Over the years, technology has made it possible for customers to use credit cards in person and online in a variety of ways. As a result, credit cards are one of the most popular payment methods today because of the convenience they offer.

The challenge for businesses is choosing the right credit card processor that is convenient for customers, easy to maintain, and offers low, competitive pricing that won’t cut into their profit margins.

Based on our evaluation, the best credit card processing companies for 2024 are:

Software Spotlight: PaymentCloud

Flexible payment processing for any business- 98% of applications are approved for a merchant account

- Wide range of payment options – including no-cost (surcharging)

- Month-to-month contract

- No setup, application, or annual fees

Visit PaymentCloud

Product

Our Score (out of 5)

Monthly Account Fee

Fee Structure

Chargeback Fee

Volume Discounts

Helcim

4.42

$0

Interchange plus

$15 (refundable)

Automatic

Payment Depot

4.37

$0

Interchange plus

$25

By request

PaymentCloud

4.34

$15–$45

Flexible

$25

By request

Stax

4.32

$99–$199

Wholesale subscription

$25

Volume-based plans

Square

4.2

$0–$89 (w/ POS)

Flat rate

Waived up to $250/mo.

By request

CardX

4.17

$29–$199

Zero-cost

Not disclosed

Volume-based plans

CDGCommerce

4.16

$0–$199

Flexible

$25 (refundable)

Volume-based plans

Expert Tip

Surcharging is when businesses pass credit card processing fees on to customers by including an extra fee in the transaction. This practice is gaining popularity among merchants and is increasingly supported by payment processors. While it is possible to impose surcharging by manually adding fees, the easiest and most compliant way to minimize processing fees with surcharging is by using a processor that automates the process.

Helcim: Best overall credit card processor

Overall Reviewer Score

4.42/5

Pricing

5/5

Hardware

3.75/5

Features

4.84/5

Support & Reliability

4.38/5

User Experience

4.38/5

Average User Review Scores

4.2/5

Pros

- Automated volume discounts

- Interchange plus pricing, no monthly fees

- Free credit card processing

Cons

- Add-on fees for Amex transactions

- Limited business integrations

- First payout takes up to 14 days

Why we chose Helcim

Helcim is our overall top choice for credit card payment processor. Helcim is a traditional merchant services provider, meaning each business has a dedicated merchant account, which offers maximum stability.

Yet, for a traditional merchant account services provider, Helcim is among the easiest to set up, use, and scale with a business. All of its credit card processing services are accessible without a monthly fee.

We love how Helcim built its software around automation. Helcim’s pricing structure provides interchange plus rates with built-in automated volume discounts. And, unlike other payment processors, every merchant account is automatically qualified for the in-person and online zero-cost processing program. Helcim even automatically gathers the additional information required for B2B businesses to qualify for level 2 and 3 discounted rates.

Payment Depot: Best for mid-sized businesses

Overall Reviewer Score

4.37/5

Pricing

4.69/5

Hardware

4.17/5

Features

4.06/5

Support & Reliability

4.58/5

User Experience

4.06/5

Average User Review Scores

4.63/5

Pros

- Custom interchange-plus rates with no monthly fee

- Multiple payment gateway options

- Compatible with most POS systems

Cons

- Lacks option for same-day funding

- Only for US-based businesses

- Non-refundable chargeback fees

Why we chose Payment Depot

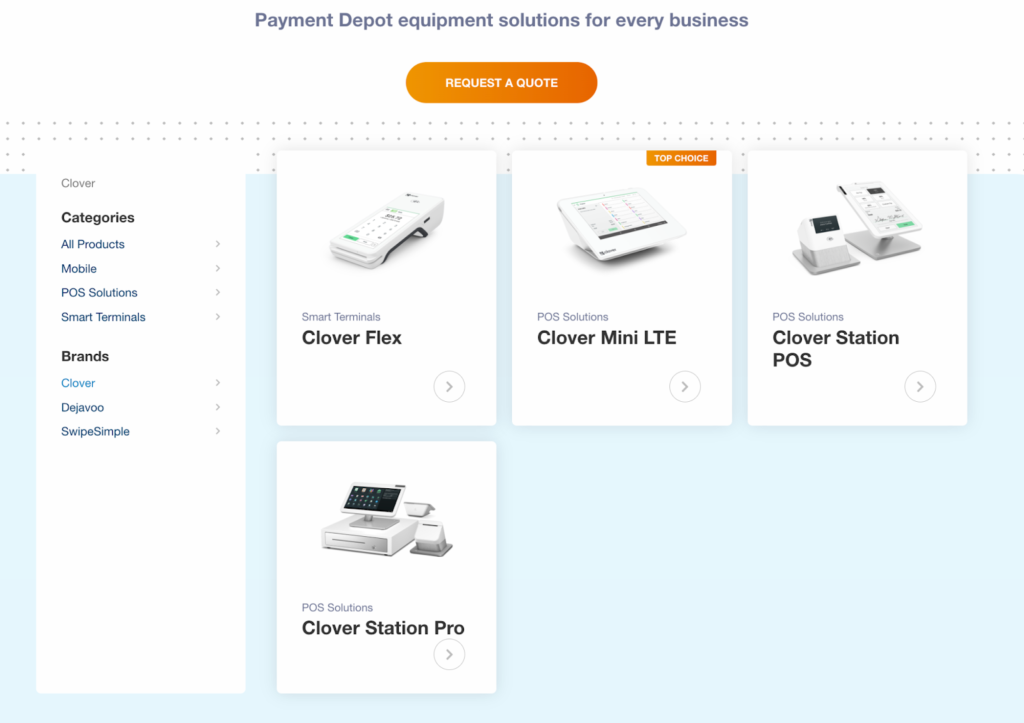

Payment Depot is a traditional merchant account service provider that was acquired by Stax (formerly Fattmerchant) in 2021. It provides credit card and other non-cash payment processing tools for all business types and sizes, supported by Stax’s secure platform.

Early this year, Payment Depot’s pricing structure changed from wholesale subscription (similar to that of Stax) to custom interchange plus pricing. This move allowed Payment Depot to distinguish itself from Stax by providing a more sustainable pricing approach to mid-size businesses that are interested in Stax but do not want the high monthly fees.

PaymentCloud: Best for high-risk businesses

Overall Reviewer Score

4.34/5

Pricing

4.06/5

Hardware

4.17/5

Features

4.22/5

Support & Reliability

4.58/5

User Experience

4.38/5

Average User Review Scores

4.65/5

Pros

- Works with high-risk businesses

- Flexible custom fee structure

- Seamlessly integrates with most payment gateways

Cons

- Lacks same-day funding option

- Charges monthly fees

- Non-refundable chargeback fees

Why we chose PaymentCloud

PaymentCloud is a traditional merchant services provider for all business types, but it is well known for its high-risk merchant expertise. Even other popular payment processors work with PaymentCloud to provide hard-to-place businesses with a merchant account. It claims a 98% high-risk account approval rate and approval time as fast as 24–48 hours.

With its services built on customization, PaymentCloud offers the most scalability of all high-risk credit card payment processors. Aside from providing an entirely customized payment services solution, it can adapt its fees based on the client’s preferred pricing structure and seamlessly integrate with any payment gateway so clients can keep using what it already has in place.

The system is also compatible with a variety of POS hardware, like Clover.

Stax: Best for established businesses

Overall Reviewer Score

4.32/5

Pricing

4.38/5

Hardware

4.17/5

Features

4.53/5

Support & Reliability

4.58/5

User Experience

4.38/5

Average User Review Scores

3.9/5

Pros

- Payment services for SaaS platforms

- Subscription management and surcharging for large businesses

- Wholesale subscription rates

Cons

- Lacks same-day funding option

- Terminal protection fee on top of equipment cost

- Additional cost for custom branding

Why we chose Stax

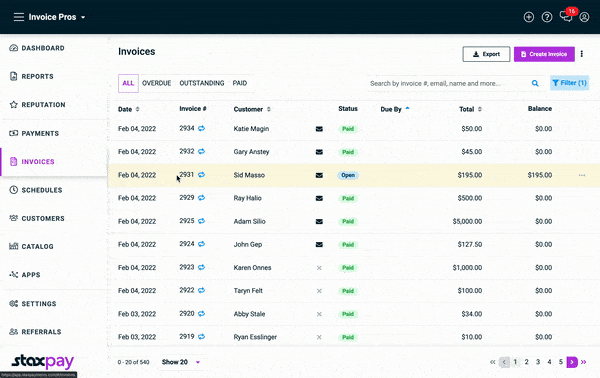

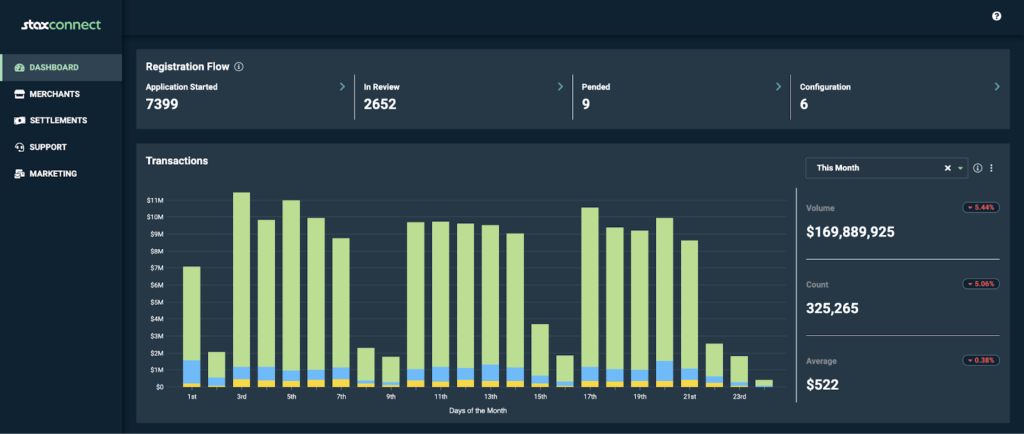

Stax is our most recommended credit card processing company for established businesses.

Over the years, it has acquired several companies, such as Payment Depot and CardX (formerly Fuse Bill), to build its portfolio of payment processing services for different industries and business types. Stax’s subscription-based pricing (wholesale interchange rates with low per-transaction markup) and unlimited payment software access provide high-volume businesses with the best value for their investment.

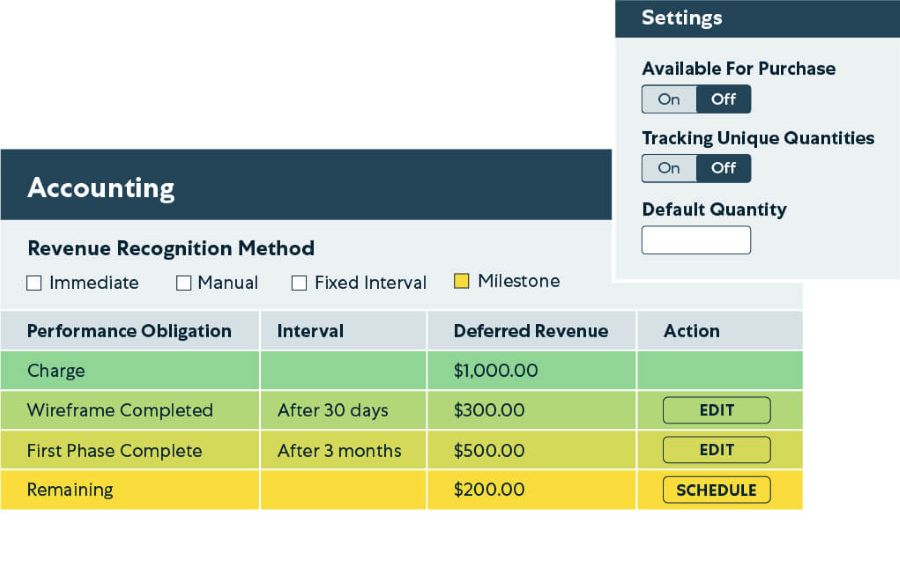

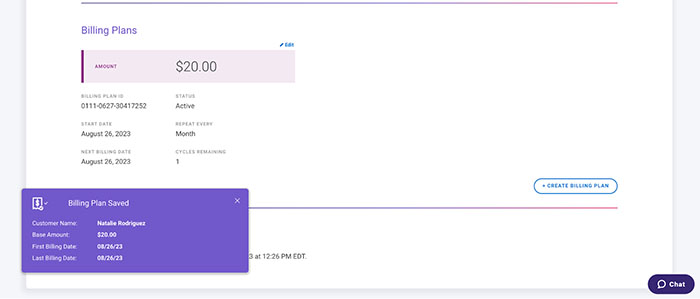

We like how Stax has diversified its services to include pre-made and customizable features that can make payment processing easier to manage for larger businesses. It offers an advanced billing management platform for businesses that run high-volume subscriptions, simple payment services integration for independent software vendors (ISVs), and custom embedded payment solutions for businesses using proprietary software.

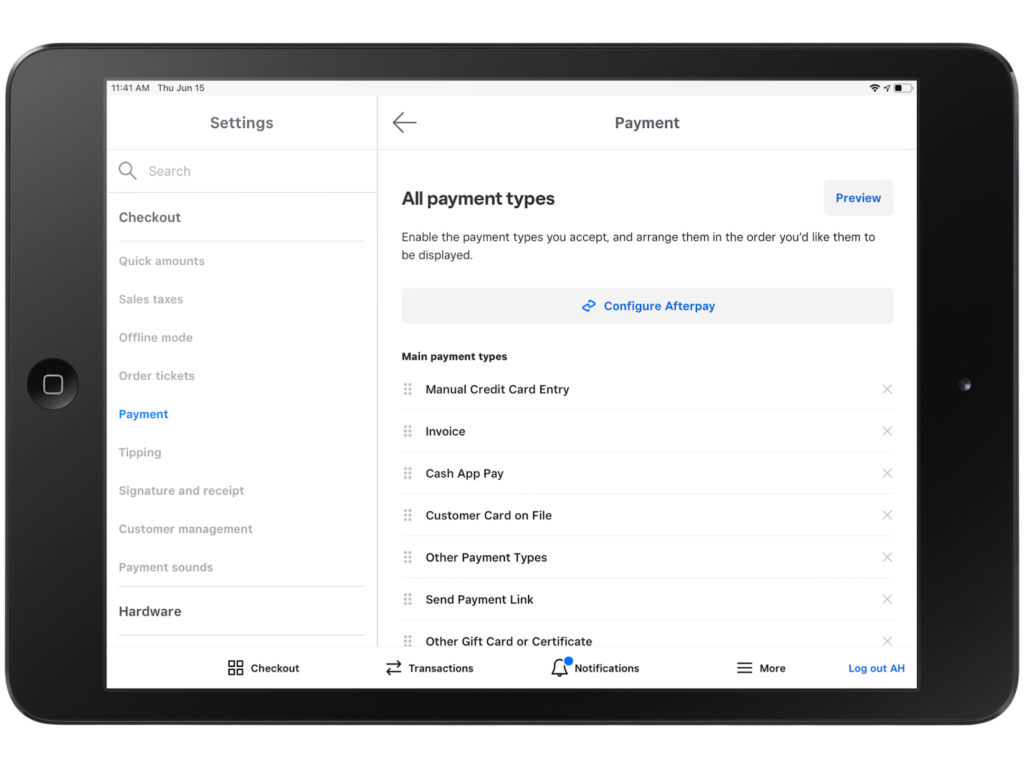

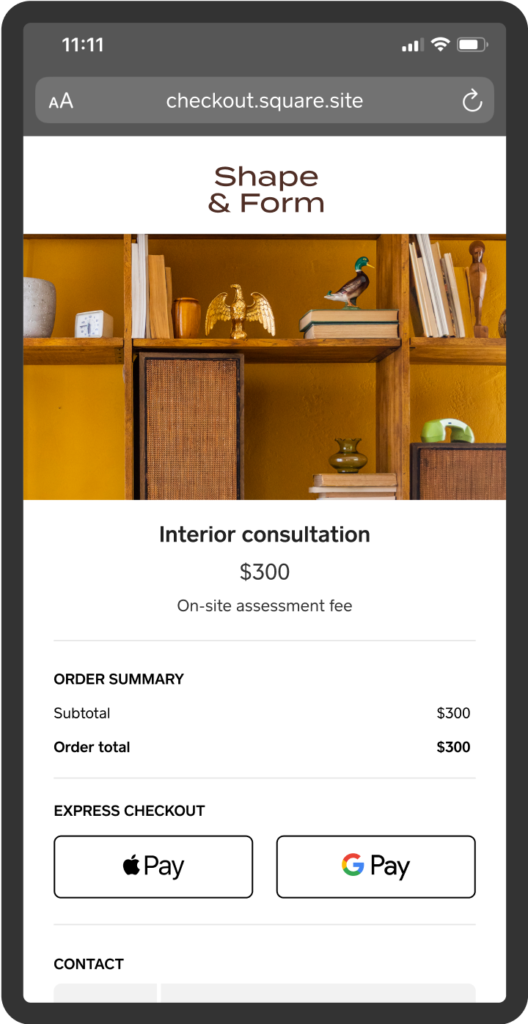

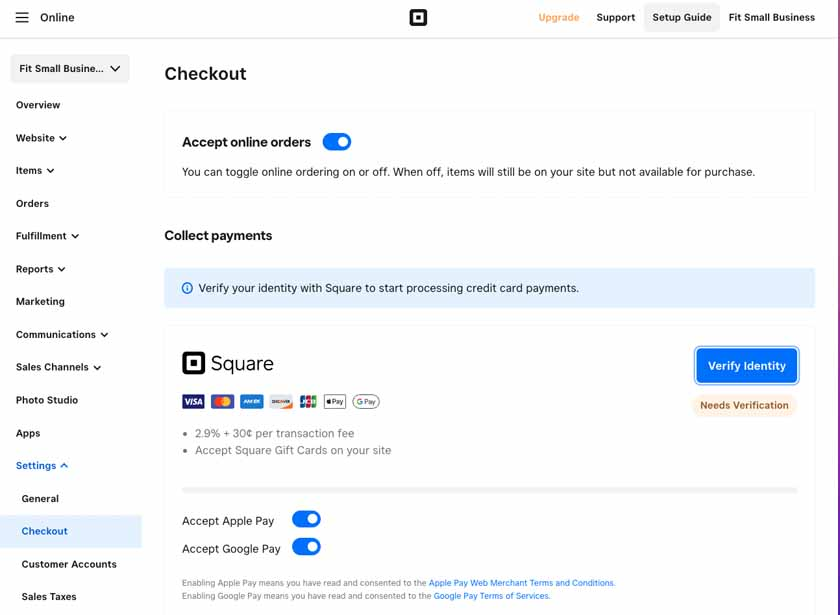

Square Payments: Best all-in-one credit card processor for new businesses

Overall Reviewer Score

4.2/5

Pricing

3.44/5

Hardware

5/5

Features

3.75/5

Support & Reliability

3.96/5

User Experience

4.38/5

Average User Review Scores

4.67/5

Pros

- Best value for a free merchant account

- HIPAA-compliant and offers CBD program

- Waived chargeback fees

Cons

- Default flat rate fees

- Custom pricing only by request

- Issues of frozen funds

Why we chose Square

Square is an all-in-one POS solution that includes a built-in payment processing system. Unlike other providers on our list, Square is a payment facilitator, not a traditional merchant account provider. This means businesses are provided with one of Square’s aggregate merchant accounts, which does not require a strict approval process (ideal for new businesses) but is less stable than a dedicated merchant account.

That said, Square provides the best value for new businesses, with minimal startup costs and no monthly fees. It is HIPAA compliant so it is compatible with small healthcare services and offers a CBD program for merchants that sell cannabis products.

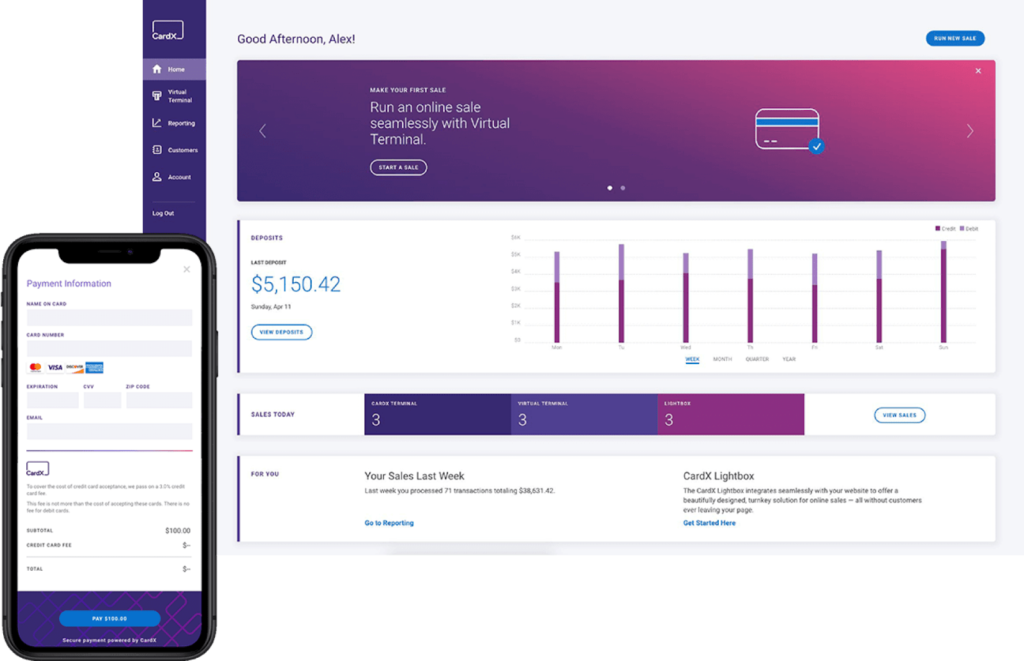

CardX: Best for surcharging

Overall Reviewer Score

4.17/5

Pricing

4.38/5

Hardware

4.17/5

Features

3.91/5

Support & Reliability

4.38/5

User Experience

4.69/5

Average User Review Scores

3.5/5

Pros

- Exclusive Mastercard surcharging partner

- Auto surcharging for online and in-person transactions

- Built-in virtual terminal and subscription management tools

Cons

- Lacks same-day funding

- No POS integration

- Limited invoicing customization

Why we chose CardX

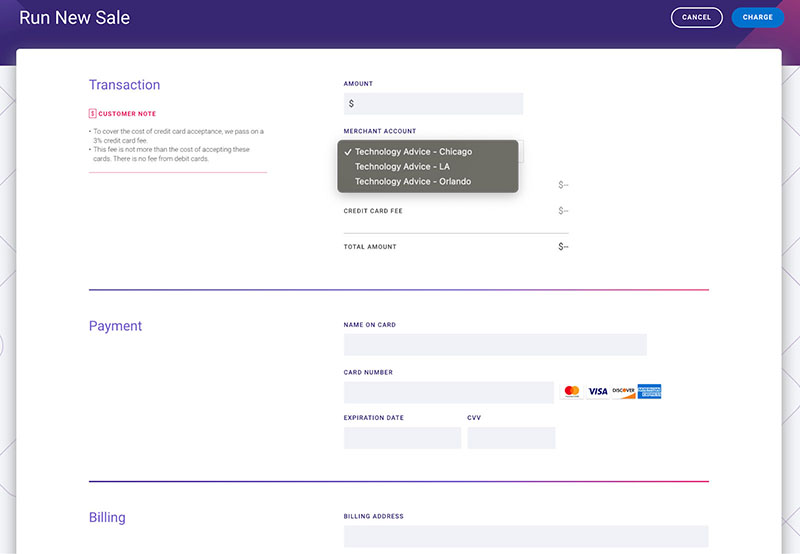

CardX is an expert in surcharging compliance and is Mastercard’s exclusive surcharging partner. It offers surcharging programs for online and in-person transactions. The system is equipped with an invoicing and subscription management feature, as well as a CRM and virtual terminal platform.

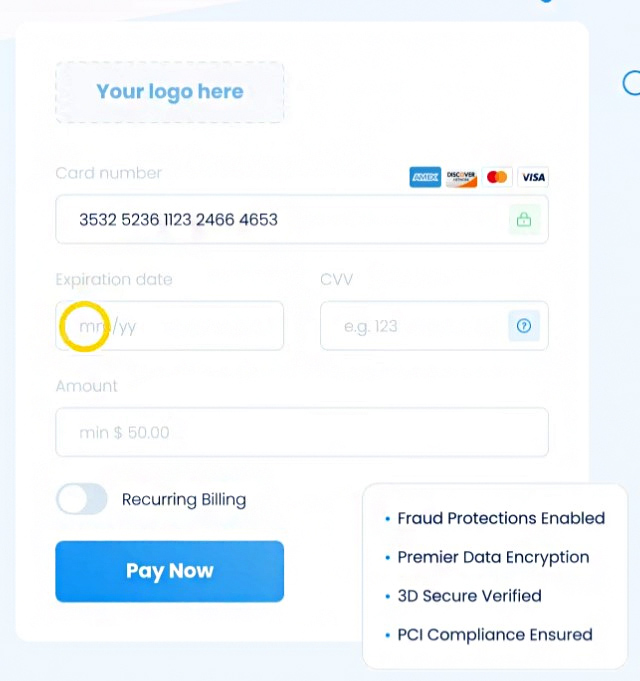

We like how CardX doubles down on compliance to provide users with a reliable surcharging program and even conducts free merchant training. CardX also supports simple and advanced online checkout customization via Lightbox. Its subscription management tools are integrated with CardX’s customer profiles, so it’s easy to track and manage accounts receivables. Users have control over fraud protection features such as address verification and CVV settings to match their acceptable risk level.

CDGCommerce: Best for restaurants

Overall Reviewer Score

4.16/5

Pricing

4.38/5

Hardware

4.58/5

Features

4.38/5

Support & Reliability

3.75/5

User Experience

4.38/5

Average User Review Scores

3.5/5

Pros

- Flexible, transparent pricing

- Multiple payment gateway integrations

- Round-the-clock customer service

Cons

- Additional fees for Amex transactions

- Lacks same-day funding option

- Insurance fee for card terminals

Why we chose CDGCommerce

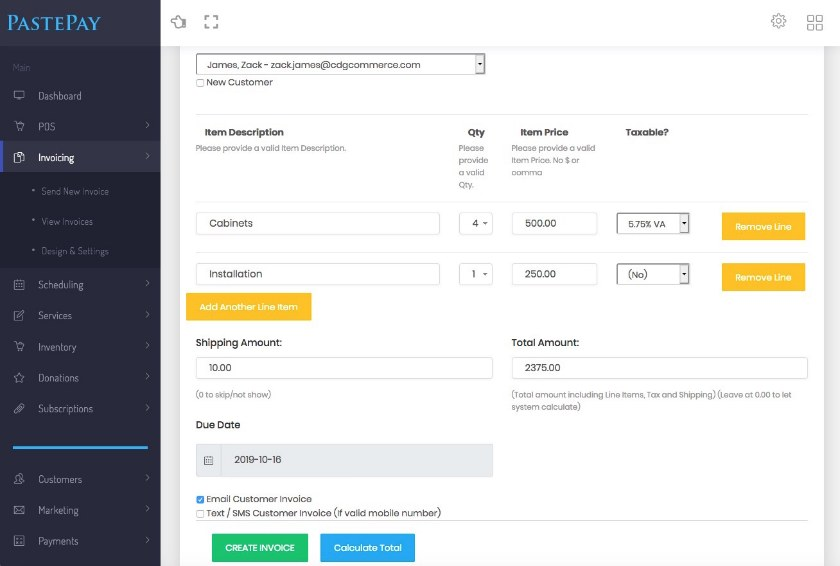

CDGCommerce is a family-owned merchant account services provider that offers a wide range of credit card processing features and multiple payment gateway integrations. It uses TSYS as its back-end processor and provides in-person and online payment services to businesses of all sizes.

CDGCommerce makes our list as the best choice for growing all business types, including restaurants. This is because the system is compatible with popular restaurant POS systems such as Touchbistro, Lightspeed, and Harbortouch to name a few. It even offers flexible pricing to match any level of sales volume. CDGCommerce also provides top notch chargeback management tools that work best for restaurants that accept online orders.

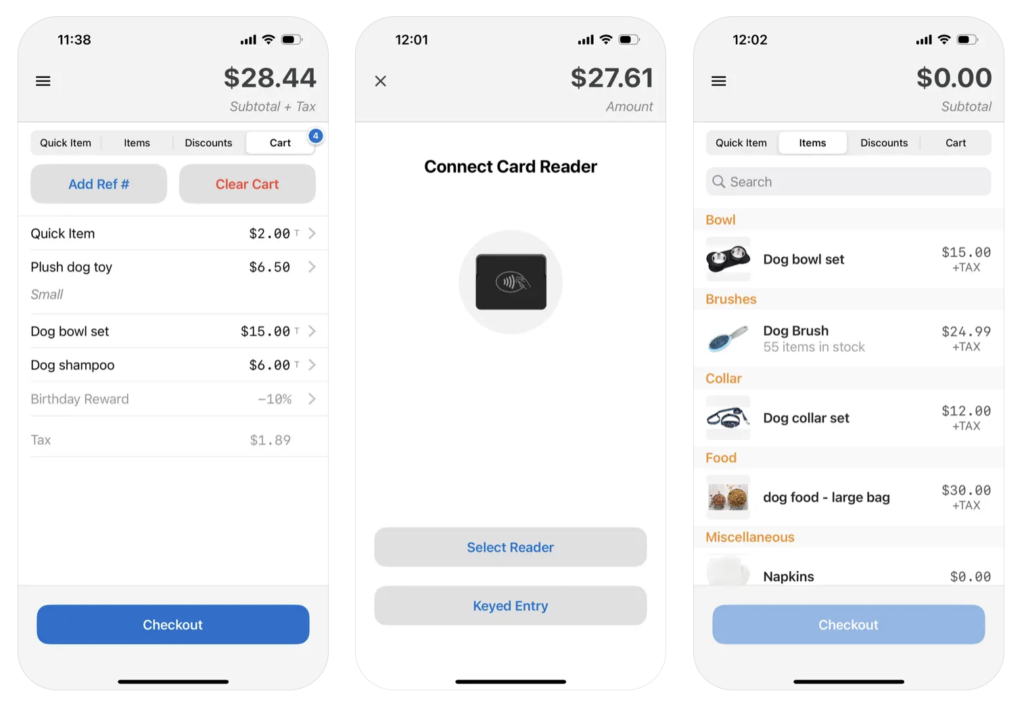

What is credit card processing?

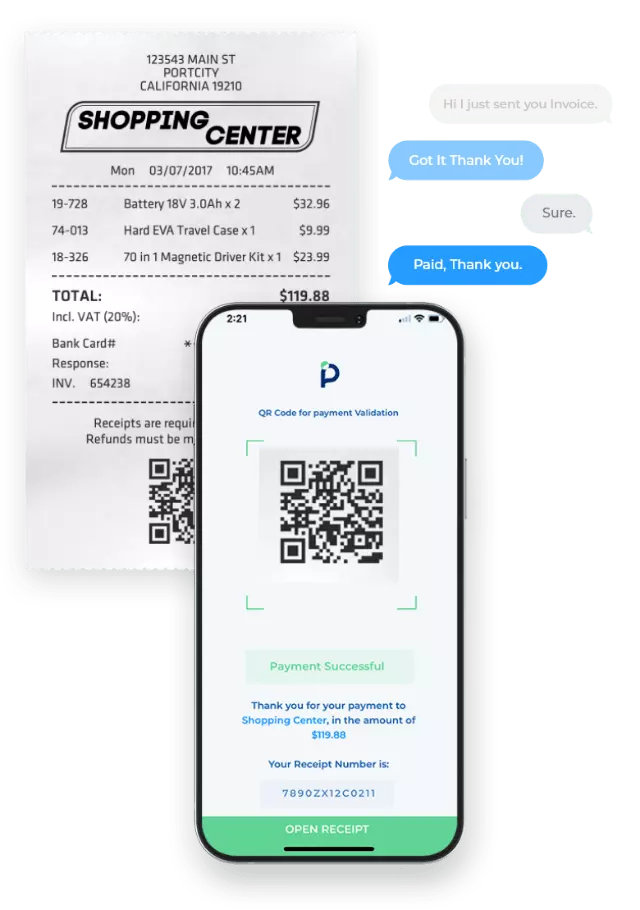

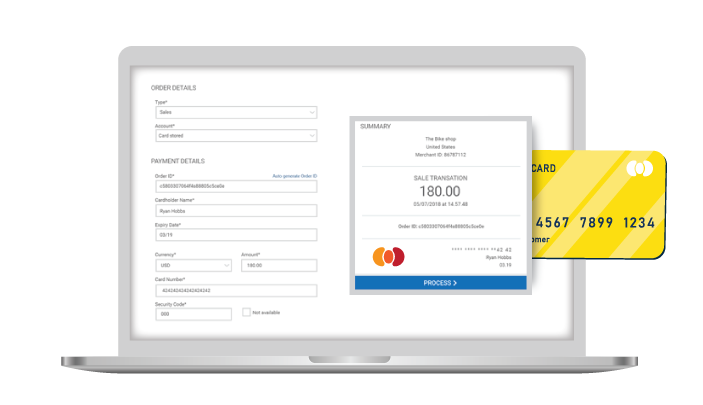

Credit card processing is where businesses accept credit cards as a form of payment in exchange for goods or services. A credit card terminal (for in-person transactions) or an online checkout form (for online transactions) is linked to a payment processor.

Credit card processing happens in a matter of seconds. When a customer uses their credit card to make a payment, the card information is securely transmitted to the customer’s bank that issued the credit card for approval (or rejection).

What you need to accept credit card payments

- A merchant account where proceeds of your credit card sales are stored before getting transferred to your business bank account.

- A payment processor or merchant account services provider partners with acquiring banks to help businesses get approved for a merchant account and provide the technology to process credit card payments.

- A business bank account where proceeds of your sales will be deposited net of credit card transaction fees.

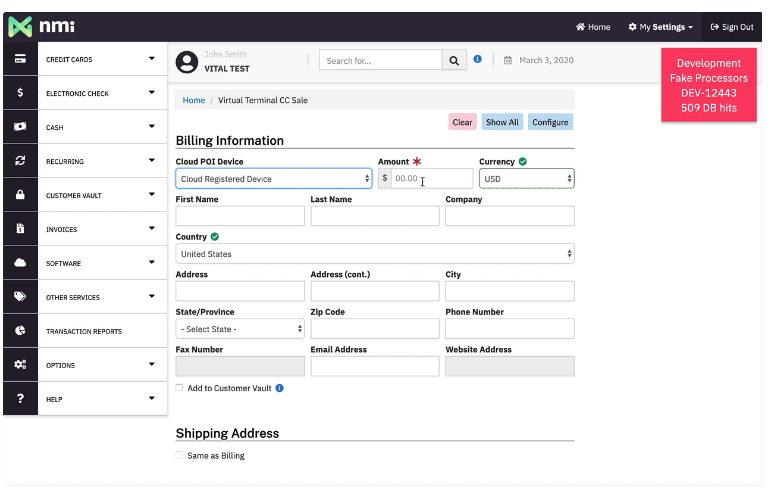

Payment processors provide businesses with services such as payment gateways, invoicing tools, cross-border payment processing, and level 2 and 3 data processing for B2Bs, to name a few.

Credit card processing fee structure

Credit card processing fees are made up of interchange rates issued by card networks, fees from the acquiring bank, and markup from the payment processor. There are different structures used by payment processors to assess credit card processing fees:

- Flat rate fees: Credit card transaction fees that combine all three components for simplicity. New businesses prefer this because it is easier to understand.

- Interchange plus fees: The payment processor’s flat markup is added directly to the interchange rate. This results in a more variable fee but also often lower overall rates.

- Wholesale subscription fees: This fee structure is similar to interchange plus, but processors charge a monthly fee in exchange for lower transaction fees. Large volume businesses find this the best option for maximizing discounts.

What to look for in the best credit card processors

Consider the following criteria when choosing a credit card processor:

Flexible fee structure

Businesses that want to accept credit card payments should expect credit card transaction fees to account for a significant portion of their operational costs. As such, business owners should know what type of fee structure is best based on sales volume and choose a payment processor that offers flexible pricing. The best credit card processing companies offer flexible fee structures and customized rates.

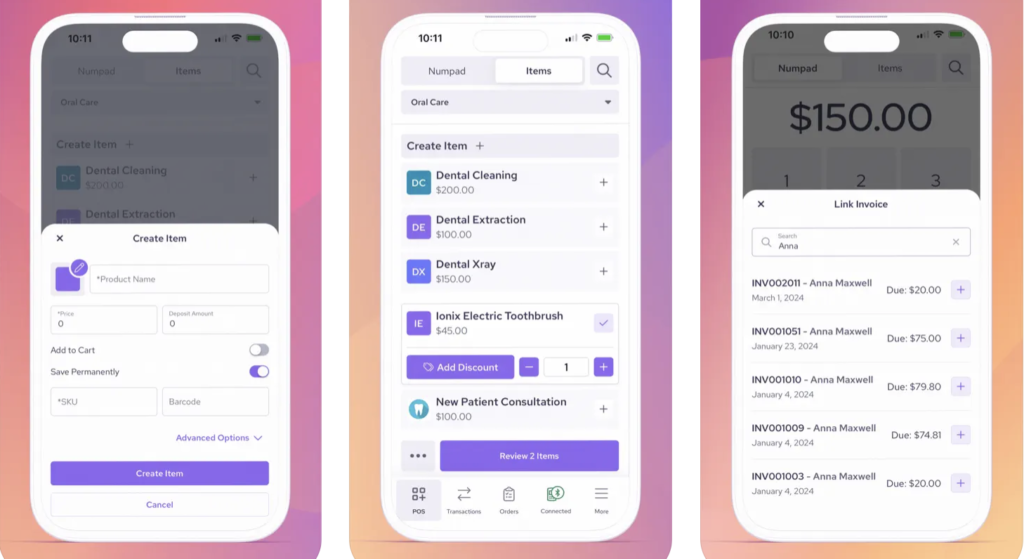

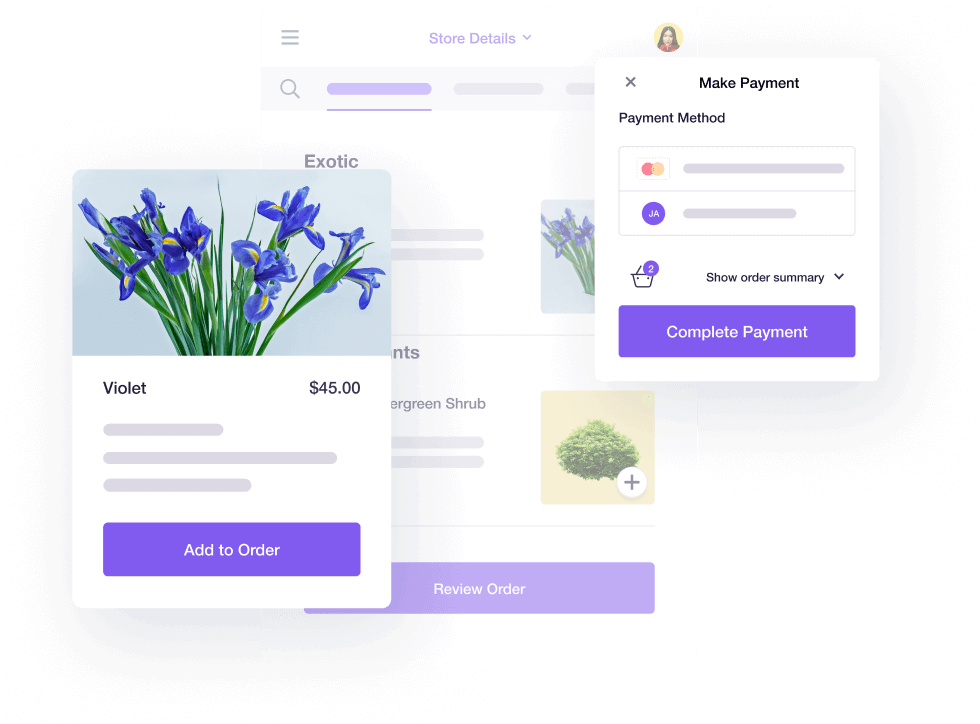

Payment methods

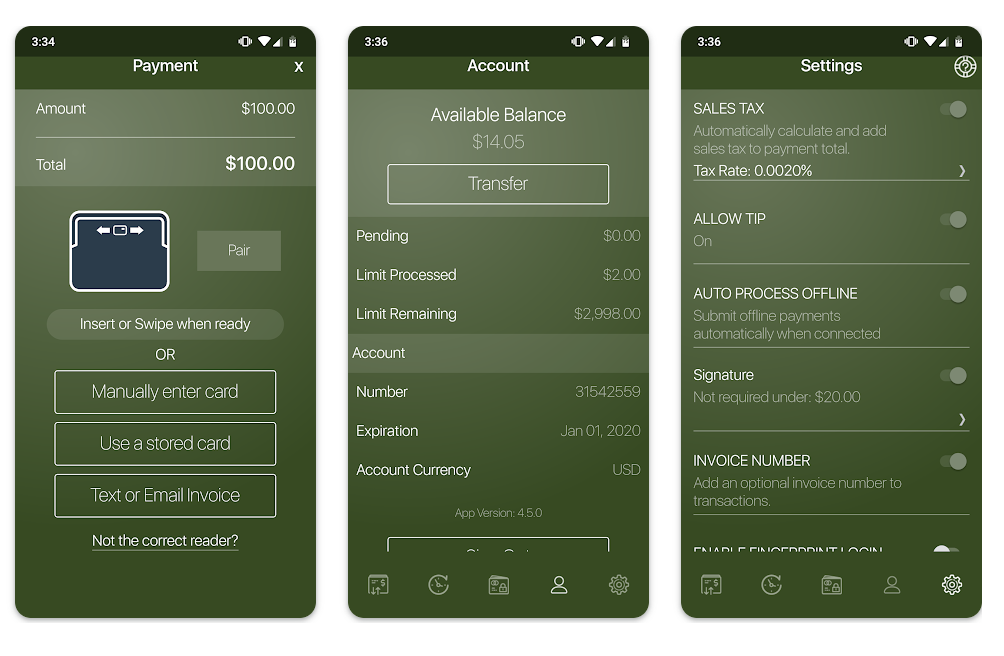

Credit cards can be used to make payments in a number of ways, and customers all have their own preferred ways to pay. So, the best credit card processing companies can offer a wide range of methods for processing credit card payments. Look for providers that offer both in-person and remote credit card payment methods without extra monthly fees to access these tools.

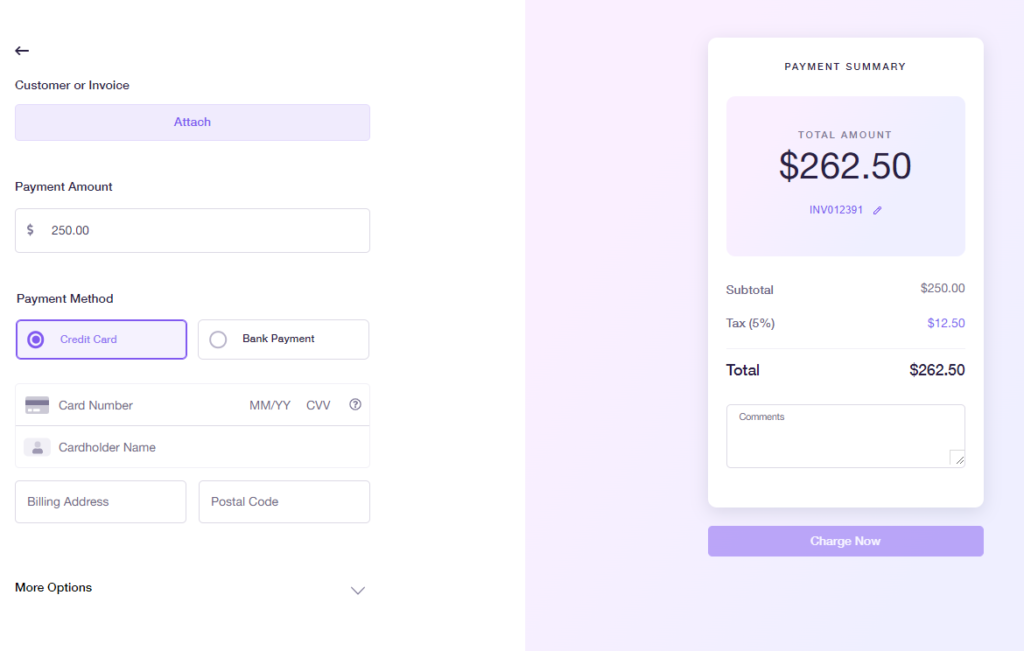

Payment processing services

Not all payment processors offer a complete suite of services. Some providers may not have a built-in virtual terminal, while others may not support level 2 and 3 data processing for B2Bs. At best, identify which type of credit card payment processing service you need and choose a provider that supports these features at no extra cost.

Chargeback management

Keeping chargebacks at bay is crucial for businesses to continue accepting credit card payments. Look for payment processors that include chargeback management tools, allowing you to respond promptly to chargeback claims.

Fraud protection and security

Fraud protection and security are top priorities for keeping your business safe from fraudulent transactions. The best credit card processing companies should be able to tell you all the security measures they have in place to protect your data, such as end-to-end encryption, tokenization, and 3D Secure.

Even better if the system provides you with a platform that displays identified suspicious transactions and the ability to manually adjust fraud detection tools.

Finding the best credit card processor for you

Cost effectiveness should be the key consideration in choosing the best credit card processor. You should only be paying for features that you need, with a credit card processing fee structure that allows you to maximize your savings.

We find Helcim the most versatile credit card processor because of its fee structure that automatically offers lower rates as your business scales, along with the free software it provides.

Payment Depot and PaymentCloud are the best options for businesses that prefer a customized solution. Both offer custom rates and work with merchants to set up a suite of payment services tailored specifically to their business needs. Choose PaymentCloud if you run a high-risk business and Payment Depot for a standard, low-risk merchant account.

We highly recommend Stax for large-volume and enterprise-level businesses. In addition to wholesale credit card rates, Stax offers a broader range of payment services to accommodate the needs of bigger companies, such as subscription service providers and independent software vendors.

Square is the best choice for new and small businesses. It offers the best value in a forever-free plan that allows businesses with a limited budget to start accepting credit card payments with nearly zero upfront cost.

Those who are looking for a fully compliant surcharging program should consider using CardX. It supports in-person and online surcharging with reasonable volume-based monthly fees.

Lastly, but not least, choose CDGCommerce if you want a payment processor that can scale with your business from the ground up. It offers flexible volume-based plans ideal for small, mid-size, and large businesses. CDGCommerce integrates with a number of restaurant POS systems, making it ideal for businesses in the food industry.