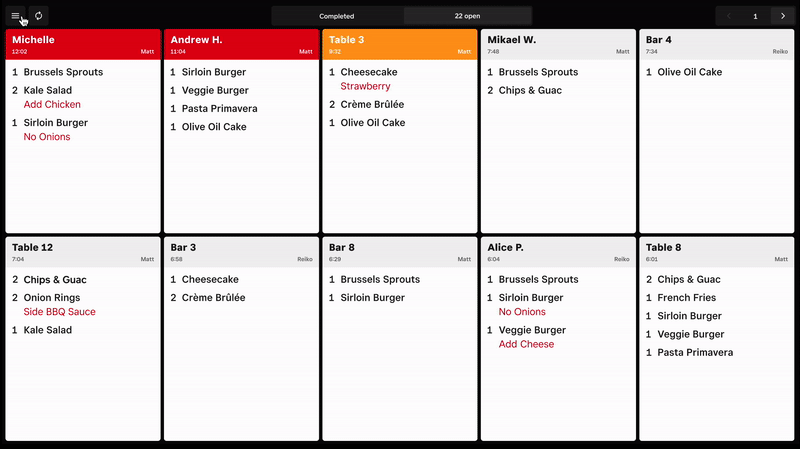

Toast: Best for restaurants

Pros

Cons

Our Rating: 4.29/5

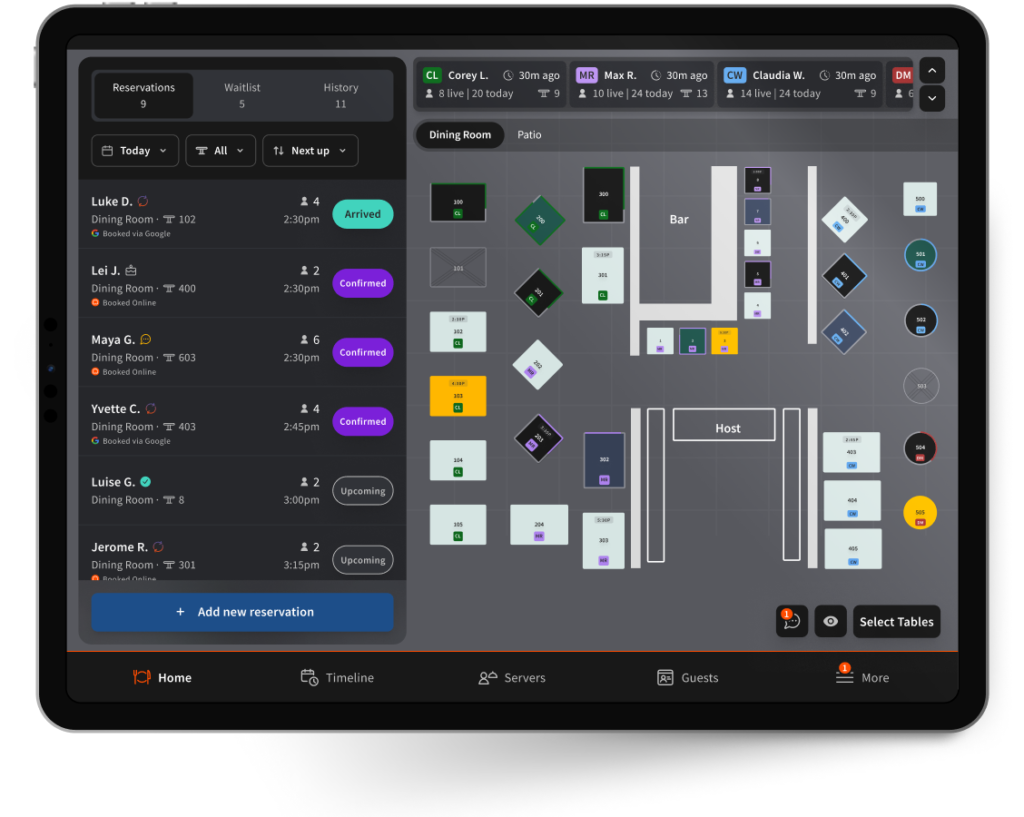

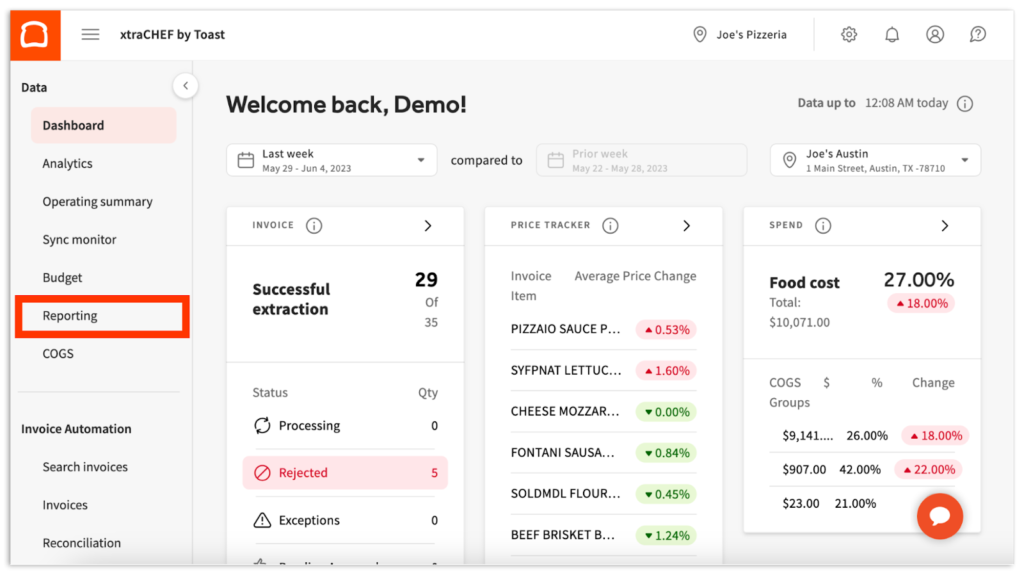

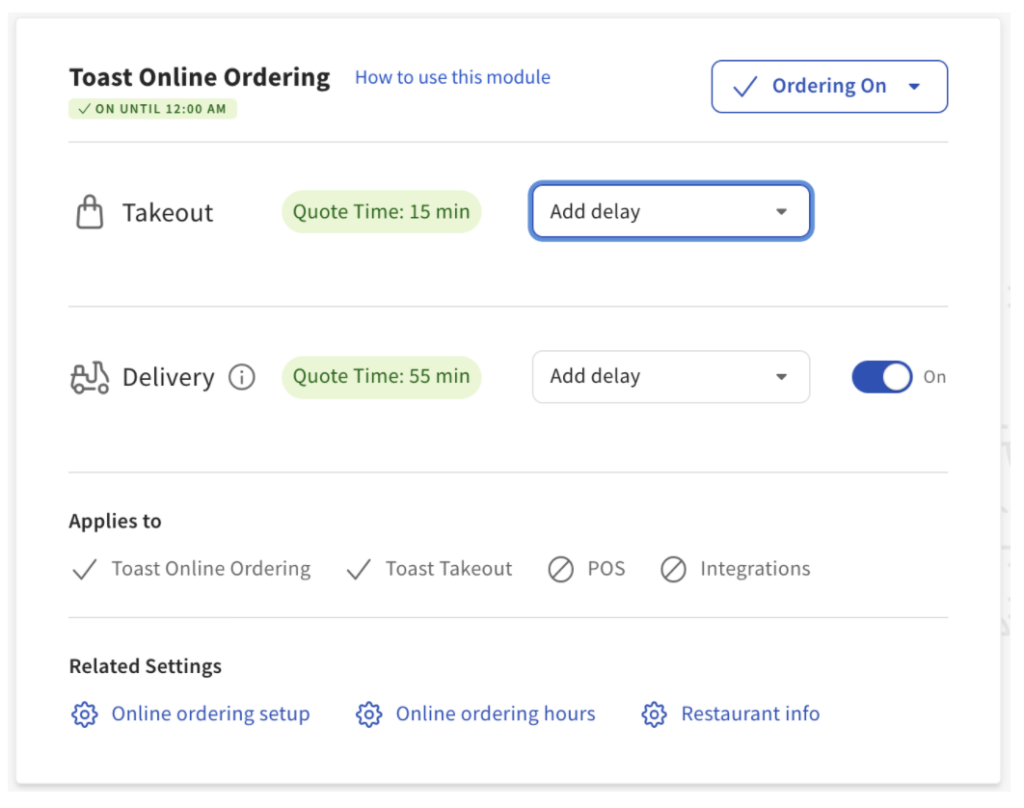

Toast is a POS system built specifically for the food service industry, with tools to support restaurants, cafes, catering businesses, food trucks, and more. The system includes tools specifically designed for restaurants, including online ordering, delivery management, tableside service, kitchen display system (KDS), and menu-based ingredient-level inventory management.

Toast bundles its hardware and software together, ensuring you have the tools you need to get your restaurant up and running. Plus, there are a number of customizable payment options, like pay-as-you-go, so small businesses can pay as revenue comes in and don’t start their business in a debt hole.

Shopify: Best for ecommerce

Pros

Cons

Our Rating: 4.27/5

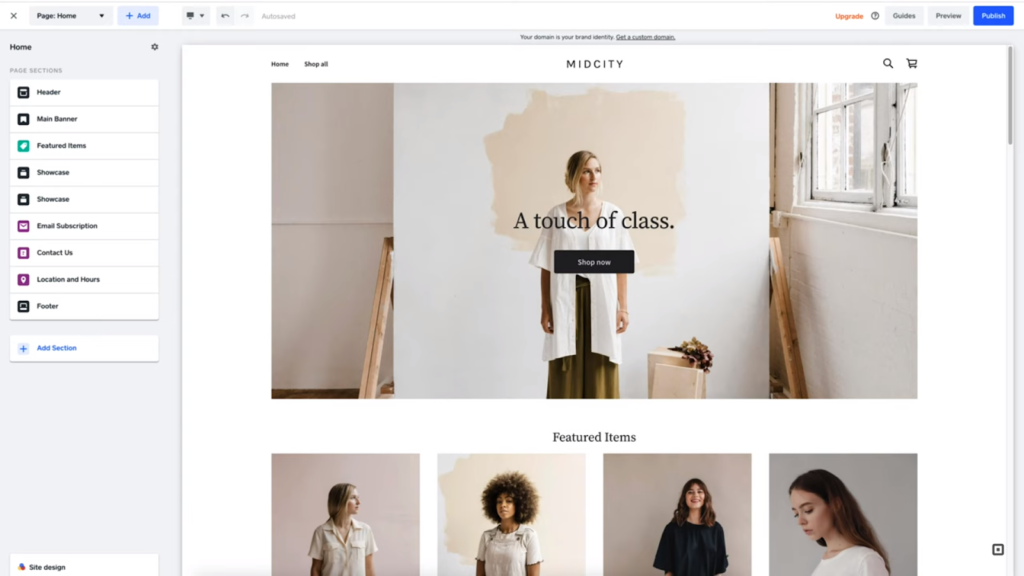

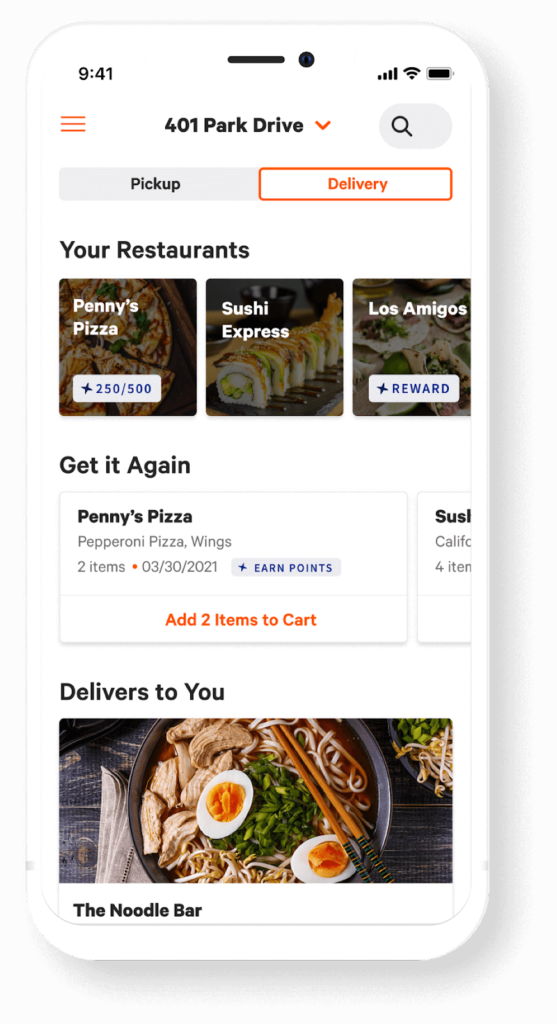

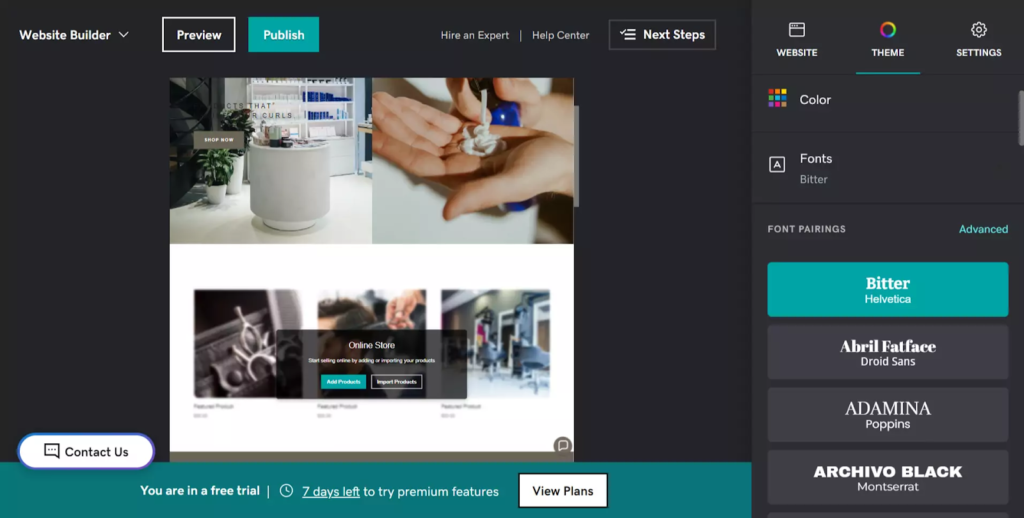

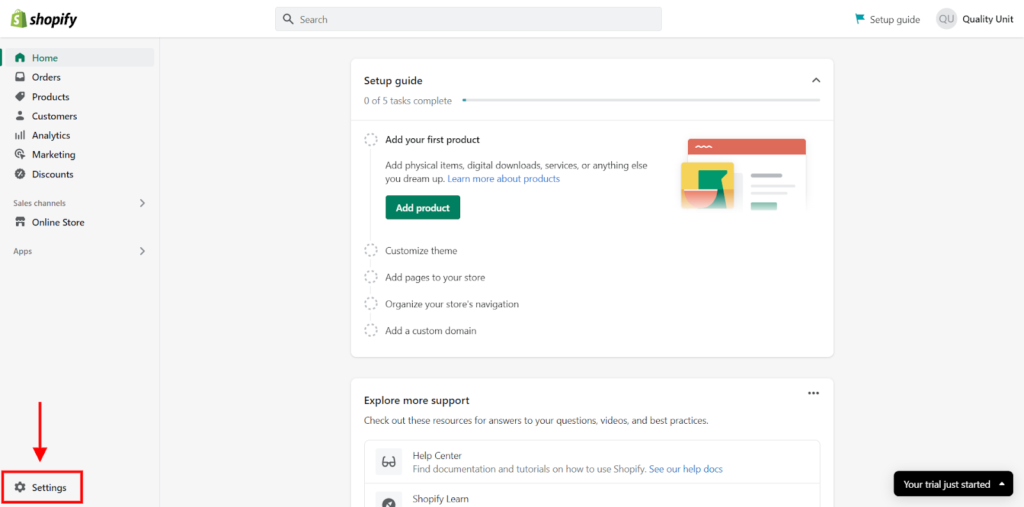

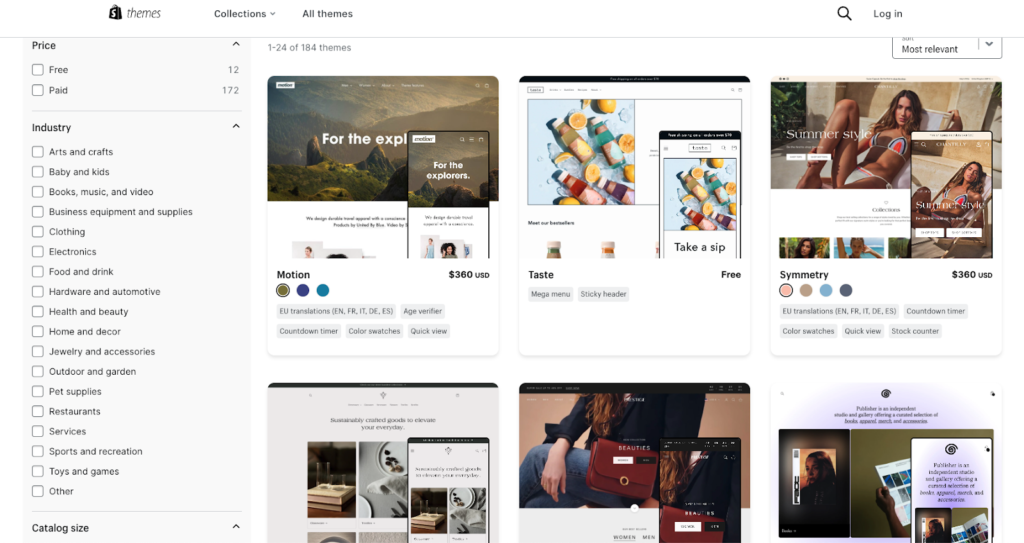

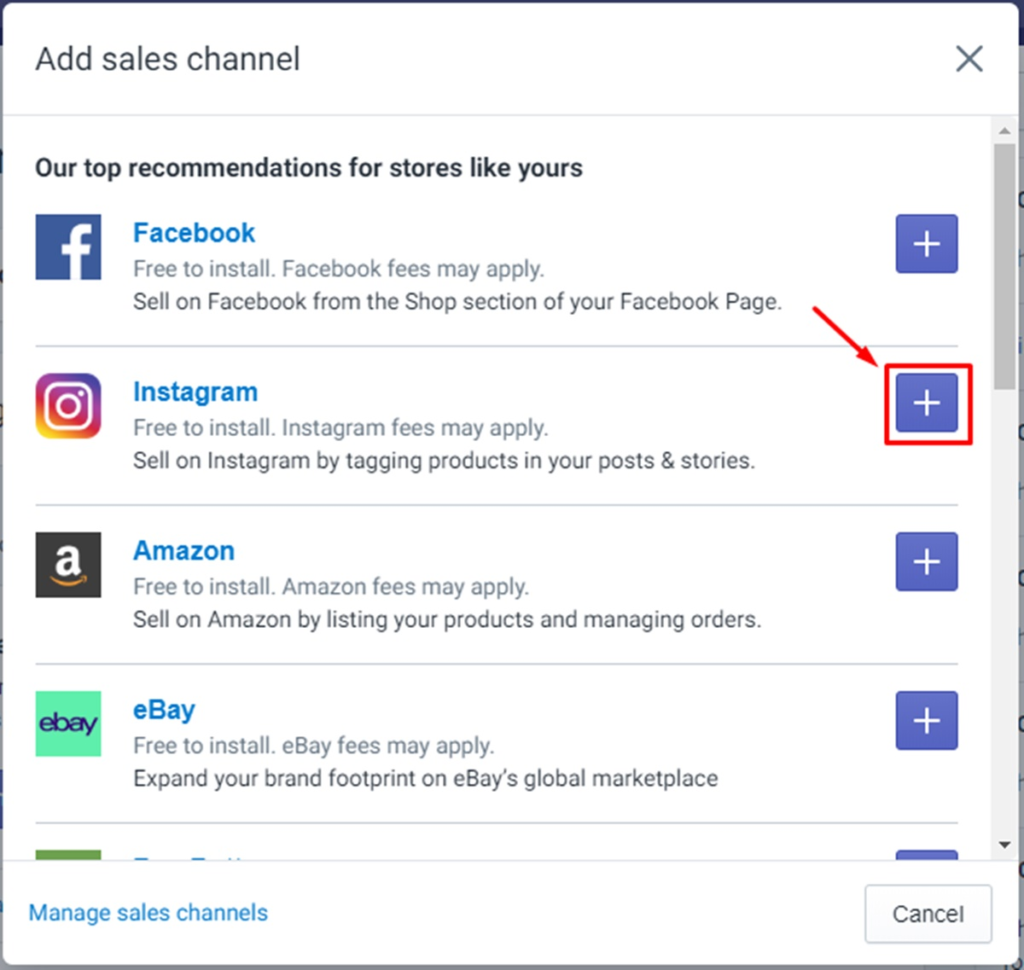

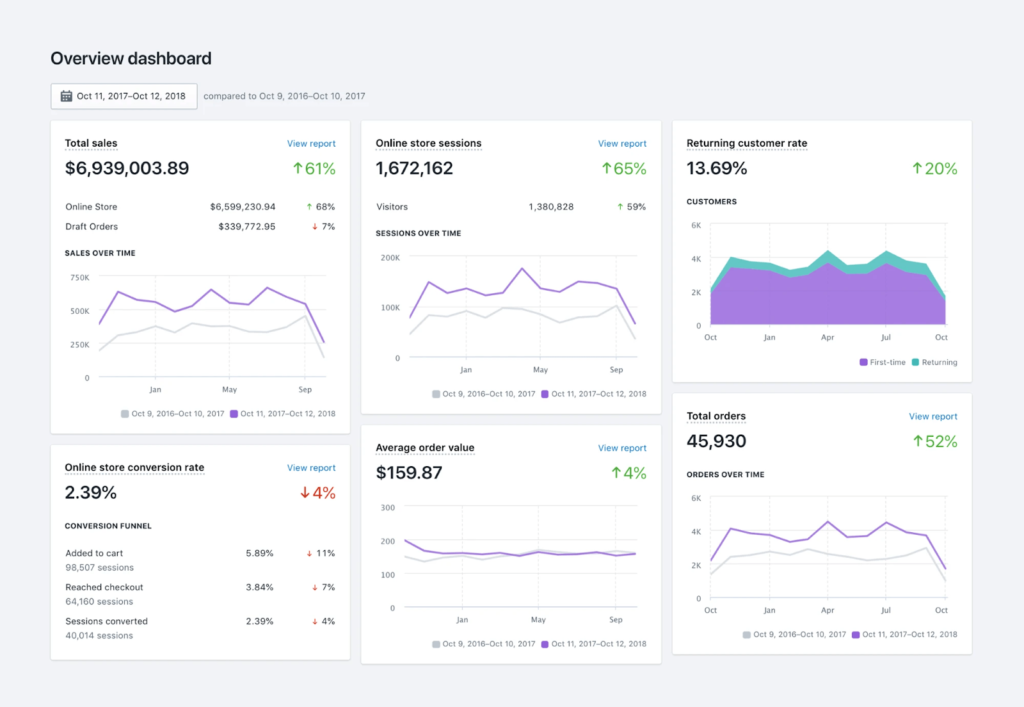

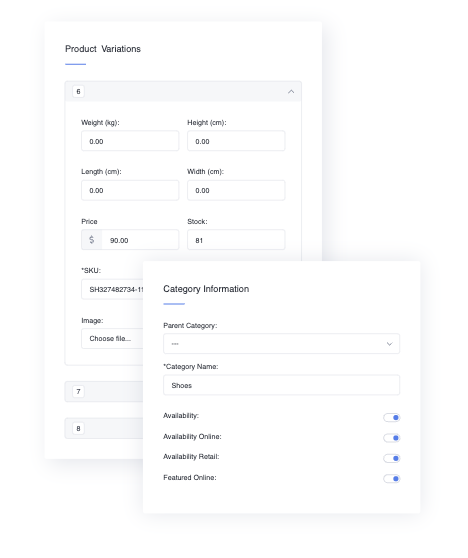

Shopify is the industry leader in ecommerce. The platform is well-known in the retail space for supporting online sellers across all their sales channels, from social media shops to all the major selling marketplaces, like Amazon, eBay, Google, and Walmart. The system comes complete with integrated payments, a rudimentary POS system for the occasional in-person sale, and plans to support your growth.

We love Shopify because it comes with a variety of plan options to support small businesses at every stage. It stands out for its excellent ecommerce site builder, ease of use, marketing tools, and omnichannel selling features.

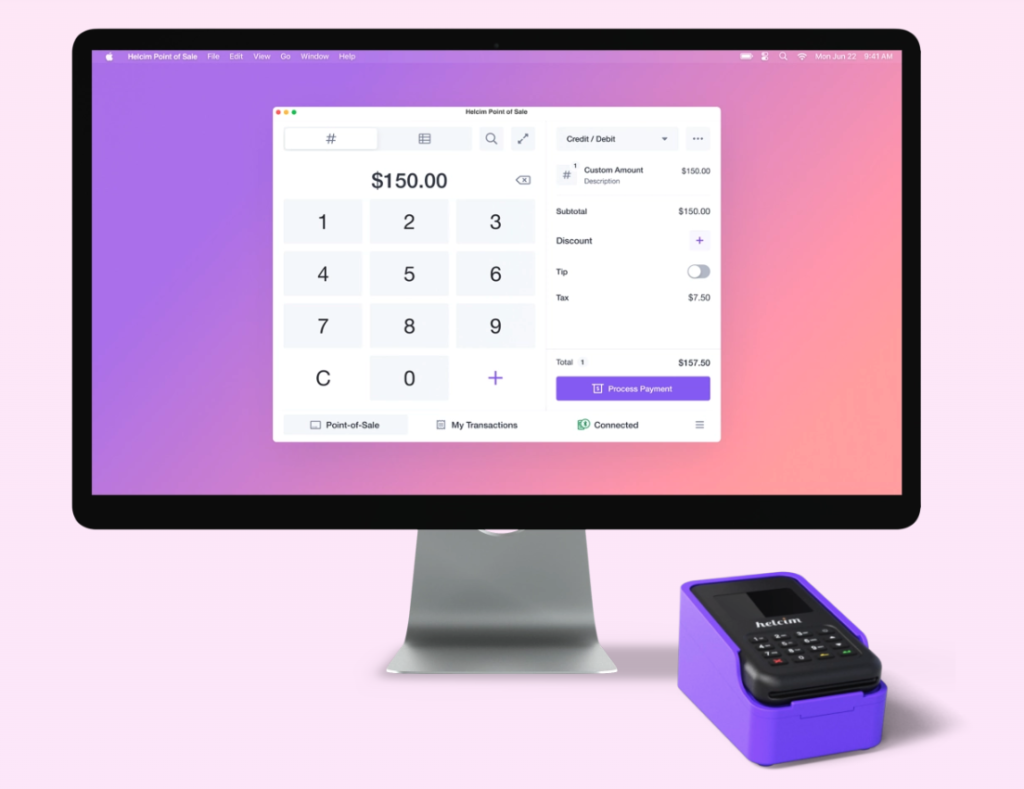

Helcim: Best for professional services

Pros

Cons

Our Rating: 4.26/5

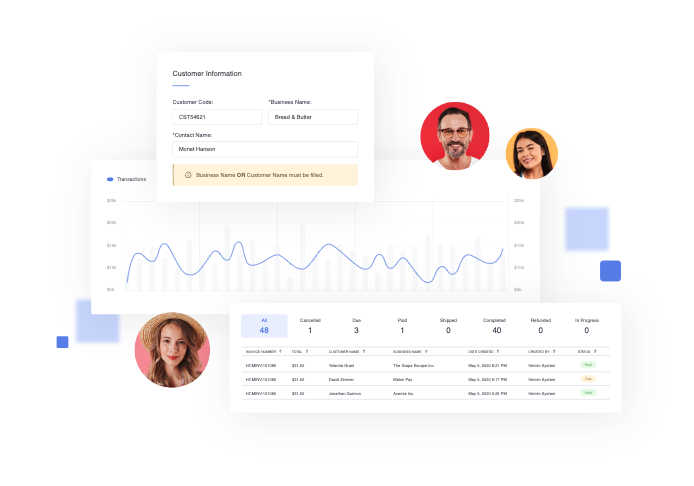

Helcim is a payment processing company that also offers a free, basic POS system for completing sales, tracking inventory, managing customers, and reporting on your small business’s performance. Helcim charges no upfront or monthly fees, you only have to pay for the Helcim card reader and payment processing. And, even that is a steal. Helcim uses interchange-plus pricing for its transaction fees, meaning you pay the minimum processing fee with increased discounts as you process more transactions.

Helcim’s POS operates on any computer, tablet, or mobile device via the Helcim Payments app. All you have to do to get started is download the app, pair your device with the Helcim Card Reader, and you are ready to go.

PayPal Zettle: Best for microbusinesses and solopreneurs

Pros

Cons

Our Rating: 4.25/5

PayPal Zettle is a POS system from PayPal that offers completely free POS software and affordable hardware options perfect for businesses that only need the basics to manage their operations. The POS system has all the basic features a small retailer needs to complete sales, track inventory, manage customers, and take their business on the go. You also get the benefit of lower processing rates because the system is tied to PayPal.

This POS solution is ideal for small sellers that operate primarily in person, as there are limited ecommerce and no additional sales channel integrations.

IT Retail: Best for grocers and markets

Pros

Cons

Our Rating: 4.09/5

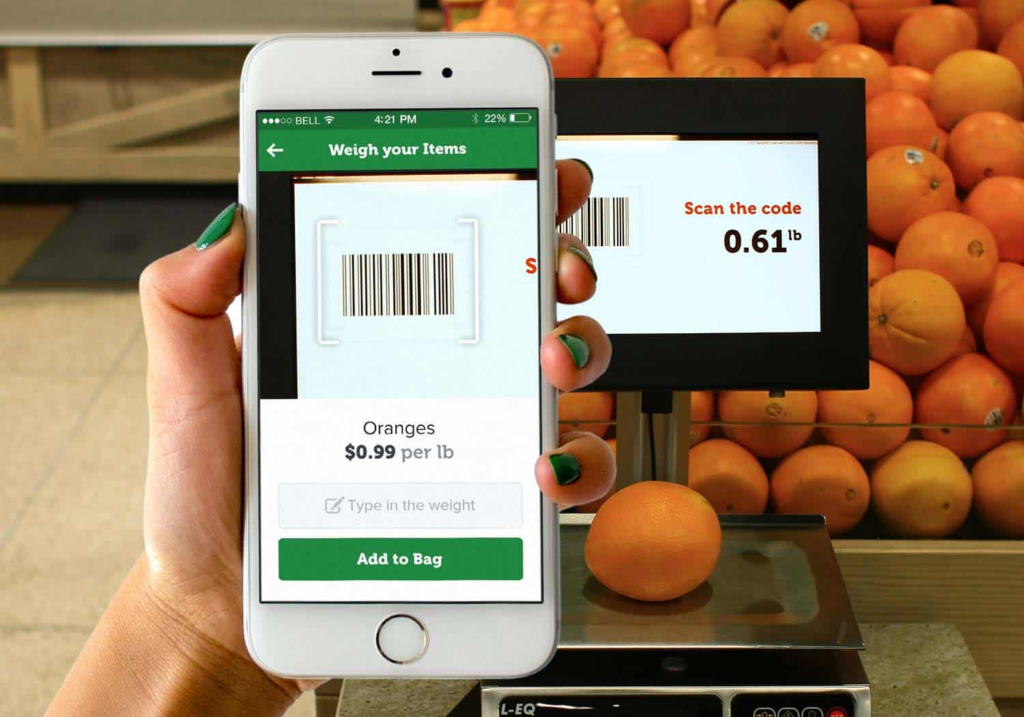

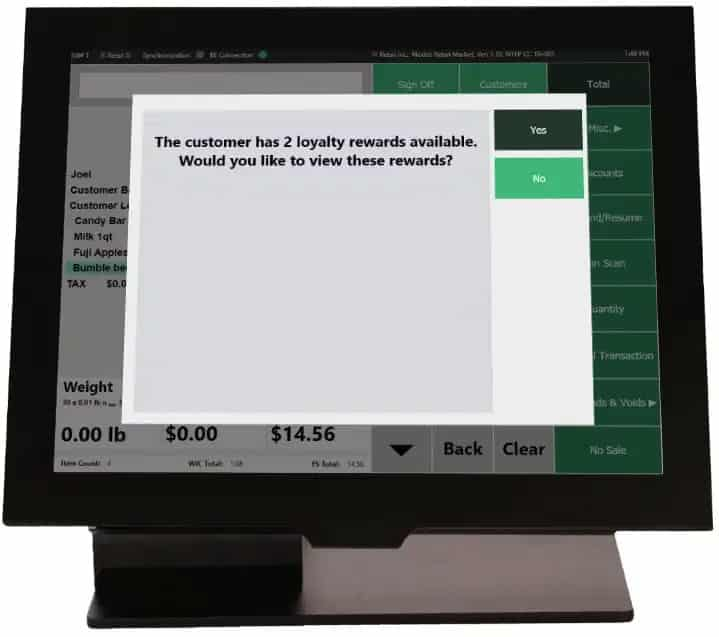

IT Retail is a POS solution specifically designed for grocers, markets, and convenience stores. With tools like ID scanning, scale integrations, a customizable rewards program, and hardware solutions specific to the food-selling industry, IT Retail is the best in the game for small business food sellers and convenience stores. The system is popular in the small business grocery industry, with thousands of satisfied customers. There are countless ways you can customize the system to make it work for you.

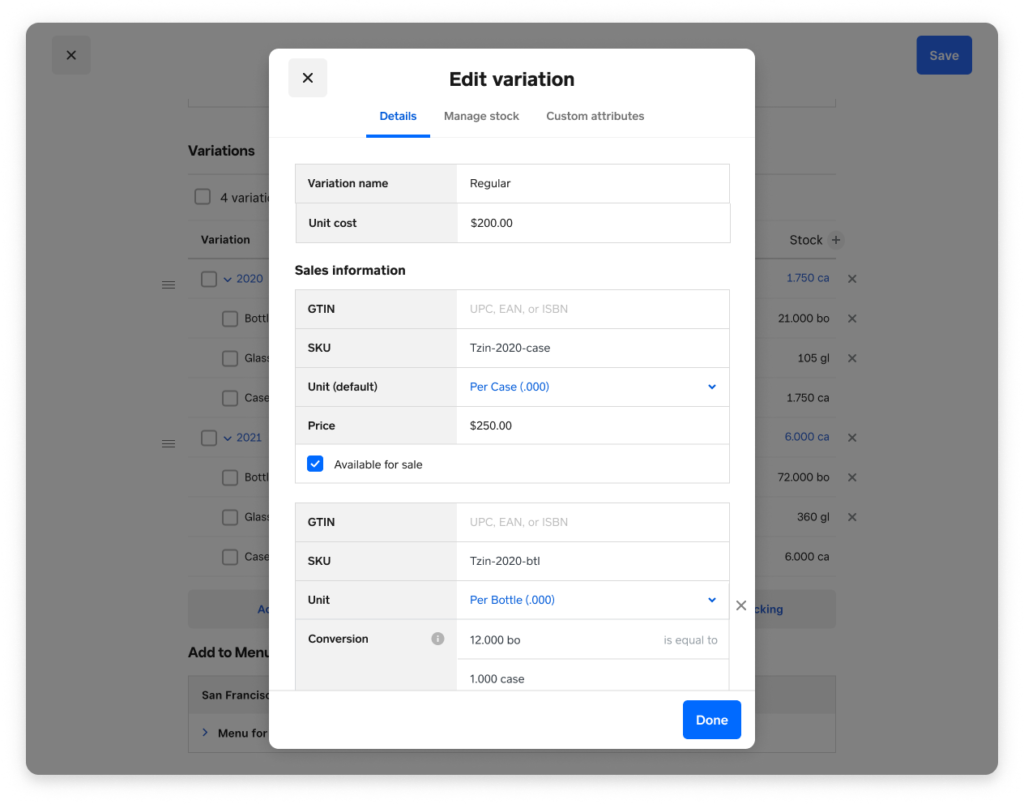

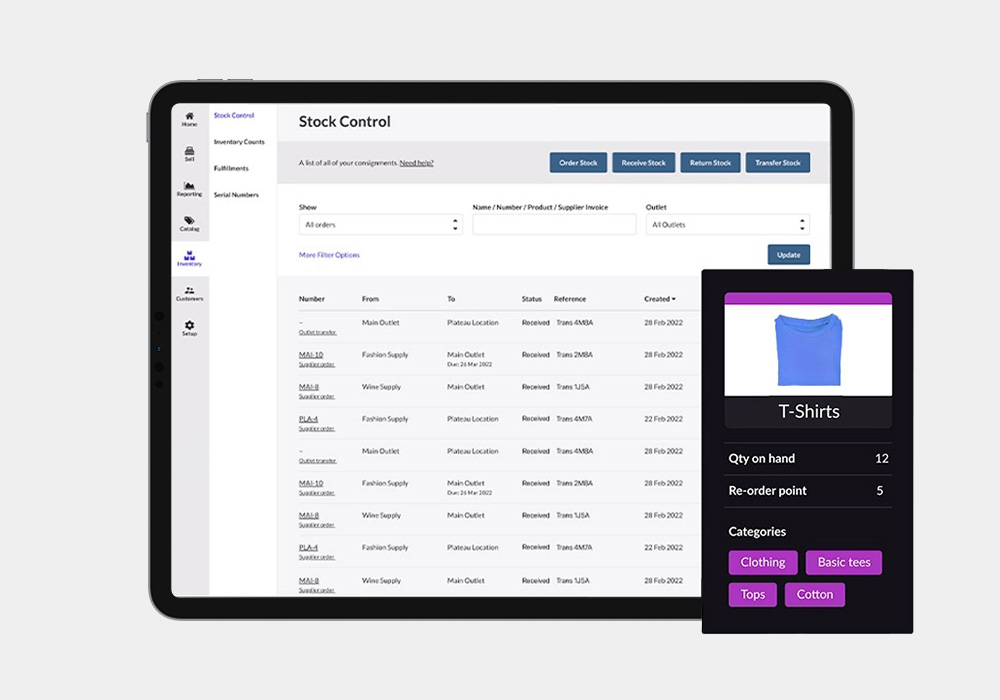

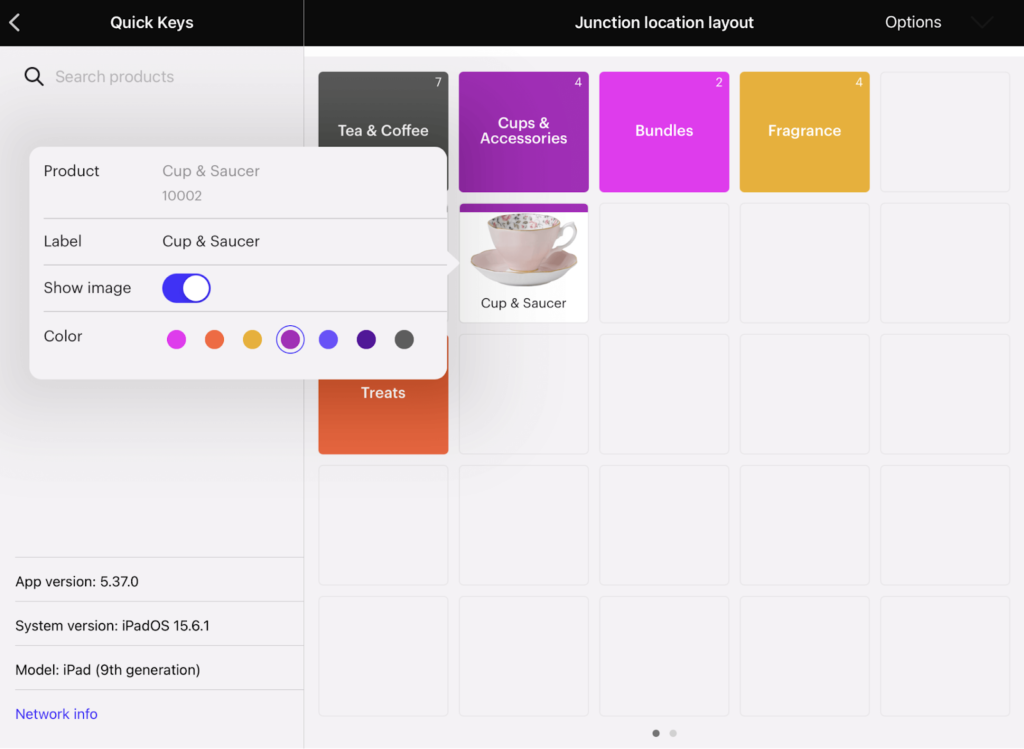

Lightspeed for Retail (R Series): Best for large, complex inventories

Pros

Cons

Our Rating: 3.79/5

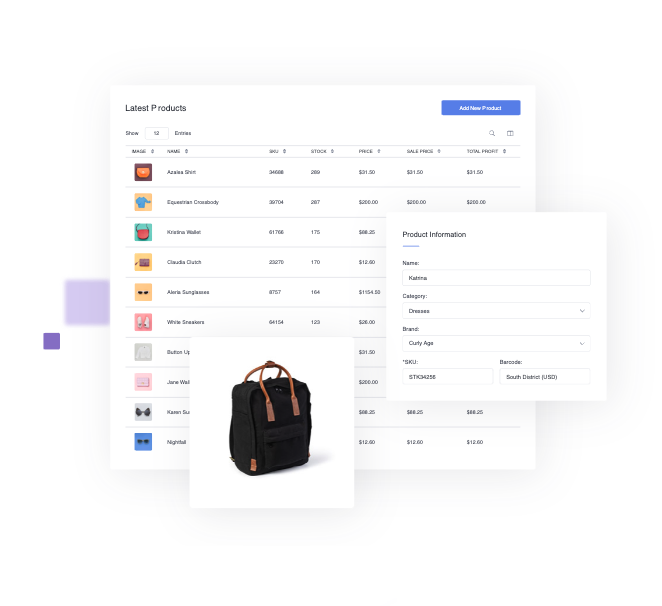

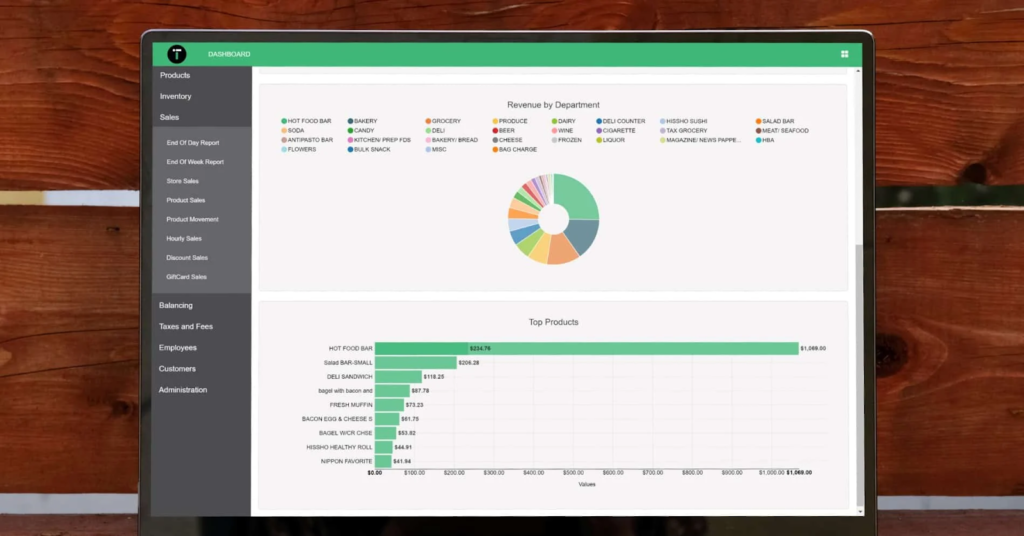

Lightspeed is a popular POS system for all kinds of businesses, with an industry-specific system just for retailers—Lightspeed R Series or Lightspeed for Retail. Lightspeed’s retail POS system has everything a retailer needs to run their business, including some of the best inventory management tools in the industry, CRM tools, advanced reporting and analytics, a customizable loyalty program, an in-house ecommerce site builder, integrated payments, and plans to support your growth.

The system also has accompanying hardware, but you can also run your POS directly from your desktop. We would not, however, recommend trying to take the system mobile without accompanying hardware, as Lightspeed’s mobile apps are not compatible with many devices and have poor customer reviews.

Not seeing the right solution for your business? Check out our comprehensive Retail POS Buyer’s Guide.

Key features of a small business POS system

When you are looking for a POS system for your small business, you should consider your unique needs, goals, and budget. The list below outlines all the tools you should consider when selecting a POS system.

Learn about the different types of POS systems and the ways they can serve your business with our guide to the different types of POS systems.

- Budget: Consider how much you can reasonably spend on your POS system. The starting price for different POS providers can vary by hundreds of dollars a month, there are different startup costs, and some even require you to purchase hardware upfront.

- Integrated or third-party payment processing: Some providers will have an in-house payment processor that you have to use and others will allow (or require) you to use a third-party merchant instead. Consider what option is better for you, with high-volume businesses typically getting better value when they can choose their own merchant account.

- Interchange-plus processing: For businesses that are looking to save on their payment processing fees, an especially important consideration for high-volume sellers, you might look for interchange-plus pricing. This is essentially a discounted processing fee structure that scales based on your sales volume, as opposed to flat rate processing, which is consistent no matter how many transactions you process.

- Hardware: The best POS systems will offer hardware for in-store and mobile sales, as well as financing options so you can pay overtime as you start making revenue.

- Mobile compatibility: If you plan to take your business on the go and want to be able to make sales from anywhere, your POS should be mobile compatible either via mobile hardware or a mobile POS app.

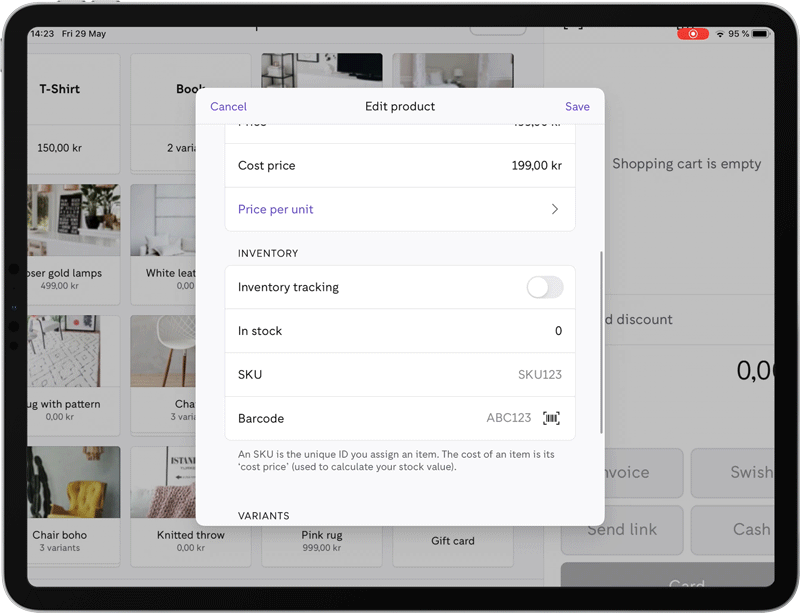

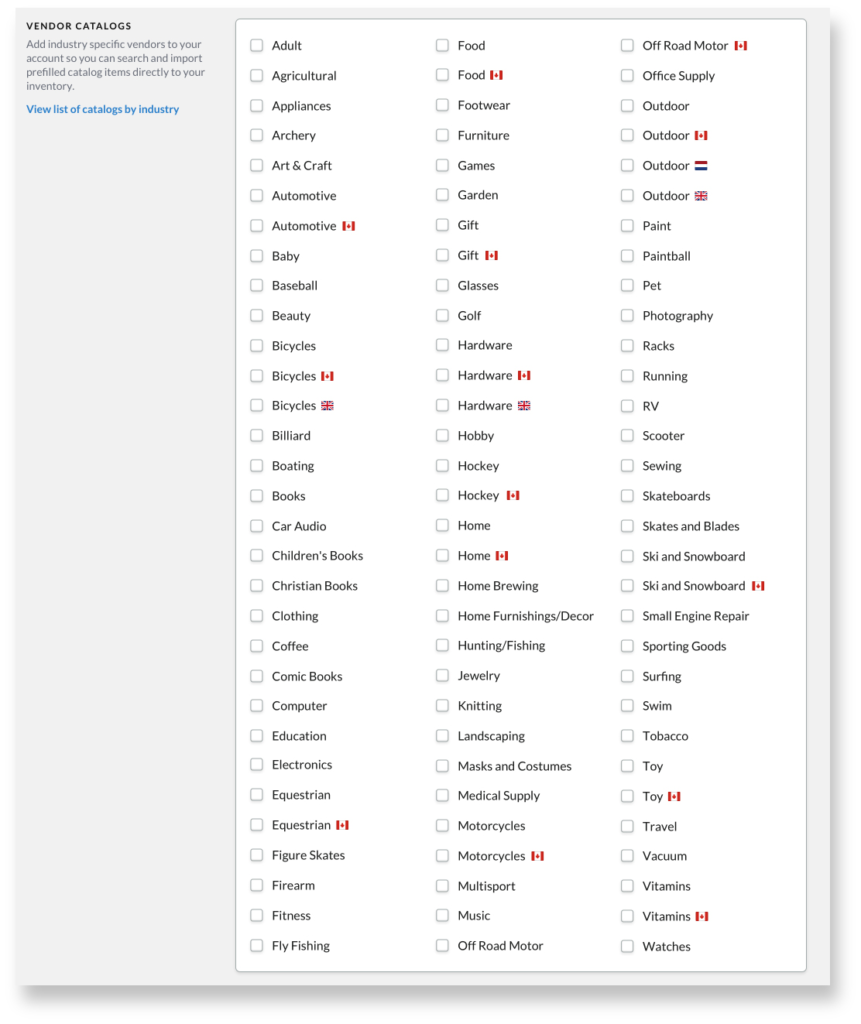

- Inventory management tools: Your POS should have tools for placing and tracking order, adding inventory to your catalog, and integrated tracking as products sell across all locations and channels. Additionally, you should be able to view inventory reports and analysis.

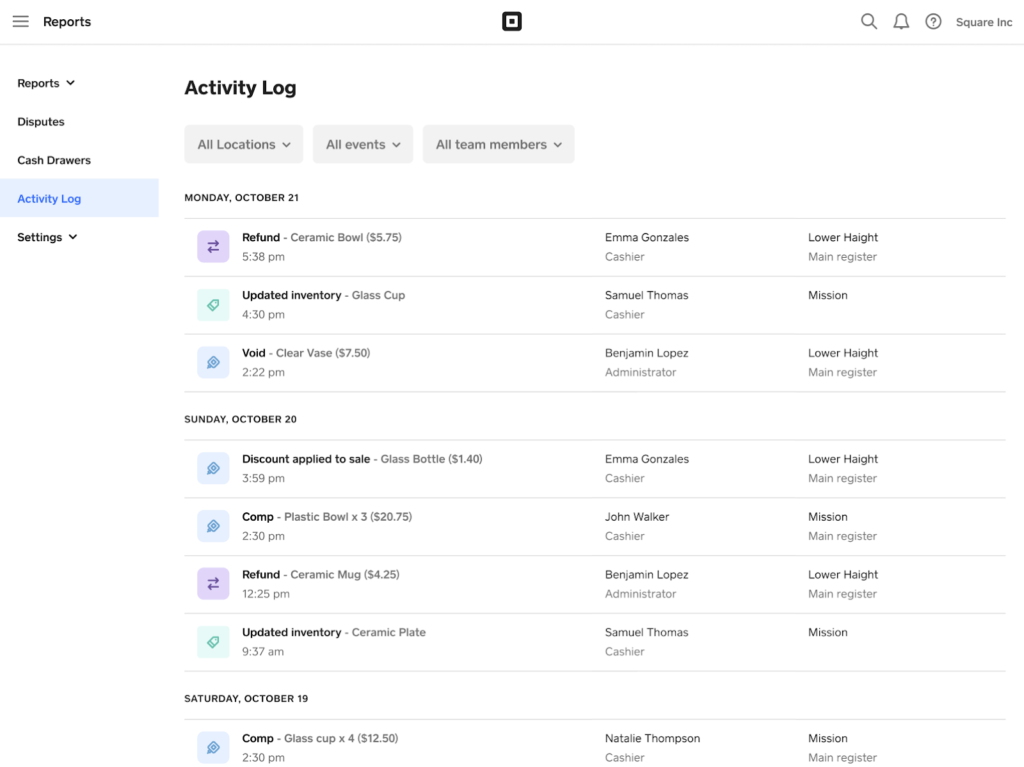

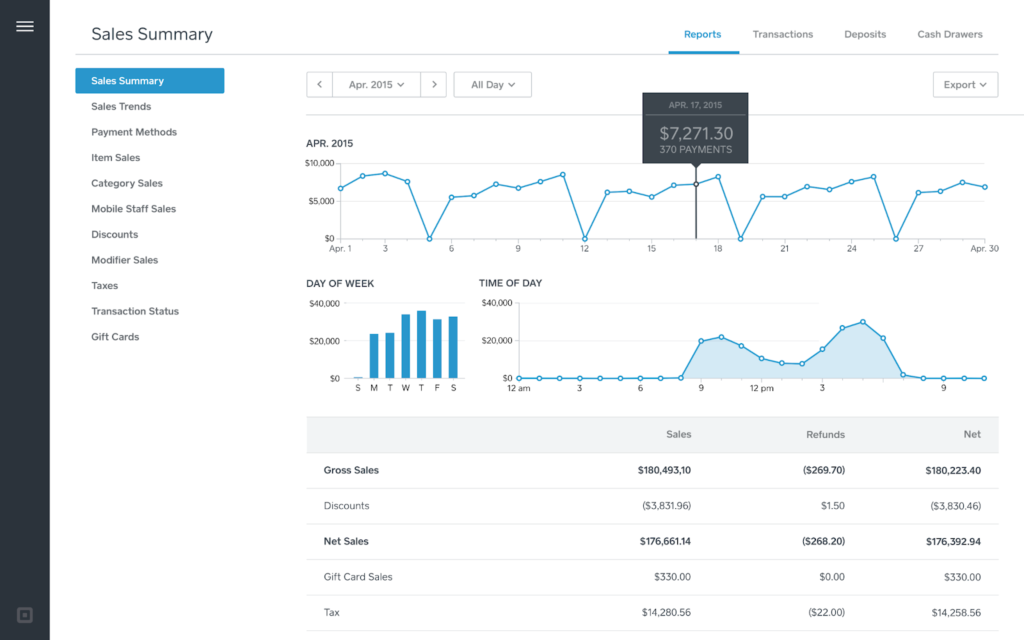

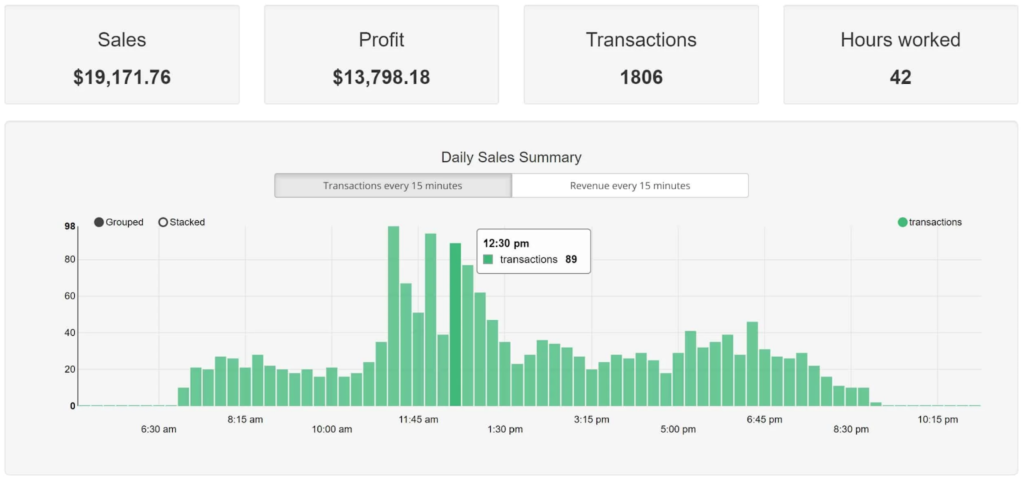

- Reporting: POS systems should offer data on your inventory, staff performance, marketing initiatives, customer relationships, and your sales channels. If you need more advanced reporting, there are also systems that support custom reporting options and actionable analyses of your performance.

- Customer relationship management tools: Your POS system should have tools for creating customer profiles that log their purchases, contact information, and relevant notes. Some systems will also include tools like loyalty programs and customer segmentation reports for better understanding and retaining your staff.

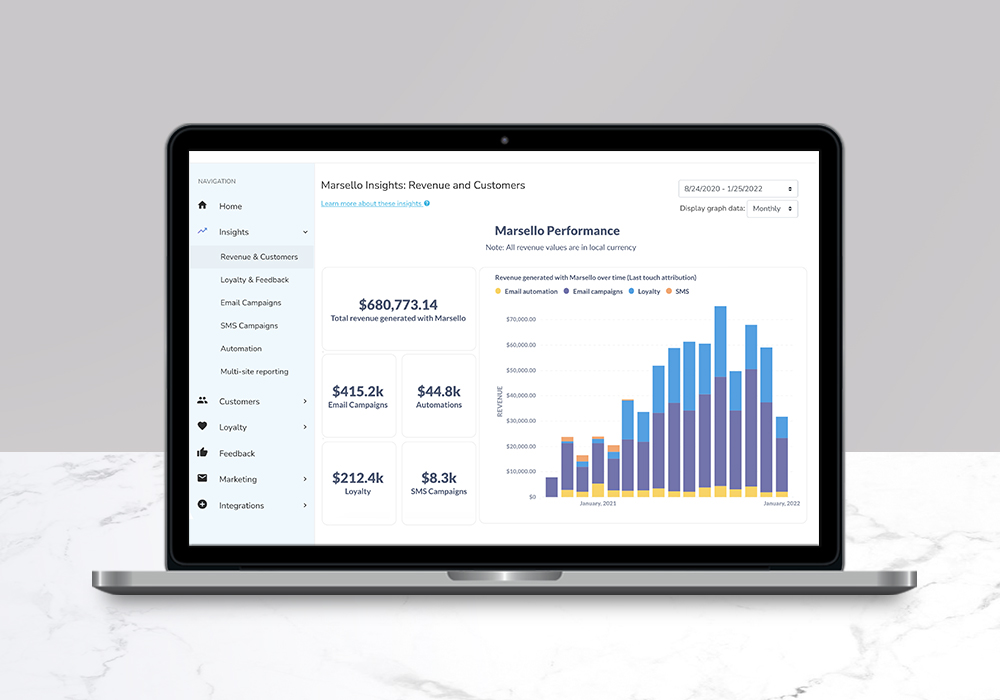

- Marketing features: Some POS systems include integrated marketing tools for sending texts and emails to your customers as well as loyalty program tools. More advanced systems will also have tools for measuring the success of your marketing campaigns and suggestions for how to improve. Depending on the POS system, these tools will either be in-house or available via a third party app integration.

- Multilocation management: For sellers that plan to sell across multiple locations, you should look for a system that can track inventory and sales across all of your locations and create reports for both cumulative performance and individual stores and sales channels. Additionally, you should be wary of how the POS system scales their pricing with location, selecting the one that scales most affordably.

- Scalability: Avoid the headache of having to change to a different POS system if your business grows by choosing an option with multiple plans that can scale with you.

- Omnichannel sales: If you plan to sell online you should look for a POS system that allows you to integrate all your sales channels, including your online store, any social media shops, and marketplaces like Amazon and Google Shop.

- Integration options: If you have an existing online store or particular tools that you want to be able to use alongside your POS system, be sure they integrate or there is a custom API option so you can keep all your tools on one platform.

Making the right POS choice for your small business

There are seemingly countless options for small business POS systems, but not all are created equal. Based on our expert evaluation, the best POS system for small businesses overall is going to be Square. However, the additional providers on this list are also top-notch, especially for niche tools and industries.

For restaurants, you have Toast. For businesses that primarily focus on online sales, we recommend Shopify. Then there is Helcim, ideal for professional services like healthcare and automotive sales. We also have PayPal Zettle, ideal for microbusinesses and solopreneurs. Along with IT Retail, which we recommend for grocers and market or convenience store sellers. And, finally, there is Lightspeed, which is ideal for businesses that manage large, complex inventories.

The one great thing about the plethora of POS system options, there is an ideal POS solution for every kind of small business. It’s just a matter of determining your needs and deciding what features are most important for your success.