Choosing the right credit card reader is essential for small businesses looking to streamline their payment processes and scale efficiently. The best credit card readers for small businesses combine advanced capabilities with portability, support a range of payment methods, offer robust security features, and have seamless integration with other business systems.

In this article, I evaluate the best credit card readers for small businesses based on their hardware features, payment processing, pricing, features, and user experience.

Based on my evaluation, the best credit card readers for small businesses for 2024 are:

- Clover Flex: Best for growing businesses

- Square Terminal: Best for new businesses

- Toast Go: Best for restaurants

- PayPal Zettle Terminal: Best for PayPal and Venmo payments

- Helcim Smart Terminal: Best for interchange-plus pricing

Best credit card readers comparison

Card Reader

Our score (out of 5)

Hardware Features

Price

Accepted Payment Types

4.49

- Receipt printer

- Barcode scanner

- Offline mode

- Wifi, LTE

- 6” touchscreen

- $599 or

- $35 per month for 36 months

- Swipe

- Dip

- Tap

- QR code

- Apple Pay, Google Pay, Samsung Pay

4.44

- Receipt printer

- Offline mode

- Wifi

- 5.5” touchscreen

- $299 or

- $27 per month for 12 months

- Swipe

- Dip

- Tap

- QR code

- Apple Pay, Google Pay, Samsung Pay

4.30

- Offline mode

- Wifi

- 7.5” touchscreen

- Pay-as-you-go plan: Free or

- Standard plan: $799.20

- Swipe

- Dip

- Tap

- QR code

- Apple Pay, Google Pay, Samsung Pay

4.20

- Barcode scanner

- Wifi, 3G/4G

- 9” touchscreen

- $199 or

- $239 (with built-in barcode scanner)

- Swipe

- Dip

- Tap

- QR code

- Apple Pay, Google Pay, Samsung Pay

- PayPal and Venmo

4.16

- Receipt printer

- Wifi

- 5.5” touchscreen

- $329

- Swipe

- Dip

- Tap

- QR code

- Apple Pay, Google Pay, Samsung Pay

Clover Flex: Best for growing businesses

Overall Score

4.54/5

Hardware features

4.44/5

Payment processing

4.69/5

Pricing and costs

4/5

Features

4.69/5

User experience

4.88/5

Pros

- Built-in printer, scanner, camera

- All-in-one device with inventory, employee management, reports

- 4G and WiFi connectivity

- Can work with different payment processors

Cons

- Higher upfront cost

- Higher processing fees

Why I chose Clover Flex

Clover Flex’s comprehensive features and versatility make it an excellent credit card reader for small businesses, especially for those on the brink of scaling up. It’s all-in-one design, which includes a built-in printer and scanner, combined with its essential backend tools, such as reporting, online ordering, and inventory tools, give it the flexibility to accept payments on-the-go or at small bazaar stalls or integrate with an extensive point-of-sale (POS) system in brick-and-mortar stores.

The combination of 4G and WiFi connectivity ensures reliable performance, while the offline mode maintains functionality during internet outages. Clover Flex is also available from different resellers, so if your business already has a merchant account, check if they are a Clover partner, as you might get a better package from your provider.

Despite the higher initial costs, these features, along with the device’s ease of use and robust security measures, make Clover Flex a suitable choice for growing businesses looking for an all-in-one credit card reader.

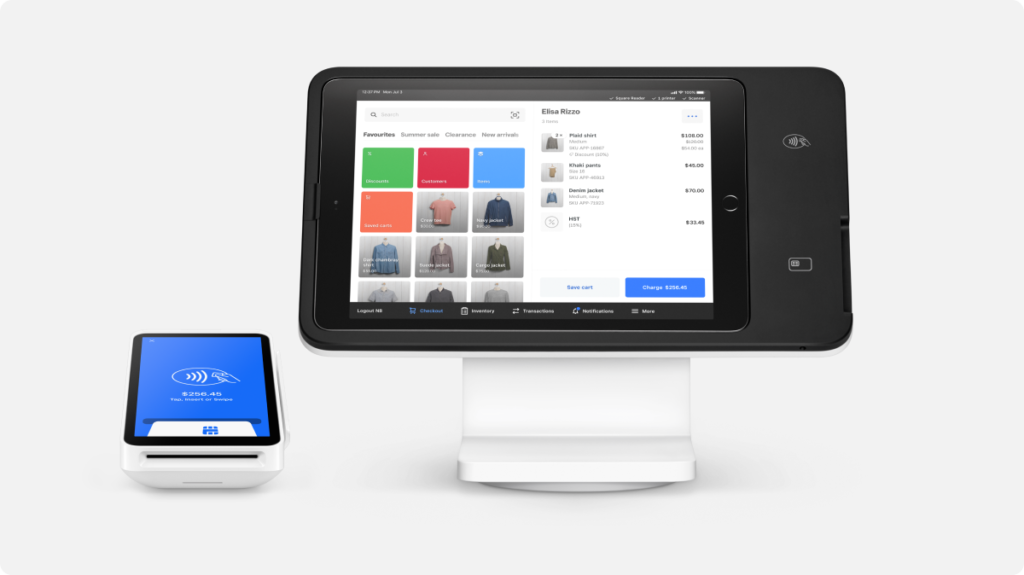

Square Terminal: Best for new businesses

Overall Score

4.44/5

Hardware features

4.58/5

Payment processing

4.06/5

Pricing and costs

4.25/5

Features

4.38/5

User experience

4.92/5

Pros

- Seamless ecosystem integration

- Built-in receipt printer

- Inventory management

Cons

- No built-in barcode scanner

- No 4G support

Why I chose Square Terminal

Square Terminal has a comprehensive and user-friendly ecosystem. It is cost-effective with its low device cost and zero monthly fees, making it the best credit card reader for new businesses. Its all-in-one design includes a built-in receipt printer and robust inventory management capabilities, making it easy for businesses to get started without additional equipment.

The seamless integration with other Square devices allows for smooth scalability, whether you’re upgrading to more advanced POS systems or adding simple card readers. Square’s consistent transaction fees, even for the free plan, further enhance its appeal to new businesses looking for cost-effective and highly functional solutions.

Toast Go: Best for restaurants

Overall Score

4.30/5

Hardware features

4.58/5

Payment processing

4.38/5

Pricing and costs

3/5

Features

4.69/5

User experience

4.85/5

Pros

- Restaurant-grade (spill proof, drop proof, dust proof)

- Offline mode

- Pay-as-you-go plan with zero monthly fee and free device

Cons

- No built-in receipt printer

- No built-in barcode scanner

Why I chose Toast Go

Toast Go stands out for its restaurant-specific design and comprehensive integration with a full restaurant management system. Its durability, long battery life, and offline mode make it highly reliable in busy, demanding environments.

The fully integrated system, which includes features like a kitchen display system, online ordering, team management, and inventory tracking, enhances operational efficiency. Additionally, the pay-as-you-go plan with no upfront device cost makes it an attractive option for restaurants looking for flexibility without a hefty initial investment.

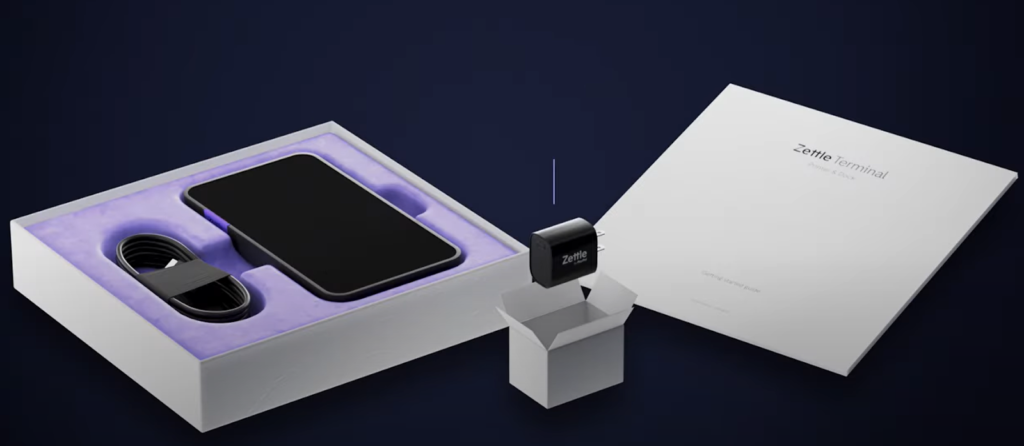

PayPal Zettle Terminal: Best for PayPal and Venmo payments

Overall Score

4.20/5

Hardware features

4.86/5

Payment processing

4.38/5

Pricing and costs

4/5

Features

3.44/5

User experience

4.35/5

Pros

- Low processing fees

- Pre-loaded SIM card at no cost

- Accepts PayPal and Venmo payments

Cons

- No magstripe reader

- No offline mode

Why I chose PayPal Zettle Terminal

The PayPal Zettle Terminal works seamlessly with PayPal and Venmo transactions, making it an excellent choice for businesses already utilizing these platforms. Its low processing fees and the inclusion of a pre-loaded SIM card at no extra cost enhance its value. Although Clover Flex processes PayPal and Venmo payments, it requires a higher Clover paid subscription.

The terminal’s built-in barcode scanner and optional charging dock with a built-in receipt printer provide essential functionality for retail environments. Among the card readers on this list, the PayPal Zettle Terminal has the lowest flat-rate processing fees. This combination of affordability, ease of use, and specialized payment acceptance makes the Zettle Terminal particularly advantageous for businesses looking to streamline their payment processing with PayPal and Venmo.

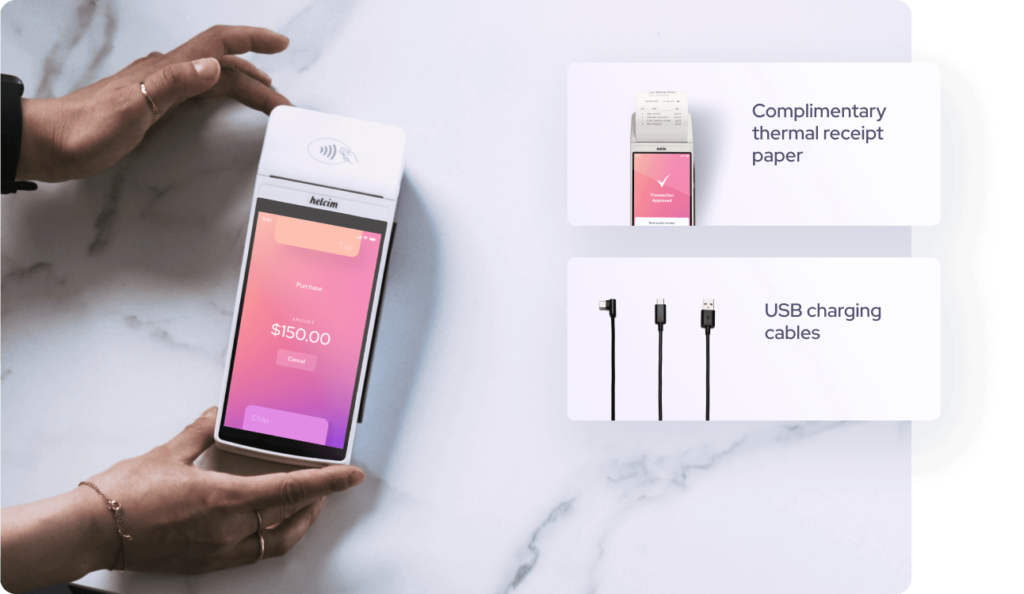

Helcim Smart Terminal: Best for interchange-plus pricing

Overall Score

4.16/5

Hardware features

4.86/5

Payment processing

4.06/5

Pricing and costs

4/5

Features

3.13/5

User experience

4.73/5

Pros

- Interchange-plus pricing

- Built-in receipt printer

- Automatic volume discounts

- Surcharging option

Cons

- Limited other hardware options

- No offline mode

Why I chose Helcim Smart Terminal

The Helcim Smart Terminal is the only card reader on this list that offers a transparent interchange-plus pricing model, which offers small businesses a clear and competitive fee structure. Its built-in receipt printer and automatic volume discounts provide added value, particularly for growing businesses.

The surcharging option allows merchants to pass processing fees to customers, reducing costs. Additionally, Helcim’s terminal supports inventory tracking and employee log-ins, enhancing operational efficiency. The competitive pricing, combined with zero monthly fees and surcharging option, makes this credit card reader among the most cost-effective for small businesses.

Did you know? Helcim is also the cheapest credit card processor for most businesses.

What is a credit card reader?

A credit card reader is a device that enables businesses to accept payments from customers via credit and debit cards. These readers can be standalone units or part of a larger POS system. They read the card’s information through magnetic stripe, EMV chip, or contactless technology (NFC) to process transactions securely. Credit card readers are essential for modern businesses as they facilitate quick and secure payment processing.

Related: Best Mobile Credit Card Processing

How do credit card readers work?

Credit card readers work by capturing and transmitting card information to a payment processor. When a card is swiped, dipped, or tapped, the reader retrieves the card’s data (magnetic stripe, chip, or NFC signal). This data is encrypted and sent to the payment processor, which verifies the card details and checks for available funds. Once approved, the transaction is completed, and funds are transferred to the merchant’s account. This process happens in seconds, ensuring fast and secure payments.

Types of credit card readers

Credit card readers come in various forms to meet different business needs. These types include magstripe readers, EMV chip readers, NFC (contactless) readers, and smart terminals, each offering distinct features and security levels to cater to diverse payment processing requirements.

- Magstripe readers: Basic devices that read the magnetic stripe on the back of cards, offering straightforward but less secure transactions.

- EMV chip readers: Devices that read the embedded chip in cards, providing enhanced security against fraud.

- NFC (Contactless) readers: Readers that accept contactless payments from cards or mobile wallets, enabling fast and convenient transactions.

- Smart terminals: Advanced, multifunctional devices that support magstripe, chip, and contactless payments, often integrated with POS systems.

Simple credit card readers, like ones that just perform the functions listed above, typically require integration with a different device (computer, tablet, or mobile device) where the POS app is installed. These simpler readers are in contrast to all the smart terminals discussed above – our recommended options are all standalone terminals and do not require any other integration to accept card payments.