Key takeaways:

Global payroll solutions can help you pay and manage employees in different states and abroad — check out our top picks in our video below:

What is a relocation policy?

A relocation policy outlines the processes for moving a new or current employee from one location to another. Companies typically move their employees to places where they need to be physically present to carry out their job responsibilities, especially when it involves collaborating with colleagues.

A relocation policy is also different from a work-from-anywhere (WFA) policy. In a WFA policy, employees may choose to work in a different location to improve their happiness, satisfaction, or productivity.

In contrast, a relocation policy requires employees to move to satisfy particular business objectives. Moreover, relocation policies typically include company-paid benefits that work-from-anywhere policies do not.

Why would you relocate employees?

Although differing between companies, you may decide to relocate employees for one of the following reasons:

An employee relocation could be permanent or temporary, depending on your needs. Temporary relocations are typically more project-based, like requiring an employee to work overseas for a few months to help establish a new location.

Even if your workforce is remote, you may consider an employee relocation policy to hire permanent international talent without forming legal entities or using an employer of record (EOR). Alternatively, offering relocation benefits to your remote workforce could help you when implementing a return-to-office policy.

What is HR’s role in an employee relocation policy?

For employee relocation, HR departments will typically:

Because HR departments function as the intermediary between the employee population and higher-ups, they can align day-to-day business operations with your company’s overall strategy. For employee relocation, this means HR departments will implement and enforce the policy while providing a smooth experience for the relocating employee.

The right human resources information system (HRIS) can streamline your relocation processes for greater efficiency. Learn about the five different types in the video below:

What are the challenges of employee relocation?

One of the biggest challenges of employee relocation involves navigating a host of both domestic and international regulations. Beyond that, employee relocation is expensive, can go awry with miscommunication, and even cause culture shock in relocated employees.

However, understanding these challenges can help you engineer a relocation policy that mitigates these issues and increases the likelihood of the employee’s relocation integration success.

Laws and regulations compliance

Even the most resource-slack corporations struggle with the number of legal factors involved in employee relocation. Some of them include the following:

Unless you can afford to create an internal relocation department, you may consider hiring a legal team or relocation management company (RMC) to minimize compliance risk.

High cost

Relocating is expensive for both the company and the employee. For example, the American Relocation Connection estimates it can cost up to $97,000 to relocate a current employee with a home in 2023.

These costs fall both on the company and the employee. For the company, this includes legal, immigration, and relocation service fees, plus any relocation benefits you offer. For your employee, it consists of the money necessary to end leases, sell and buy new homes, and pay moving expenses. Don’t forget how long it takes employees to wrap up personal affairs that can affect their bottom line.

Because of relocation’s steep cost, you must ensure the decision aligns with your overall business strategy. The benefits of relocating the employee must outweigh the overall cost.

Some vendors provide free tools to help you estimate the cost of employee relocation before going through the process. Oyster’s free employee cost calculator is one such tool you can leverage before relocating your employee overseas.

Visit Oyster to try their free employee cost calculator after signing up for a free account.

Lack of communication

Failing to provide constant information throughout the relocation is a surefire way to cause mishaps, such as missing important deadlines or exceeding relocation budgets. Inconsistent communication can also cause undue stress for the employee, potentially dissuading them from relocating entirely.

You can leverage your human resources software to create consistency in relocation communication among various stakeholders. With Zoho People, for example, you can create a workflow to prepare and send the technology relocated employees need for the position as soon as you receive their new address. This ensures IT teams stay on top of their responsibilities during the relocation process.

Culture shock

Leaving a place of community and safety and venturing elsewhere, even if domestically, can result in severe culture shock for your employee, especially if the destination location’s values and beliefs differ greatly from their own.

In fact, a February 2023 poll by the Center for Business and Social Justice indicates 73% of adults agree it is vital to understand state-level social policies when considering relocating to a given state. Similarly, 89% of employees who relocated domestically in the past year considered social policies in their decision to move.

Daniel F. Pyne III, co-chair of Hopkins & Carley’s Employment and Labor Law Practice, explains that you must be mindful of your employee’s cultural and social reservations during relocation. “In my experience, [the] relocations that fail most often [do so] because the employee doesn’t integrate well with the new community or with the company culture in the new location.”

To mitigate such risk, offer robust relocation benefits such as language classes, expanded mental health services, and access to local resources that can assist with the employee’s transition.

Relocation policy best practices

It is best practice to offer relocation assistance, cost of living adjustments, and a relocation buddy in your relocation policy. You should also outline the legal expectations of the relocation process and whether you partner with RMCs or other experts.

As with any policy, be sure to gain the approval of all necessary stakeholders, put it in writing, communicate it to your staff, and collect their acknowledgments. Remember that relocation policies take longer to draft than most, as you must collaborate with various internal and external parties, including finance, operations, management teams, and relocation and immigration experts.

Offer relocation assistance

Relocation assistance refers to the benefits employers provide to employees and their families moving to a new location, such as transportation or moving assistance. Offering these benefits can significantly lessen relocating employees’ financial burden and increase the likelihood they’ll agree to move.

You can offer your employee varying levels of relocation assistance depending on their seniority, role, or personal situation. Most companies offer a tiered approach to relocation benefits packages, which specifies different levels of benefit packages based on particular employee criteria. Alternatively, you may offer employees a lump sum or reimburse their moving expenses.

When developing your relocation benefits package, consider offering the following:

To protect yourself financially after investing in the employee’s move, you may consider adding a payback clause to recoup some of your relocation expenses should an employee separate within a certain timeframe. If you do, check state and country employment laws before including such a clause.

Provide cost of living adjustments

A cost of living adjustment (COLA) is an increase in employees’ pay or benefits to maintain a particular standard of living. COLA ensures employees moving from areas with relatively low living costs to higher costs can afford the same standard of living or better.

If your employees are relocating temporarily, COLA functions more like a per diem allowance or stipend to cover additional costs only while the employee is away. However, for permanent relocations, COLA may change the employee’s wages, salary, benefits, or retirement packages.

Providing COLAs to employees who are relocating is not legally required, so not all companies offer it as part of their relocation packages. To ensure fair pay, companies that operate remotely may not offer COLA to employees who relocate. Nevertheless, it is worthwhile to consider COLA if you initiate the employee relocation, especially as part of your global compensation strategy.

Designate a relocation buddy

A relocation buddy assists employees during their relocation by answering questions and helping them become acquainted with their new home. Usually, they are either current employees who have been through the relocation process before or a local in the area.

According to Karoli Hindriks, CEO and founder of Jobbatical, a visa and relocation automation platform, buddy systems are essential to making employees feel comfortable and confident in their new environment. “The buddy system helps new employees integrate more quickly into their new work and social setting, which can lead to greater job satisfaction and a better overall experience,” says Hindriks.

Pyne also says relocation buddies should be outside the employee’s direct chain of command. This way, employees feel comfortable discussing relocation concerns without fear of repercussions. Thus, designating a relocation buddy is a great way to help employees establish much-needed social or cultural connections and acclimate faster.

Outline the legal requirements

You should clearly outline the legal responsibilities of relocation for you and your employees to ensure your company remains in regulatory compliance. Your typical legal duties include:

Because laws vary drastically from region to region, your legal responsibilities will be different for every relocation. Your employees should also be mindful of their legal duties, such as obtaining a passport.

Consider partnering with relocation experts

Partnering with experts, such as tax specialists, employment law attorneys, or relocation consultants, can help you organize, plan, and delegate relocation responsibilities. In addition, they can tailor a relocation process to your specific situation.

Alternatively, outsourcing your relocation processes to RMCs allows you to consolidate operations, offer customized employee relocation packages and assistance, and navigate legal challenges. “[It] is a lot more cost-effective than trying to throw internal resources at this, who may lack the required experience or proper tools,” explains Hindriks.

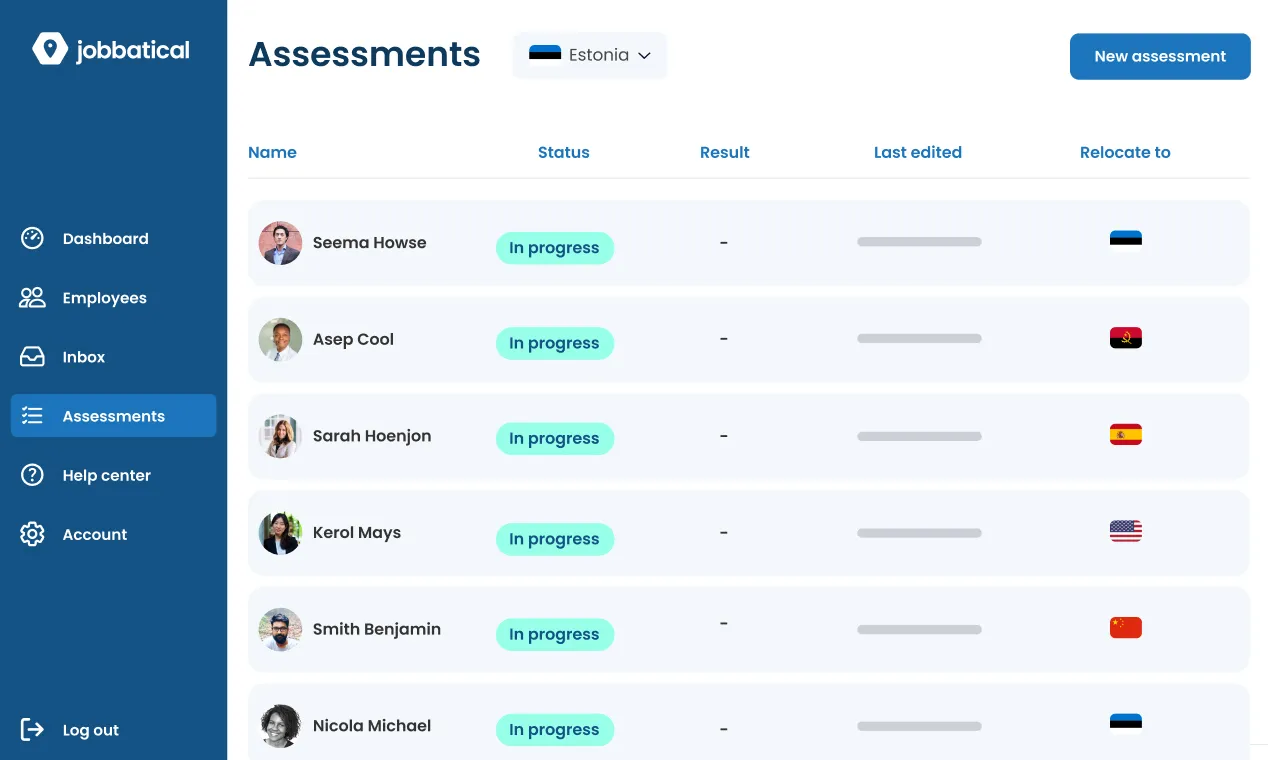

Software also helps with portions of the relocation process. Hindriks’s Jobbatical platform, for example, allows employers to apply for and track their employees’ international work visas. Jobbatical’s automations ensure employees and employers can meet critical deadlines. Such programs can help you save time, mitigate immigration violations, and provide a positive employee experience.

Should you have a relocation policy?

A relocation policy is necessary if you plan to expand and need specialized talent in strategic locations. Moreover, it may be a tactic required to fill key positions in areas that are hard to staff. Bringing in your skilled workers can help improve productivity, efficiency, and customer satisfaction.

Despite relocation’s high upfront costs, it can have several long-term benefits for your company, including:

Making relocation part of your long-term recruitment strategy ensures you have the right talent in the right places to realize your company’s vision faster.

If you need help with the relocation process, check out our remote working software and HR software guides for solutions to get started.